Markets navigated a fancy panorama on Monday as looming U.S. authorities shutdown fears weighed on the greenback whereas valuable metals and cryptocurrencies caught sturdy bids on safe-haven flows and monetary uncertainty.

Take a look at the headlines and financial updates you could have missed within the newest buying and selling periods!

Headlines & Knowledge:

- Japan Main Indicators Index for July 2025: 106.1 (105.9 forecast; 105.6 earlier)

- Financial institution of Japan board member Asahi Noguchi stated on Monday that the necessity for adjusting coverage charge is rising

- U.Okay. Mortgage Approvals for August 2025: 64.68k (64.5k forecast; 65.35k earlier)

- U.Okay. Web Lending to People for August 2025: 6.0B (6.2B forecast; 6.14B earlier)

- U.Okay. BoE Client Credit score for August 2025: 1.69B (1.5B forecast; 1.62B earlier)

- Euro space Financial Sentiment for September 2025: 95.5 (95.1 forecast; 95.2 earlier)

- Euro space Client Confidence for September 2025: -14.9 (-14.9 forecast; -15.5 earlier)

- Federal Reserve Financial institution of St. Louis President Musalem stated he’s open to additional charge cuts, however ought to transfer fastidiously

- Federal Reserve Financial institution of Cleveland President Beth Hammack argues in opposition to charge cuts as inflation might keep above targets for a couple of years

- New York Fed President Williams thinks inflation dangers have dipped whereas employment dangers have risen

- U.S. Pending Residence Gross sales for August 2025: 4.0% m/m (1.7% m/m forecast; -0.4% m/m earlier); 3.8% y/y (1.9% y/y forecast; 0.7% y/y earlier)

- U.S. Dallas Fed Manufacturing Index for September 2025: -8.7 (-7.0 forecast; -1.8 earlier)

- US President Trump and Israeli Prime Minister Netanyahu introduced on Monday an settlement to a 20-Level plan to finish struggle in Gaza

Broad Market Value Motion:

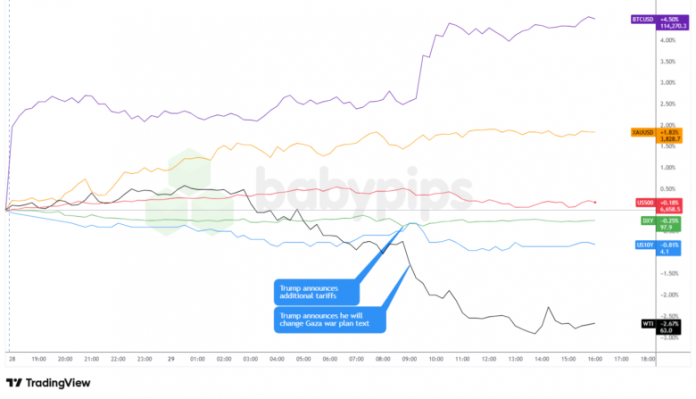

Greenback Index, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingView

Authorities shutdown anxieties dominated Monday’s buying and selling narrative as congressional leaders ready for a crucial White Home assembly with President Trump simply hours earlier than federal funding would expire. Regardless of the political uncertainty, threat property confirmed shocking resilience whereas conventional havens diverged of their responses.

The S&P 500 managed to eke out marginal beneficial properties as traders appeared to look previous quick shutdown dangers, seemingly signaling they have been centered on Fed charge cuts. The index traded in tight ranges all through the session, with early weak point giving solution to a modest restoration in the course of the New York afternoon as pending residence gross sales information stunned considerably to the upside.

Bitcoin emerged as Monday’s standout performer, surging 4.60% to commerce above $114,000 because the cryptocurrency seemingly continued to profit from its evolving function instead hedge in opposition to fiscal uncertainty and potential greenback weak point. The digital asset caught a robust bid throughout Asian hours and maintained momentum all through world buying and selling periods.

Gold prolonged its run larger, climbing 1.80% to recent all-time highs round $3,825 per ounce. The dear metallic’s relentless advance mirrored mounting issues about U.S. fiscal sustainability, authorities shutdown dangers, and blended alerts from Federal Reserve officers in regards to the future path of financial coverage.

WTI crude oil confronted important promoting stress, plummeting 2.70% to shut close to $63.10 as experiences emerged that OPEC+ might take into account further manufacturing will increase at their upcoming assembly. The prospect of recent provide into an already oversupplied market plus rising sentiment of a deal within the works to finish the struggle in Gaza had oil bears out to play and in management at present.

The ten-year Treasury yield declined 0.74% as bond patrons emerged amid shutdown issues and blended Fed commentary, with the benchmark yield pulling again from latest highs as merchants positioned for potential financial disruption from a authorities closure.

FX Market Habits: U.S. Greenback vs. Majors:

Overlay of USD vs. Majors Chart by TradingView

The U.S. greenback suffered broad-based losses on Monday, weakening in opposition to all main currencies. Promoting stress emerged in the course of the Asian session and intensified forward of European buying and selling hours. Merchants appeared to place defensively forward of a crucial congressional assembly scheduled for later within the day to deal with funding negotiations.

Volatility elevated throughout U.S. buying and selling hours amid conflicting developments. President Trump introduced new tariff threats on furnishings and movies, whereas concurrently unveiling an settlement with Israeli Prime Minister Netanyahu on a proposal to finish the struggle in Gaza. A number of Federal Reserve officers spoke after the London shut, with their feedback on gradual coverage changes probably offering modest help for the greenback in the course of the closing hours of buying and selling.

Towards particular person currencies, the yen emerged because the day’s strongest performer versus the greenback, seemingly a response to BOJ board member Noguchi’s hawkish feedback in regards to the rising want for coverage changes, driving USD/JPY 0.63% decrease. The remarks bolstered market expectations for potential BOJ tightening, offering elementary help for the yen past haven flows.

The Aussie additionally had a strong day AUD in opposition to the majors as merchants awaited Tuesday’s RBA choice, probably reflecting merchants pricing in internet constructive Australia information in latest weeks, together with a sturdy CPI learn final week.

Upcoming Potential Catalysts on the Financial Calendar

- Japan Retail Gross sales for August 2025 at 11:50 pm GMT

- Japan Industrial Manufacturing Prel for August 2025 at 11:50 pm GMT

- Japan BoJ Abstract of Opinions at 11:50 pm GMT

- New Zealand ANZ Enterprise Confidence for September 2025 at 12:00 am GMT

- Australia Constructing Permits Prel for August 2025 at 1:30 am GMT

- China NBS Manufacturing PMI for September 2025 at 1:30 am GMT

- Australia RBA Curiosity Charge Resolution for September 30, 2025 at 4:30 am GMT

- Australia RBA Press Convention at 5:30 am GMT

- Japan Housing Begins for August 2025 at 5:00 am GMT

- Germany Retail Gross sales for August 2025 at 6:00 am GMT

- U.Okay. GDP Progress Charge Last for June 30, 2025 at 6:00 am GMT

- Swiss KOF Main Indicators for September 2025 at 7:00 am GMT

- Germany Unemployment Charge for September 2025 at 7:55 am GMT

- U.S. Fed Jefferson Speech at 10:00 am GMT

- Germany Client Costs Progress Charge Prel for September 2025 at 12:00 pm GMT

- U.Okay. BoE Ramsden Speech at 12:00 pm GMT

- ECB President Lagarde Speech at 12:50 pm GMT

- U.S. S&P/Case-Shiller Residence Value for July 2025 at 1:00 pm GMT

- U.S. Home Value Index for July 2025 at 1:00 pm GMT

- U.Okay. BoE L Mann Speech at 1:25 pm GMT

- U.S. Chicago PMI for September 2025 at 1:45 pm GMT

- U.S. JOLTs Job Openings for August 2025 at 2:00 pm GMT

- U.S. CB Client Confidence for September 2025 at 2:00 pm GMT

Markets are in for a BUSY day with tons of potential sentiment-changers on faucet. The RBA Financial Coverage Assertion is true across the nook, and prone to shake up Aussie positions quickly, so make sure you try our Occasion Information earlier than dipping a toe into these waters.

Merchants will even be looking out for the U.S. JOLTs Job Openings & Client Confidence information updates in the course of the U.S. session. Markets will prone to any jobs surprises and sentiment shifts following final week’s stronger U.S. financial information that already trimmed charge minimize expectations.

As all the time, look out for world commerce developments and geopolitical headlines that might affect general market sentiment. Keep nimble and don’t overlook to take a look at our Foreign exchange Correlation Calculator when taking any trades!