Lucid Group (LCID 4.64%) is getting into probably the most thrilling years in its historical past. Following the latest launch of its Gravity SUV platform, analysts count on the corporate to greater than double its gross sales this yr. That is an enormous purpose why shares are priced at a lofty 11 instances gross sales.

For those who’re betting on this development inventory, be sure to additionally take note of the metric I discuss under. Long run, it might show simply as essential as gross sales development.

Lucid wants this quantity to enhance

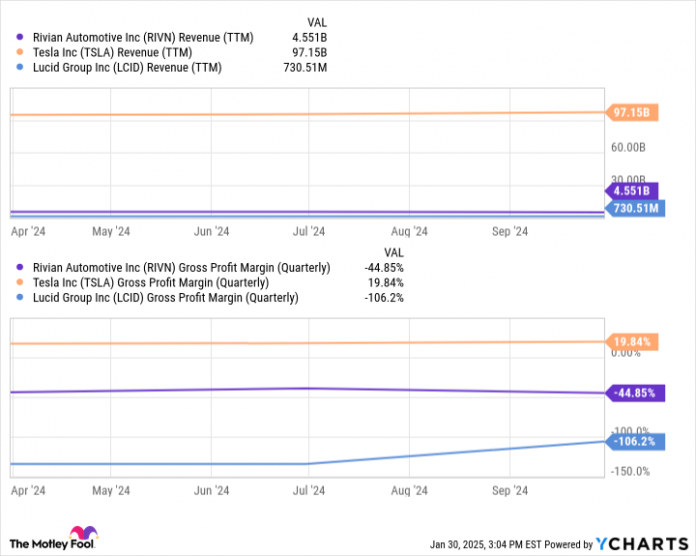

Creating and scaling an electrical car producer is costly. It takes billions of {dollars} to convey a brand new automotive mannequin to market, and earnings should not be anticipated for years, if not many years. Firms like Tesla had been capable of obtain constructive gross margins pretty early, however newcomers like Rivian have discovered it harder to show a revenue on every automotive offered. Because the smallest of the three, Lucid stays nicely behind on this class.

RIVN Income (TTM) knowledge by YCharts

Whereas the market is paying shut consideration to Lucid’s gross sales development trajectory, gross margin can turn into a significant factor at any time, particularly if gross sales development stalls unexpectedly. That is as a result of gross margins are a dependable indicator of Lucid’s money circulation wants. Tesla makes a revenue on each automotive it sells, making it a lot simpler to generate a internet revenue total, and thus simply as more likely to generate free money circulation over time. Lucid, nevertheless, nonetheless loses cash on each automotive it sells. That makes turning a companywide revenue practically inconceivable, sometimes resulting in destructive free-cash-flow era.

For now, Lucid’s fast gross sales development can preserve the warmth off of weak gross margin. However for those who’re a long-term investor in Lucid, gross sales development and gross margin enchancment are the 2 most essential metrics to trace.

Ryan Vanzo has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Tesla. The Motley Idiot has a disclosure coverage.