Candlestick patterns are key instruments, serving to merchants to know market actions. An Engulfing sample stands out as one of the dependable indicators of a possible development reversal, usually predicting value modifications with notable accuracy. Its effectiveness has made it a well-liked selection amongst each novice and seasoned merchants.

You’ll learn to acknowledge an Engulfing sample and apply it in buying and selling. Uncover the world of candlestick evaluation and unlock new methods for profitable buying and selling!

The article covers the next topics:

Main Takeaways

- An Engulfing sample is a two-candlestick formation that indicators a doable development reversal, the place the second candlestick fully overlaps the physique of the primary one.

- A Bullish Engulfing sample types throughout a downtrend, whereas a Bearish Engulfing sample seems throughout an uptrend, indicating a change in market sentiment.

- The sample ought to be confirmed, as false indicators might happen in periods of low volatility.

- The sample’s reliability will increase whether it is confirmed by quantity, indicators, or key help/resistance ranges.

- The sample is used to open trades with clear stop-loss and take-profit ranges.

- Understanding how an Engulfing sample works will help merchants analyze charts and create worthwhile methods.

What’s the Engulfing Candlestick Sample?

The engulfing candlestick sample is a Japanese candlestick sample that consists of two candlesticks, a bullish and a bearish one. The determine warns market members about an upcoming value reversal, relying on the character of the sample.

The engulfing sample is usually utilized in Foreign exchange, in addition to the inventory, cryptocurrency and commodity markets.

The bigger the timeframe on which the sample seems, the stronger the reversal sign it offers. As well as, the potential of a value reversal will increase if different candlestick patterns or technical indicators verify the engulfing sample.

Forms of Engulf Candlestick Patterns

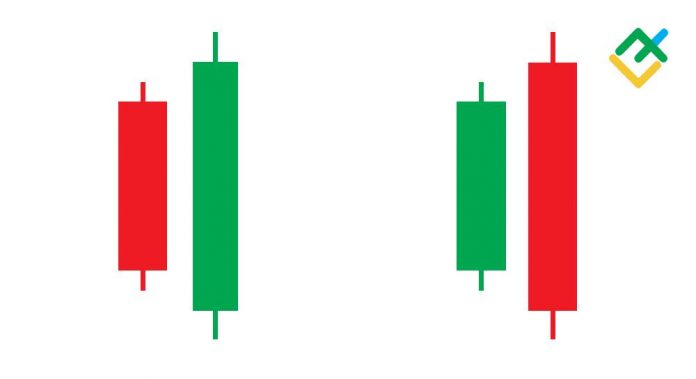

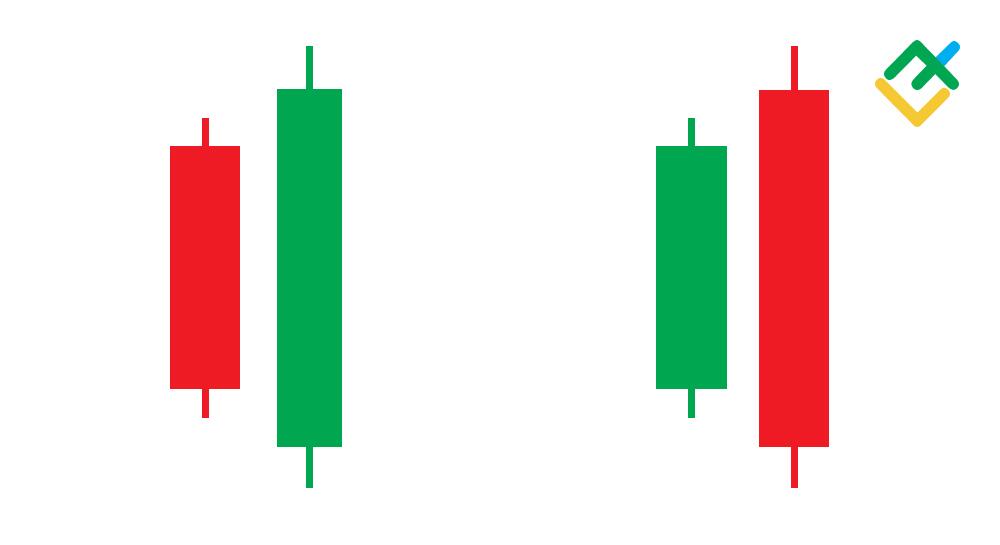

On this part, you’ll study in regards to the kinds of patterns discovered out there. There are two kinds of this sample: bullish and bearish engulfing.

It is necessary to not confuse this sample with the harami sample.

In a harami, the primary candle engulfs the second, however this sample isn’t a reversal. That is reasonably a warning a few brief lull out there. As well as, the harami sample is a single-candle sample that may be both bullish or bearish.

Bullish engulfing sample

A bullish engulfing sample is a sample by which the second ascending candle engulfs the primary bearish candle. That’s, the bulls present their power and open giant purchases of the asset.

A bullish engulfing sample happens after a downtrend within the space of low costs. The sample on the backside warns that the worth is about to reverse. On increased timeframes from H4, the sample offers a stronger sign for development reversal.

On timeframes as much as H1, the sample is fashioned primarily throughout value corrections. Typically, on smaller timeframes, this sample could be discovered in the midst of a downtrend or at a neighborhood prime. That is because of the excessive degree of market noise. False patterns are fashioned on the chart, which might mislead merchants.

Engulfing can be utilized for intraday buying and selling. Nonetheless, it is very important additional verify the sample utilizing different candlestick patterns or technical indicators.

What do Bullish engulfing patterns present merchants?

The formation of a bullish engulfing sample within the chart indicators that the worth has reached the underside and is making ready to reverse the development to bullish.

A bullish engulfing candle should meet the next standards to verify an impending value reversal:

- a bullish engulfing sample have to be preceded by a particular downtrend;

- first, a bearish candle should type, which could be full-bodied or with small wicks up and down;

- the opening value of the second candle have to be decrease than the closing value of the primary candle. That’s, a downward value hole ought to type;

- by the tip of the second candle, the closing value ought to be increased than the opening value of the primary candle. On this case, shadows of the absorbing candle are allowed.

It ought to be emphasised {that a} bullish engulfing sign could be enhanced if:

- A big downward hole has been fashioned. The second candle closed a lot increased.

- A protracted bullish engulfing candle has fashioned. Thus, the chance of a development reversal will increase.

- An engulfing candle overlapped a number of earlier candles.

- There aren’t any shadows of the engulfing candle.

- The engulfing candle covers not solely the physique of the primary candle but additionally its shadows.

- When a bullish engulfing candle is constructed, buying and selling volumes improve.

Bullish Engulfing Sample Examples

Let’s take a better take a look at the bullish engulfing sample on the Nvidia every day timeframe.

The chart reveals a collection of reversal bullish engulfing candlestick patterns after a protracted downtrend. These patterns served as a sign for a worldwide value reversal and the start of a long-term bullish development.

One other instance of a bullish engulfing candle could be seen beneath within the XAUUSD every day chart. After the formation of the gold sample, quotes reversed upward and grew by greater than 43% in 5 months.

Bearish engulfing sample

A bearish engulfing sample consists of two candles, the primary of which ought to be bullish, and the second ought to be bearish. The second candle is an engulfing candle and warns of an imminent value reversal downwards after an uptrend. The smaller the physique of the primary candle and the longer the physique of the engulfing candle, the upper the potential of a bearish reversal. Additionally, engulfing the shadows of the primary candle along with its physique enhances the impact and will increase the potential of a reversal.

What Can a Bearish Engulfing Sample Inform You

A bearish engulfing sample happens on the prime within the high-price space. This sample indicators an imminent value reversal downwards. The looks of a bearish engulfing candle is preceded by a protracted upward development. For the time being of formation of the primary bullish candle, buying and selling volumes lower. On this case, the dimensions of the candle physique doesn’t matter.

When the second candle opens, an upward value hole is fashioned, which serves as a sign of an uptrend continuation. Nonetheless, by the tip of the chosen time interval, quotes fall beneath the opening value of the primary candle. That’s, the physique of the second candle engulfs the physique of the primary candle whereas buying and selling volumes start to develop.

Presently, the bulls start to shut their positions with a revenue. Bears, quite the opposite, search for worthwhile entry factors into the market and open brief trades.

The development reversal sign is strengthened if the next situations are met:

- the longer the physique of the engulfing bearish candle and the shorter the physique of the bullish one, the stronger the sign for a downward reversal;

- brief wicks or their absence in a bearish candle signifies sturdy strain from sellers and the fast improvement of a downtrend;

- a bigger hole between candles additionally strengthens the reversal sign;

- if a bearish candle engulfs not solely the physique of the bullish candle, but additionally its shadows.

Bearish Engulfing Sample Examples

The Adidas AG inventory chart beneath reveals bearish engulfing. After an upward development, the asset value reversed down in the important thing resistance zone.

Patrons tried to revive the worth from the help degree, however a collection of bearish engulfing candlestick patterns fashioned on this zone. The sign for a development reversal was strengthened by the absence of higher wicks in each the primary and second figures. A lower in volumes through the formation of the primary candle and their improve through the formation of an engulfing candle function extra affirmation.

The final affirmation sign for opening brief trades was the breakout of the primary help degree, after which the worth started to say no actively.

Let’s think about the bearish engulfing sample within the EURUSD hourly chart.

When buying and selling Foreign exchange, you’ll be able to see an engulfing sample and not using a value hole. This is because of the truth that forex pairs are traded with out interruption, besides on weekends. On this case, a value hole might come up as a consequence of sure basic components.

After the looks of bearish engulfing candlesticks patterns, the worth reversed down and commenced to actively decline. The bearish development was stopped by two reversal patterns, the hammer and the inverted hammer.

Bullish and Bearish Engulfing Patterns: What is the Distinction?

Bullish and bearish engulfing patterns are reverse to one another.

Nonetheless, they each warn of a development reversal and supply sturdy indicators to market members.

Extra detailed details about the variations between these patterns is offered beneath.

|

Bullish Engulfing Sample |

Bearish engulfing sample |

|

Varieties within the help zone after a downtrend. |

Varieties within the resistance zone after an uptrend. |

|

Warns of an upward value reversal. |

Warns of a downward value reversal. |

|

A bullish engulfing candle opens with a value hole down. By the tip of the interval, it closes above the opening value of the earlier candle. |

A bearish engulfing candle opens with a value hole up. By the tip of the interval, it closes beneath the opening value of the earlier candle. |

The best way to Use Engulf Candle in Buying and selling Methods

As with all different technical evaluation patterns, the engulfing sample supplies distinctive warning indicators. Beneath is an evaluation of engulfing buying and selling methods.

Engulfing Candle Reversal Technique

This technique includes opening positions on a development reversal after the sample formation. Opening/closing a commerce is carried out in keeping with the principles of danger and cash administration.

For a bullish candle

The formation of a bullish engulfing candlestick sample on the backside after a protracted downtrend suggests a subsequent reversal because the asset has reached a low value zone.

Let’s think about bullish engulfing buying and selling utilizing the instance of the GBPUSD forex pair. The H4 chart beneath reveals a number of reversal patterns of bullish engulfing and hammer close to help 1.2331. Then, the worth reversed up and reached resistance at 1.2493. After this, the quotes skilled a correction.

Nonetheless, it turned clear that the worth had reached its backside. Thus, after the primary engulfing sample appeared on the degree of 1.2385, it was doable to open a protracted commerce. Cease loss is about beneath the help degree round 1.2304.

Then, one other collection of bullish engulfing and hammer patterns fashioned within the chart. Value lows and highs are additionally rising, which is one other signal of a bullish reversal.

The second alternative to open a protracted commerce was round 1.2439. The cease loss needed to be set decrease, round 1.2358. The breakout of the important thing resistance at 1.2493 allowed us to achieve the primary goal on the degree of 1.2574. On this case, it was doable to take 50% of the revenue and go away a part of the commerce for the second and third targets on the ranges of 1.2682 and 1.2763, respectively.

For a bearish candle

A bearish engulfing sample types on the prime within the excessive value zone after a protracted uptrend. Let’s think about bearish engulfing buying and selling utilizing the instance of the Tesla Inc shares. The screenshot beneath reveals that the asset has reached 310.00 and can’t escape the resistance degree.

The value was within the facet channel 268.00 – 310.00 for a very long time, forming reversal patterns. The primary sign for a reversal was the formation of the night star sample, which indicators the bulls to shut lengthy trades. Two extra reversal candlestick patterns, a hanging man and a darkish cloud cowl, fashioned one after the opposite.

Earlier than the ultimate reversal and breakout of the important thing help at 268.00, a collection of bearish engulfing patterns fashioned within the chart. The fashioned sample after retesting the extent of 310.00 turned a sign to open brief trades with targets at 268.00, 226.00, 194.50, 163.00, 142.00. The cease loss needed to be set increased, round 320.50.

Engulfing Candle When Pattern Buying and selling

Engulfing patterns can not all the time be thought-about reversal patterns. In a powerful development, these patterns can turn out to be a sign of development continuation. Let’s examine this case in additional element utilizing the instance of Apple Inc shares.

Within the chart beneath, the worth of the asset reached the underside on the key help zone of twenty-two.40, the place a double backside value sample was fashioned. This was confirmed by the bullish engulfing reversal sample, after which it was doable to open a protracted commerce round 24.00 with a revenue goal of 27.20. The cease loss is about beneath the low of the engulfing candle at 23.20.

Then, the worth efficiently examined the primary resistance degree 24.80, having beforehand fashioned one other bullish engulfing candlestick sample. It ought to be famous that these patterns are fashioned at nearly each new degree that the bulls have overcome throughout the development. On the similar time, a bearish engulfing sample has fashioned on the degree of 27.20, which signifies the vital significance of this degree for merchants. Nonetheless, the sellers’ try to vary the scenario was unsuccessful, as indicated by bullish hammer patterns.

The technique for buying and selling the engulfing sample in keeping with the development is predicated on a constant improve or lower in value to new goal ranges at which this sample is fashioned. The formation of such patterns signifies the continuation of secure value motion.

This technique supplies merchants with the chance to see an goal image of the market and open trades with seen targets. It ought to be emphasised that this technique ought to be used throughout a powerful development and from the purpose of value reversal.

Engulfing Potential Commerce Entry & Promote Indicators

The engulfing sample is a powerful reversal sample. The looks of a sample within the chart indicators an imminent development reversal. Nonetheless, engulfing requires extra affirmation from different technical indicators or candlestick patterns.

It ought to be emphasised that engulfing offers extra correct indicators on increased timeframes from H4 and better. On decrease timeframes, the sample can provide false indicators, main merchants right into a entice. This occurs as a consequence of sturdy market noise.

Engulfing should meet the next standards:

- The sample is fashioned within the zone of excessive or low costs after a protracted upward or downward development, respectively. In circumstances of a powerful development, engulfing can verify the continuation of the development.

- The 2 candles that make up the sample should have completely different instructions. An engulfing candle should overlap the earlier candle.

The components beneath can improve an engulfing candle:

- A lower in buying and selling volumes when the primary candle is fashioned and a rise in volumes when the second candle is fashioned.

- The bigger the engulfing candle and the smaller the primary candle of the sample, the stronger the sign for a value reversal.

- An engulfing candle overlaps a number of earlier candles.

The best way to Commerce on Engulfing Candlestick Patterns

To efficiently commerce Foreign exchange utilizing engulfing, you should use candlestick evaluation with varied technical indicators.

Beneath is a step-by-step information utilizing the GBPUSD forex pair for example:

-

To begin with, having chosen an instrument for buying and selling, decide the closest help and resistance ranges.

-

Add the next technical indicators to the chart: quantity, RSI and MACD.

-

If a bullish engulfing sample is detected, anticipate affirmation of this sample utilizing technical indicators and different candlestick patterns.

After the formation of a bullish engulfing sample, one other engulfing sample and a hammer reversal sample fashioned within the chart. Within the hammer zone, the MACD indicator crossed the zero border from backside to prime and commenced to develop within the constructive zone. As well as, the RSI crossed degree 50, which implies a bullish reversal.

-

Solely after such affirmation can we are saying that progress begins. After the worth consolidates above the primary resistance degree, that you must open a protracted commerce. In our case, revenue targets had been at native ranges of the second and third resistance.

-

The cease loss have to be set beneath the primary resistance. In our case, in keeping with danger administration, the cease order needed to be positioned within the most zone of the engulfing candles. In the event you set it even decrease, then if the forecast is inaccurate, merchants might lose a big a part of the deposit.

Engulfing Sample Buying and selling Ideas

Beneath are quite a few suggestions for utilizing the engulfing candlestick sample in buying and selling:

- Attempt to use engulfing on increased time frames, at which stronger indicators seem indicating a development reversal or its continuation. For intraday buying and selling, it’s higher to make use of timeframes from H1.

- To examine the sample, use the quantity indicator to keep away from market traps.

- Make sure you anticipate engulfing affirmation utilizing different candlestick patterns and technical indicators earlier than opening a place.

- Use help and resistance ranges to set revenue targets.

- For the reason that market is unpredictable, set cease losses to reduce the chance of shedding your deposit.

Benefits of Buying and selling the Engulfing Sample

Bullish and bearish engulfing are extremely popular amongst each novices and skilled merchants. So why is that this sample engaging for buying and selling?

Beneath are the advantages of the engulfing candlestick sample:

- The sample is simple to identify on the worth chart. It consists of two candles which have completely different instructions. The second of those candles is clearly seen within the chart.

- The engulfing sample could be present in any timeframe in any monetary market.

- Engaging risk-reward ratio. An engulfing cease loss is about barely beneath or above the low or excessive of the engulfing candle, relying on the development.

Limitations of Engulfing Patterns

- Merchants usually confuse the engulfing sample with a value rollback. It seems within the zone of key resistance and help ranges. Additionally, take note of volumes when constructing the second candle. If the quantity of the second candle is decrease than that of the primary, then the worth is extra more likely to roll again. Additionally, the engulfing sample can simply be confused with the Marubozu sample, which signifies a continuation of a development and has a protracted physique.

- The engulfing sample must be confirmed utilizing extra candlestick patterns and technical indicators. Due to this fact, earlier than buying and selling, it’s vital to review different reversal patterns in candlestick evaluation.

Conclusion

The engulfing sample has a particular function in buying and selling. The formation of this sample within the chart precedes a development reversal out there. The sample is widespread in monetary markets and is simple to determine. The looks of a sample on increased timeframes indicators a extra world development reversal.

From a psychological viewpoint, in the mean time the sample is fashioned, the earlier development weakens because of the large closure of positions. On the similar time, the choice development strengthens, consequently, trades are opened in the wrong way.

You possibly can attempt buying and selling utilizing the engulfing sample within the handy and multifunctional LiteFinance net terminal with a variety of buying and selling devices.

Engulfing Candlestick Patterns FAQ

The content material of this text displays the writer’s opinion and doesn’t essentially mirror the official place of LiteFinance dealer. The fabric printed on this web page is supplied for informational functions solely and shouldn’t be thought-about as the supply of funding recommendation for the needs of Directive 2014/65/EU.

In response to copyright regulation, this text is taken into account mental property, which features a prohibition on copying and distributing it with out consent.