Analysts are highlighting ETH USD priming to retest $4,700 – and amid the upside stress – is darkish cash rotating into Ethereum?

A pockets tied to a $300M Coinbase rip-off purchased $18.9M price of Ether as ETH ripped previous $4,700 Yesterday.

In keeping with Lookonchain, a crypto handle linked to the “Coinbase hacker” marketing campaign purchased 3,976 ETH for $18.9 million on Sept. 13.

The hacker who stole $300M+ from #Coinbase customers purchased one other 3,976 $ETH($18.9M) at $$4,756 an hour in the past.https://t.co/xgGLej7nrd pic.twitter.com/WrxobUkK7k

— Lookonchain (@lookonchain) September 13, 2025

The purchases, made at a median value of $4,756, got here as Ether pushed previous the $4,700 mark.

Analysts monitoring the pockets say the funds had been funneled via 18.911 million DAI earlier than being transformed to ETH. Arkham Intelligence knowledge reveals the pockets aggregated DAI in quantities starting from $80,000 to $6 million earlier than swapping.

The handle has additionally been lively not too long ago, choosing up 4,863 ETH and 649 ETH in July and round $8 million price of Solana in August.

Blockchain investigator ZachXBT estimated that the broader scheme drained at the very least $330 million from victims earlier this 12 months.

2/ Myself and @tanuki42_ hung out reviewing Coinbase withdrawals and gathering knowledge from my DMs for top confidence thefts on varied chains.

Under is a desk we created which reveals $65M stolen from Coinbase customers in Dec 2024 – Jan 2025.

Our quantity is probably going a lot decrease than… pic.twitter.com/ZceQ5AggYU

— ZachXBT (@zachxbt) February 3, 2025

The operation, described as a wide-scale social engineering marketing campaign, focused Coinbase customers and has saved the pockets underneath shut surveillance from on-chain analysts.

The timing of the newest ETH accumulation has bolstered hypothesis of a market rotation into Ether.

Merchants famous the pockets’s strikes coincided with renewed momentum in ETH/USD, including weight to the narrative that deep-pocketed actors are shifting into the asset.

Ethereum Value Evaluation: How Excessive May ETH Go If the $4,700 Neckline Breaks?

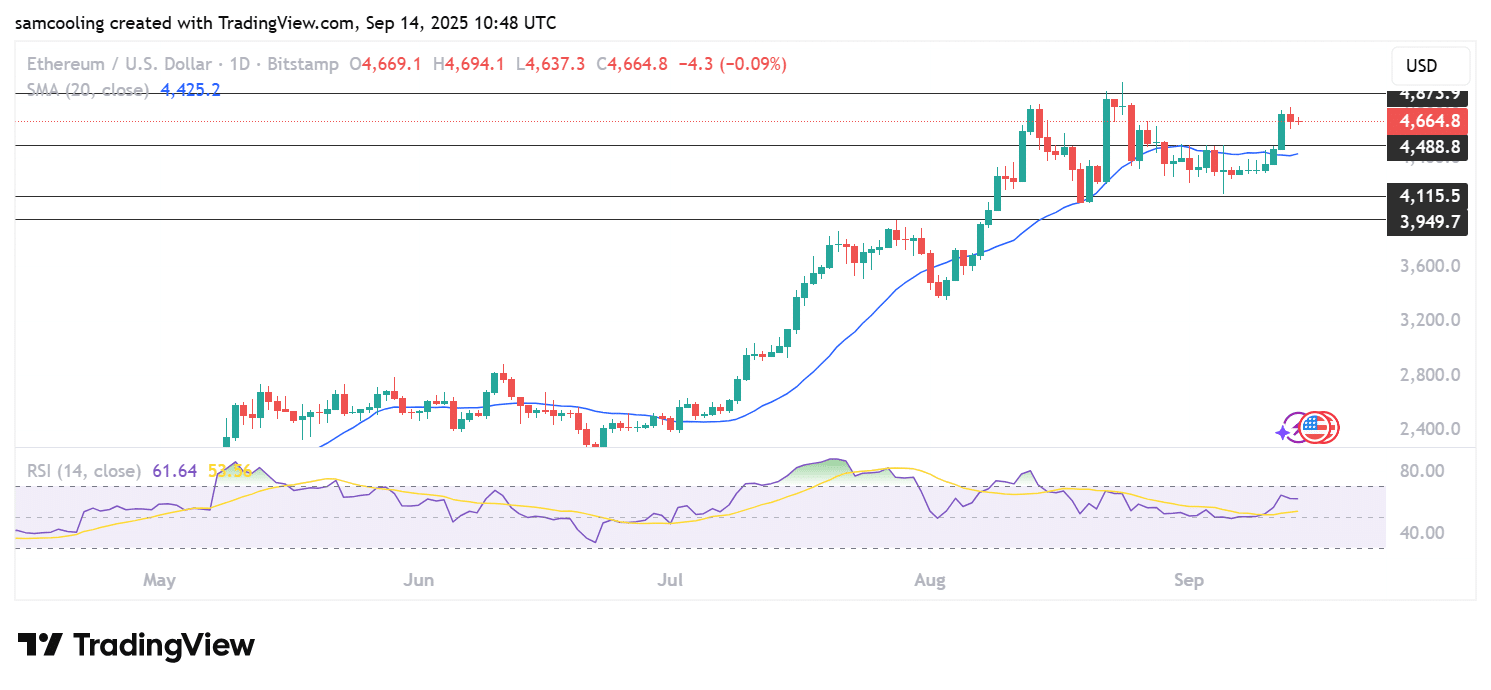

Ethereum is exhibiting renewed energy, with technical indicators pointing to a attainable breakout that might ship costs towards $5,500.

As per Tradingview knowledge, ETH trades close to $4,660, holding above its short-term transferring averages on the 4-hour chart.

(Supply – ETH USDT, TradingView)

The 50-EMA sits at $4,462 and the 100-EMA at $4,421, each trending upward. This setup suggests patrons stay in management regardless of minor pullbacks.

Current periods have additionally seen increased quantity, supporting the transfer that lifted ETH from the $4,300 vary to above $4,650 in just some days.

The broader construction reveals a restoration development after weeks of sideways motion. Brief-term candles reveal temporary dips adopted by contemporary shopping for, an indication of regular demand.

If ETH holds help above the 50-EMA, momentum could proceed. If not, value dangers sliding again to the $4,400-$4,300 zone, the place each transferring averages converge.

Analyst Titan of Crypto pointed to an Adam & Eve double-bottom sample on the every day chart.

The formation combines a pointy “V”-shaped low with a rounded base, signaling a possible reversal. The neckline lies just under $4,700, near present ranges.

A confirmed breakout above that neckline would challenge a measured transfer goal of $5,500, in keeping with historic resistance. This provides weight to the view that Ethereum could possibly be organising for a extra substantial rally if shopping for stress holds.

What Are Derivatives Telling Us About Ethereum’s Subsequent Transfer?

If Ethereum breaks above the neckline, merchants might flip bullish, with $5,500 as the subsequent goal. But when it fails, the worth could pull again to check how strong the latest rally actually is.

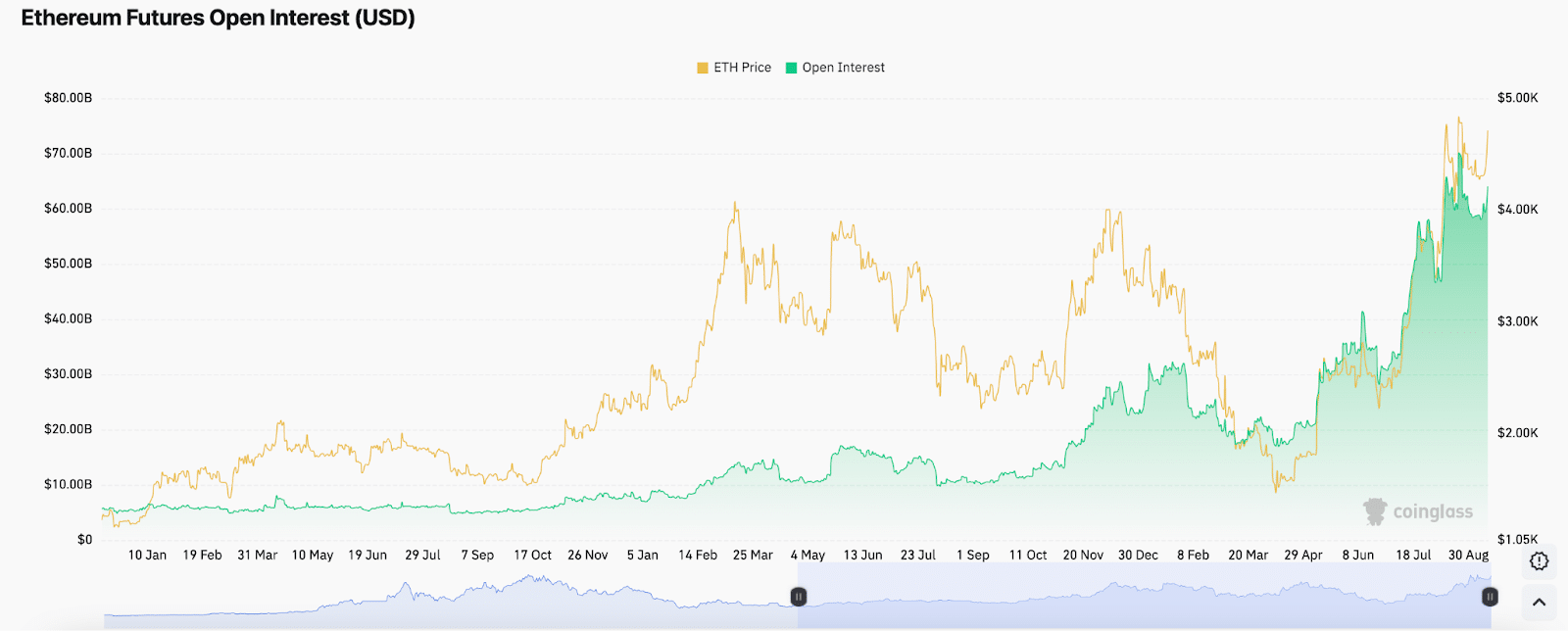

Derivatives exercise reveals elevated positioning. CoinGlass knowledge places ETH futures open curiosity close to $64Bn, whereas funding charges final session hovered round 0.01% throughout main exchanges, regular, however not extreme.

Spot ETF flows have additionally improved. On Sept. 12, after a number of days of outflows, Farside Traders reported internet inflows into US ETH funds, pointing to contemporary institutional demand.

DISCOVER: 9+ Finest Excessive-Danger, Excessive-Reward Crypto to Purchase in 2025

The publish ETH USD Value Primes to Retest $4,700: Darkish Cash Rotating into Ethereum? appeared first on 99Bitcoins.