Ethereum (ETH) has misplaced a few of its upward momentum after nearing its all-time excessive, mirroring a broader correction throughout the cryptocurrency market. The second-largest digital asset by market capitalization briefly touched $4,776 final week, simply shy of the $4,878 document set in 2021, earlier than retreating.

On the time of writing, ETH trades at $4,280, reflecting a 5.7% decline up to now 24 hours and almost $500 beneath its current peak. The pullback comes as analysts carefully watch buying and selling exercise in derivatives markets.

In accordance with knowledge shared by CryptoQuant analyst CryptoOnchain, retail participation in Ethereum’s futures market has surged considerably in current periods. This heightened exercise, mixed with elevated open curiosity ranges, has sparked debate about whether or not the market is approaching a tipping level.

Associated Studying

Ethereum Futures Market Exhibits Overheating Indicators

CryptoOnchain famous that Ethereum’s futures buying and selling frequency has entered what he describes because the “Many Retail” and “Too Many Retail” zones, thresholds that traditionally seem close to the late phases of sturdy uptrends.

“Retail participation has sharply elevated as ETH costs moved above $4,500,” he defined, including that such situations typically deliver larger volatility and sudden pullbacks.

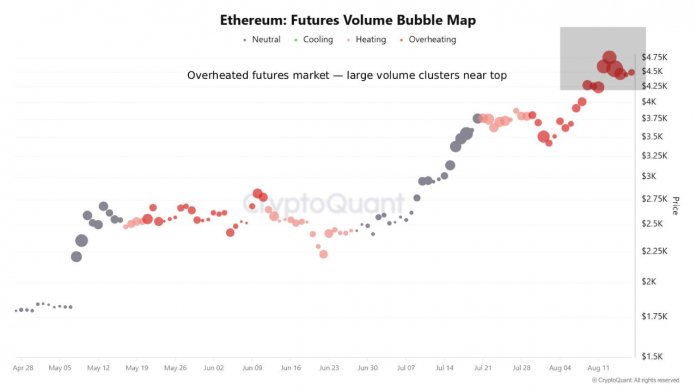

Further indicators help this cautious outlook. The analyst highlighted Ethereum’s Futures Quantity Bubble Map, which at present reveals clusters of huge pink bubbles close to current worth highs. These patterns, he stated, have often preceded both sharp breakouts or fast corrections when extreme leverage unwinds.

In the meantime, open curiosity (OI) on Binance futures climbed to just about $12 billion earlier than easing again to round $10.3 billion. Whereas nonetheless at traditionally excessive ranges, the current dip suggests some merchants might already be lowering publicity.

“Excessive open curiosity enlargement close to worth peaks can both present gas for additional upside or set off squeezes when the market turns,” CryptoOnchain wrote. He additionally identified that Binance’s taker purchase/promote ratio has remained beneath 1, indicating promoting stress has dominated buying and selling exercise in current days.

Spot Market Dynamics Supply a Totally different Perspective

Not all analysts see the present pullback as a direct signal of market stress. In a separate put up, CryptoQuant contributor Woominkyu noticed that funding charges for ETH perpetual futures stay flat round zero.

This contrasts with earlier bull runs in 2020–2021 and early 2024, when funding charges spiked above 0.05–0.10, signaling overheated lengthy positions.

“ETH simply pushed above $4.2K, however funding continues to be sitting flat,” Woominkyu defined. “That means the rally has been pushed extra by spot shopping for moderately than leverage.”

Associated Studying

In accordance with the analyst, this dynamic signifies a comparatively more healthy market setting in comparison with previous rallies, because it reduces the danger of compelled liquidations. He added {that a} funding fee surge above 0.05 can be the extent to observe for potential short-term tops.

Featured picture created with DALL-E, Chart from TradingView