Most large-cap altcoins have moments of brilliance on this present bull cycle, with Solana and XRP being among the stand-out performers. Then again, Ethereum “the king of altcoins” has struggled to impress, underperforming over the previous 12 months.

The most recent on-chain knowledge reveals {that a} vital proportion of ETH traders at the moment are underwater, partially because of the downturn that lately plagued the overall market. Under is the quantity of the Ethereum provide in loss and its potential affect on value.

How Many ETH Tokens Are In Revenue?

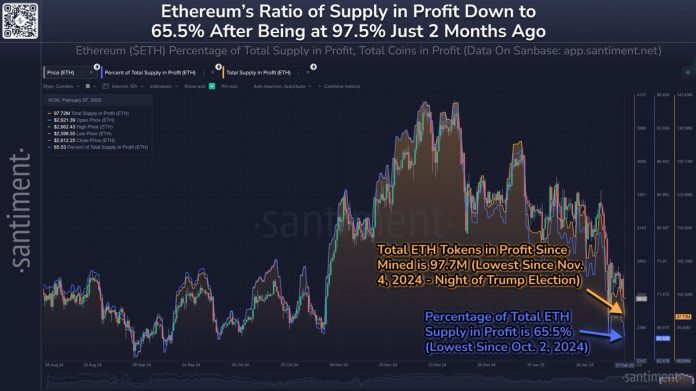

In a Feb. 8 submit on the X platform, distinguished on-chain analytics agency Santiment revealed that the quantity of Ethereum tokens within the pink has steadily elevated over the previous few weeks. The 2 related metrics listed here are the “p.c of complete provide in revenue” and “complete provide in revenue.”

For context, the “provide in revenue” metric is calculated by including all token quantities that have been final transferred when the token’s value was lower than the present value. In the meantime, the “p.c of complete provide in revenue” metric measures the share of a cryptocurrency’s complete provide at the moment being held at a value increased than the unique buy value. It represents the ratio between provide in revenue and circulation provide.

In response to Santiment, Ethereum’s market capitalization has slumped by no less than 36% since reaching an area excessive of $4,016 in mid-December. Expectedly, this regular value decline has resulted in a notable drop within the quantity of ETH tokens in revenue since their date first mined.

Supply: Santiment/X

Knowledge from Santiment reveals that the quantity of Ethereum tokens in revenue is at the moment round 97.7 million, the bottom worth since November 4, 2024 (the evening Trump received the US Presidential election) On the similar time, the ratio of the entire ETH provide in revenue stands at 65.5%, the bottom worth since October 2, 2024, and down from 97.5% in early December.

Santiment famous in its submit:

The gang has been notoriously destructive towards the #2 market cap because it has under-performed in comparison with different giant caps. With an excessive amount of FUD and retail merchants willingly dumping their tokens, there could also be some shock bounces in retailer as soon as crypto markets are capable of stabilize.

When a comparatively lesser proportion of a token’s provide is in revenue, resilient long-term holders are prone to dominate the market. This implies most “FUD and retail merchants” have exited their positions and offered their tokens, decreasing downward stress and setting the stage for a possible rebound.

Ethereum Value

As of this writing, the value of ETH sits simply above the $2,600 mark, reflecting an over 2% enhance up to now 24 hours.

The value of ETH on the day by day timeframe | Supply: ETHUSDT chart on TradingView

Featured picture from iStock, chart from TradingView