The value of Ethereum had fairly a tough efficiency over the previous week, falling from its typical vary above the $4,600 stage to under $4,500. Regardless of the injection of bullish momentum into the market by the US Federal Reserve’s rate of interest minimize, the “king of altcoins” didn’t maintain its rally again to the $4,600 area.

Based on the most recent on-chain knowledge, the Ethereum worth might be gearing up for a good longer time within the chilly, as buyers appear to be turning away from the second-largest cryptocurrency by market cap. The query, although, is how deep the worth of ETH will fall within the coming weeks?

ETH Worth At Danger Of Return To $1,500?

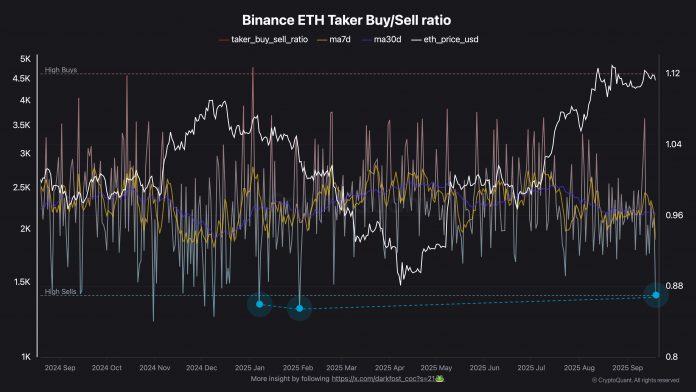

In a latest publish on the social media platform X, pseudonymous crypto analyst Darkfost revealed that the Ethereum buyers may be flooding out of the market in the intervening time. This statement is predicated on the latest downturn within the ETH Taker Purchase-Promote Ratio on the world’s largest crypto trade by buying and selling quantity.

Associated Studying

The Taker Purchase-Promote Ratio is an on-chain indicator that compares the proportion of the taker purchase volumes to the taker promote volumes on crypto exchanges. When the worth of this metric is larger than one, it alerts that the taker purchase quantity is increased than the taker promote quantity on a crypto trade. This pattern sometimes factors to the willingness of extra merchants to buy cash at the next worth on the buying and selling platform.

In the meantime, a less-than-one worth for the Taker Purchase-Promote Ratio sometimes signifies that the taker promote quantity is increased than the taker purchase quantity on the trade. In the end, this low worth signifies that extra sellers are offloading their property at a cheaper price, precipitating bearish strain out there.

Based on knowledge from CryptoQuant, the Ethereum Taker Purchase-Promote Ratio fell under the 1 threshold to round 0.87 on Friday, September 19. This newest decline marked the third time this metric has fallen this low up to now in 2025.

As noticed within the above chart, Darkfost famous that the indicator fell as little as 0.85 in January and February 2025. This ratio decline coincided with the bearish pattern, throughout which the worth of Ethereum fell to across the $1,500 area.

As of the time of publishing their publish on X, Darkfost revealed that the 7-day common of the Taker Purchase-Promote Ratio stood at 0.93, which remains to be in need of the 1 threshold. The on-chain analyst concluded that whereas the Ethereum worth is seeking to break above the $5,000 milestone, extra buyers appear to be more and more betting in opposition to the altcoin’s rally.

Though it’s extremely unlikely to see a downturn just like the one in 2025’s first quarter, the most recent on-chain occasions counsel that the worth of ETH may nonetheless face some bearish strain within the coming weeks.

Ethereum Worth At A Look

As of this writing, the worth of ETH stands at round $4,475, reflecting a mere 0.4% leap up to now 24 hours.

Associated Studying

Featured picture from iStock, chart from TradingView