CryptoQuant has launched a brand new report, highlighting a major shift in Ethereum’s alternate provide dynamics and institutional habits. In response to the information, the quantity of ETH held on crypto exchanges has crashed to sudden lows. The decline coincides with rising institutional accumulation, a development typically considered as an early sign of a bullish worth outlook.

Ethereum Trade Balances Fall To 2016 Lows

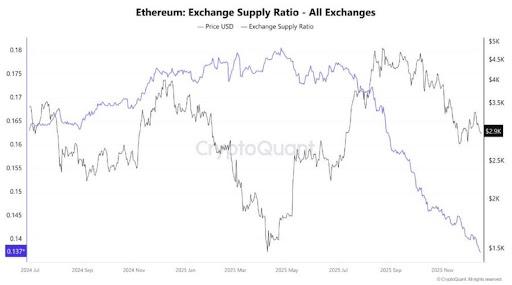

Arab Chain, a crypto analyst on CryptoQuant, revealed that Ethereum’s alternate provide ratio throughout all tracked platforms has declined to roughly 0.137. In response to the information referenced within the report, this represents one of many lowest readings noticed since 2016.

Associated Studying

The analyst emphasised that this metric displays the proportion of complete ETH provide presently held on exchanges relative to the general circulating provide. Decrease ranges of this metric replicate a smaller fraction of ETH prepared for liquidation on exchanges, which the analyst identifies as an essential think about understanding market liquidity situations.

Arab Chain additionally famous that the sustained decline on this ratio signifies a continued outflow of ETH from centralized exchanges to exterior wallets. This motion suggests {that a} smaller portion of Ethereum’s provide is available for buying and selling. It additionally alerts rising confidence amongst holders preferring long-term positioning over short-term hypothesis.

From a broader market perspective, a shrinking alternate provide is commonly seen as bullish for costs because of fundamental supply-and-demand dynamics. When fewer cash can be found to promote, even a slight improve in demand can push costs up, as consumers compete for a smaller pool of liquid ETH. Lowered liquidity may restrict the depth of declines, as giant promote orders develop into tougher to execute with out shifting the market.

In his report, Arab Chain references historic behaviour, illustrated by a chart displaying the Ethereum provide ratio for all exchanges. The analyst famous that comparable declines in alternate provide have occurred in periods of reaccumulation or within the lead-up to steady worth actions following important market volatility.

Ethereum Provide On Binance Crashes

Arab Chain has additionally shared insights on Ethereum’s provide on Binance. The analyst disclosed that ETH balances on the alternate have been steadily declining over the previous few months. As one of many largest crypto exchanges on the earth, Binance’s reserve modifications typically replicate broader market sentiment.

Associated Studying

The CryptoQuant report highlights that the Trade Provide Ratio on Binance has crashed to 0.0325, a comparatively low degree in comparison with earlier months. This means a gradual withdrawal of ETH from the crypto alternate, decreasing the quantity of tokens accessible for rapid spot market promoting.

Arab Chain advised that the drop in Ethereum provide on Binance exhibits that merchants have gotten extra cautious. Slightly than partaking in short-term trades, many look like holding ETH off exchanges because of ongoing market volatility and uncertainty. The analyst added that the falling provide, mixed with ETH’s worth stability, signifies decrease promoting strain. It additionally alerts that the market could also be coming into a brand new section of liquidity absorption and repositioning.

Featured picture from Adobe Inventory, chart from Tradingview.com