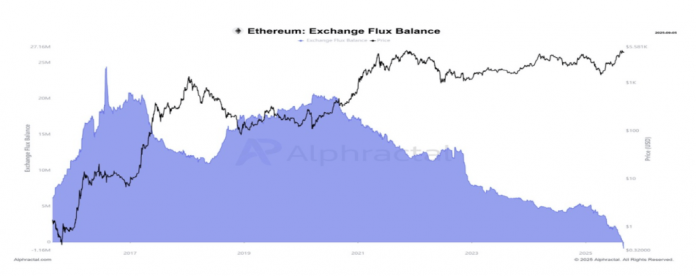

Ethereum (ETH) has simply made historical past with a improvement that would reshape its market trajectory. For the primary time, the Ethereum trade steadiness has turned unfavourable, which means extra tokens are being withdrawn from buying and selling platforms than deposited. This structural shift in provide dynamics has analysts labeling it a key bullish sign for the market’s subsequent rally.

Ethereum Trade Steadiness = Damaging

Crypto market skilled Cas Abbe shared a brand new report displaying that Ethereum’s trade flux has slipped into the unfavourable territory for the primary time on report. He means that the most recent improvement might be bullish for ETH, because it indicators lowered promoting stress and rising investor confidence.

Associated Studying

Traditionally, the trade steadiness metric has served as one of many clearest indicators of investor habits. When balances rise, it sometimes indicators mounting promoting stress, as merchants transfer cash for liquidation functions. Conversely, once they fall, it signifies that cash are being withdrawn into non-public wallets, that are much less prone to be offered.

The analyst’s chart illustrates a pointy and accelerating drop in Ethereum’s trade balances over the previous few years, culminating on this historic low. Billions price of ETH have been faraway from centralized platforms, coinciding with the asset’s advance towards a goal above $5,500. This means a transparent discount in liquid provide throughout already heightened demand.

In line with Abbe, the significance of this decline can’t be overstated. He famous that market tops in crypto usually happen after inflows spike again into these centralized platforms, not when balances are draining to new lows. In different phrases, Ethereum is probably not positioned for a sell-off however for accumulation.

As promoting stress subsides, long-term holders exert better management over provide, creating circumstances for probably sturdy upward value momentum. If historical past is any information, Abbe means that the shrinking trade steadiness might set the stage for Ethereum’s subsequent leg up.

Analyst Units $7,000 As ETH’s Subsequent Goal

Whereas Ethereum’s trade provide hits uncharted lows, technical analysts like Crypto Goos are more and more bullish on its value. The market skilled introduced in a publish on X that ETH has formally damaged out of a long-term wedge sample, which has constrained value motion since 2021.

The accompanying chart illustrates ETH lastly piercing via resistance after years of sideways buying and selling. Crypto Goos factors to the breakout stage round $3,600, and with Ethereum now buying and selling considerably above it, the transfer seems confirmed.

Associated Studying

Though Ethereum has skilled quite a lot of value swings up to now few weeks, Crypto Goos stays assured that it might probably attain a new all-time excessive quickly. The analyst’s projection from the wedge breakout targets the $7,000 area, representing a possible upside of about 62% from present value ranges above $4,300. Ought to momentum persist, the cryptocurrency might lengthen even past the $7,000 milestone.

Featured picture from Unsplash, chart from TradingView