Ethereum remains to be struggling under $3,000 regardless of the Bitcoin worth sitting near all-time highs. On the present ranges, Ethereum continues to look extremely bearish, with sell-offs dominating the market at this degree. Whereas piling shorts are pointing to a doable reduction rally, there may be additionally the likelihood that the worth will crash again down from right here. Crypto analyst Weslad maps out the ETH worth trajectory utilizing the ABCDE wave construction, exhibiting a doable crash under $2,000.

The Bullish Ethereum State of affairs

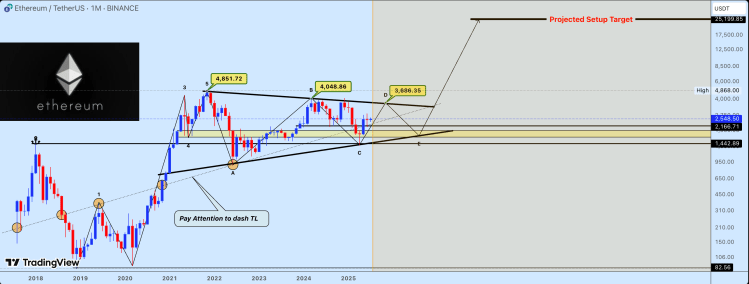

Weslad factors to the 2021 Ethereum peak when the worth reached $4,851 as the purpose when a large-scale symmetrical pennant had fashioned for the digital asset. Apparently, this has continued for a number of years already, and continues to play out even in 2025, 4 years later. To date, the analyst believes that the altcoin has been in a long-term accumulation section in an outlined corrective vary.

Associated Studying

One other vital growth is the formation of an ABCDE wave sample. This sample usually predicts peaks and troughs, and relying on the place the asset is within the sample, it might level to a restoration or a crash. Presently, the crypto analyst places the Ethereum worth as being someplace in a D wave, which is nonetheless bullish for the worth.

“Presently, worth motion is growing close to level D, approaching the higher boundary of the pennant, a vital space that would outline the subsequent directional transfer,” the analyst mentioned. If this D wave performs out as anticipated, then the Ethereum worth is anticipated to truly surge from right here. The highest of this sample would put it above $3,500 earlier than the transfer is accomplished.

On the higher finish of that is the formation of an Inverse Head and Shoulders Sample. This sample has seen the $2,855 appearing as key resistance, beating the Ethereum worth down a number of occasions this 12 months. Nonetheless, if a sustained break is achieved above this degree, along side a breakout from Wave D, then it’s doable that the worth does rally to new all-time highs above $6,000.

The Bearish State of affairs

Whereas the formation of the ABCDE wave depend factors to some bullishness for the Ethereum worth, there may be nonetheless the likelihood that the worth might go in the other way. For instance, after the D wave is accomplished, comes the subsequent wave within the sequence, which is the E wave, and it is a bearish wave.

Associated Studying

Because the crypto analyst explains, a non permanent rejection on the neckline or pennant resistance would set off an E wave retracement. On this case, the Ethereum worth might see an over 30% crash, placing it again towards the $1,400-$1,800 degree, the place there may be probably the most assist.

“Current worth habits exhibits compressed volatility and elevated shopping for curiosity on dips, reinforcing the opportunity of an imminent directional breakout,” Weslad warned. “A decisive transfer exterior this macro construction might mark the start of a brand new section of long-term worth enlargement.”

Featured picture from Dall.E, chart from TradingView.com