- EUR/CHF edges greater amid hypothesis of intervention from the Swiss Nationwide Financial institution in foreign money markets.

- EU–US commerce talks stall forward of August tariff deadline, fueling market uncertainty and limiting EUR/CHF good points.

- EUR/CHF checks key Fibonacci resistance as downtrend holds, whereas bearish momentum fades.

The Euro (EUR) is edging greater in opposition to the Swiss Franc (CHF). On Monday, basic dynamics are more and more shaping the trajectory of EUR/CHF.

With current information pointing to attainable intervention by the Swiss Nationwide Financial institution (SNB), the pair has recovered to commerce above 0.9330 on the time of writing.

Swiss Franc below stress as SNB deposits spike, lifting EUR/CHF off key assist

In keeping with a Reuters report on Monday, industrial banks lodged CHF 11.2 billion extra in in a single day balances with the SNB final week. This lifted whole sight deposits to CHF 475.3 billion, their highest degree since April 2024.

Merchants usually see a leap in deposits as an indication the central financial institution is both easing coverage or stepping in to forestall additional foreign money appreciation. Nonetheless, the report additionally indicated that the SNB declined to touch upon the allegations.

A weaker Franc helps ease deflationary pressures and helps Switzerland’s export sector, making potential SNB motion a key theme for merchants.

EU–US commerce talks stall forward of August tariff deadline, fueling market uncertainty

For the Euro aspect, sentiment stays fragile amid renewed EU–US commerce tensions. With the August tariff deadline looming, officers are struggling to finalize a framework for a commerce deal.

With commerce between the EU and the US totaling $1.96 trillion in 2024, US President Donald Trump intends to impose a baseline tariff of 15%-20% EU imports.

Buyers are rising uneasy over the dearth of progress, notably as discussions surrounding agricultural entry and industrial subsidies stay contentious.

This reinforces expectations that the European Central Financial institution (ECB) will preserve a cautious stance at its upcoming charge choice on Thursday, doubtlessly signaling a reduce later this 12 months.

Rising uncertainty is dampening sentiment towards the Euro and holding EUR/CHF below stress.

EUR/CHF checks key Fibonacci resistance as downtrend continues

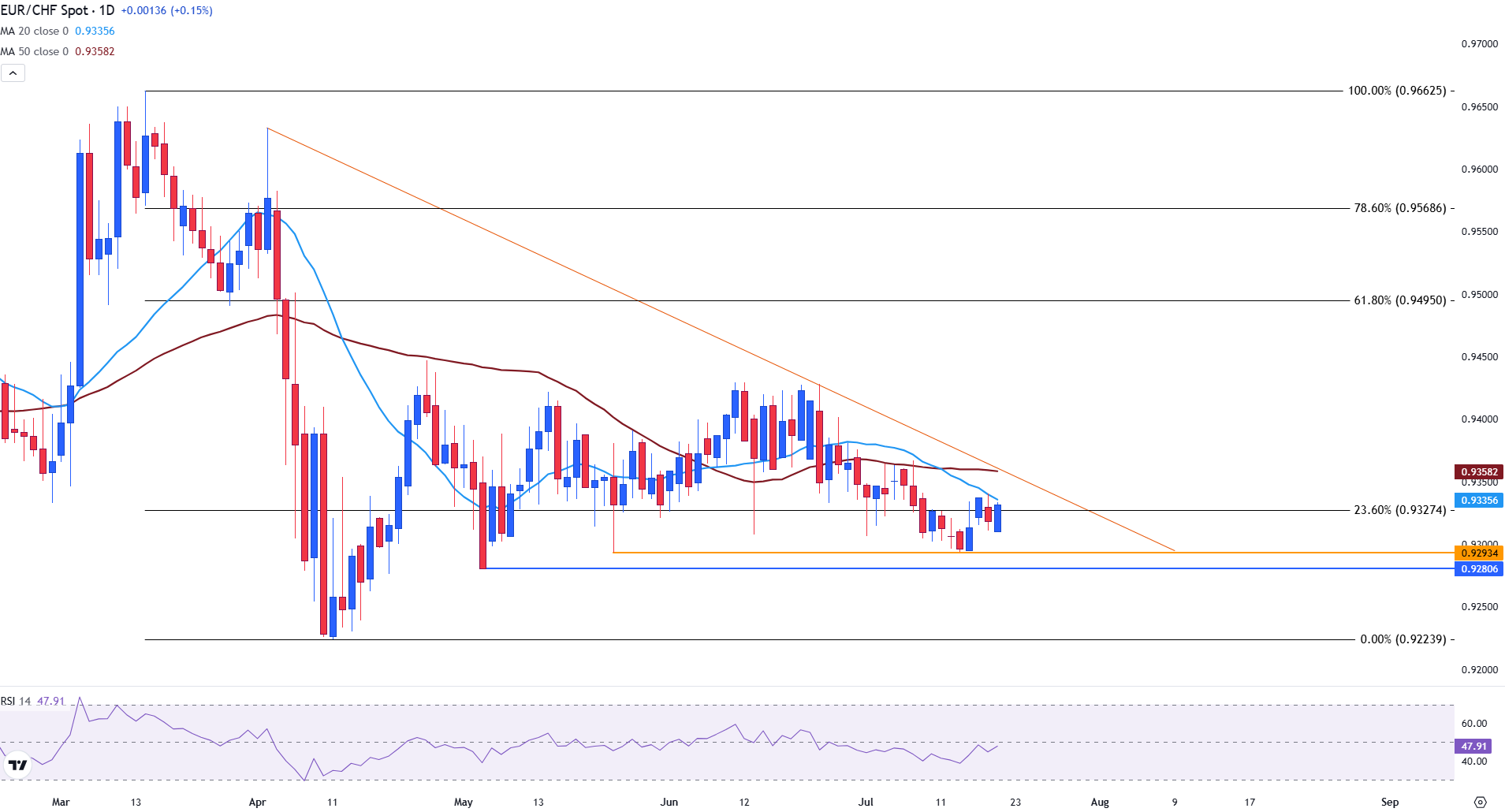

From a technical standpoint, the day by day chart displays a clearly established downtrend, marked by a constant sequence of decrease highs and decrease lows.

Because the pair continues to commerce inside the confines of a descending triangle, instant assist may be seen on the base of the triangle close to 0.9293, with a break beneath this degree opening the door for the Could low of 0.9280.

With EUR/CHF at the moment testing the 23.6% Fibonacci retracement degree of the March-April decline at 0.9327, the falling trendline from the April rally stays intact, reinforcing a broader bearish bias.

EUR/CHF day by day chart

On the upside, there’s a confluence space the place the descending trendline intersects the 20-day Easy Transferring Common (SMA) at 0.9336 and the 50-day SMA at 0.9358.

A transfer above this zone may then open the door for bullish continuation towards the 0.9400 psychological degree.

With the Relative Power Index (RSI) above 48, bullish momentum has began to select up, pushing the pair nearer to impartial territory.

SNB FAQs

The Swiss Nationwide Financial institution (SNB) is the nation’s central financial institution. As an impartial central financial institution, its mandate is to make sure worth stability within the medium and long run. To make sure worth stability, the SNB goals to take care of acceptable financial situations, that are decided by the rate of interest degree and trade charges. For the SNB, worth stability means an increase within the Swiss Shopper Value Index (CPI) of lower than 2% per 12 months.

The Swiss Nationwide Financial institution (SNB) Governing Board decides the suitable degree of its coverage charge in keeping with its worth stability goal. When inflation is above goal or forecasted to be above goal within the foreseeable future, the financial institution will try to tame extreme worth development by elevating its coverage charge. Larger rates of interest are usually optimistic for the Swiss Franc (CHF) as they result in greater yields, making the nation a extra engaging place for buyers. Quite the opposite, decrease rates of interest are likely to weaken CHF.

Sure. The Swiss Nationwide Financial institution (SNB) has usually intervened within the overseas trade market as a way to keep away from the Swiss Franc (CHF) appreciating an excessive amount of in opposition to different currencies. A powerful CHF hurts the competitiveness of the nation’s highly effective export sector. Between 2011 and 2015, the SNB applied a peg to the Euro to restrict the CHF advance in opposition to it. The financial institution intervenes out there utilizing its hefty overseas trade reserves, often by shopping for foreign currency echange such because the US Greenback or the Euro. Throughout episodes of excessive inflation, notably because of power, the SNB refrains from intervening markets as a powerful CHF makes power imports cheaper, cushioning the value shock for Swiss households and companies.

The SNB meets as soon as 1 / 4 – in March, June, September and December – to conduct its financial coverage evaluation. Every of those assessments ends in a financial coverage choice and the publication of a medium-term inflation forecast.