- EUR/USD bounces again to close 1.0500 because the US Greenback falls again.

- Trump put proposes tariffs for Columbia on maintain because the nation accepts Trump’s phrases.

- Traders will keenly give attention to the Fed’s and the ECB’s coverage conferences later this week.

EUR/USD recovers intraday losses and rebounds to close 1.0490 in Monday’s European session and goals to revisit a six-week excessive close to 1.0520. The most important forex pair rebounds because the US Greenback (USD) struggles to carry intraday positive aspects that had been impressed by fears of United States (US) President Donald Trump’s tariffs on Columbia. The US Greenback Index (DXY), which tracks the Dollar’s worth towards six main currencies, falls again from the intraday excessive of 107.80.

On the weekend, Trump proposed 25% tariffs on its South American buying and selling associate Columbia after the nation refused to just accept navy flights carrying deportees from the US. Nevertheless, the White Home later reported that the Colombian authorities agreed to “Trump’s phrases of accepting unlawful immigrants,” and Trump’s proposed tariffs had been “now on maintain,” the Related Press (AP) reported.

In the meantime, the market sentiment is poised to stay cautious, with buyers awaiting rate of interest choices from the Federal Reserve (Fed) and the European Central Financial institution (ECB) on Wednesday and Thursday, respectively.

In keeping with the CME FedWatch software, the Fed is definite to maintain rates of interest unchanged within the vary of 4.25%-4.50%. Traders pays shut consideration to Fed Chair Jerome Powell’s press convention to find out whether or not policymakers are comfy with Trump’s name for quick charge cuts.

On the US financial entrance, buyers will focus this week on the Sturdy Items Orders and the Private Shopper Expenditure Value Index (PCE) knowledge for December and the preliminary This fall Gross Home Product (GDP) knowledge.

Every day digest market movers: EUR/USD trades with warning forward of Fed-ECB coverage conferences

- The restoration transfer within the EUR/USD pair is pushed by a resumption within the draw back transfer within the US Greenback. In the meantime, the Euro (EUR) trades lackluster forward of the ECB’s financial coverage choice. The ECB is broadly anticipated to cut back its Deposit Facility charge by 25 foundation factors (bps) to 2.75%, with the Essential Refinancing Operations Charge sliding to 2.9%. This might be the fourth rate of interest lower by the ECB in a row.

- Merchants are assured that the ECB will lower rates of interest on Thursday, as Eurozone inflation has remained beneath management and progress prospects stay sluggish. Market contributors will give attention to ECB President Christine Lagarde’s press convention for contemporary steering on rates of interest and the way the central financial institution will counter the results of Trump’s tariffs on the Eurozone. In the meantime, buyers have additionally priced in three extra rate of interest cuts this 12 months, coming within the remaining three conferences within the first half of the 12 months.

- On the financial entrance, the German IFO Enterprise Local weather Index surprisingly accelerated to 85.1 in January from 84.7 in December, whereas it was anticipated to have dropped marginally to 84.6. In the identical interval, the Present Financial Evaluation Index got here in larger at 86.1, in comparison with 85.1 in December and the estimates of 85.4. In the meantime, the IFO Expectations Index, which displays companies’ expectations for the following six months, decelerated at a slower-than-expected tempo to 84.2 from 84.4 in December. Economists anticipated the index to return in at 84.0.

- This week, buyers may also give attention to preliminary Eurozone This fall GDP knowledge, which will likely be launched on Thursday. Economists anticipate the shared bloc to have grown by 1% in comparison with the identical quarter final 12 months. Within the earlier quarter, the financial system expanded by 0.9%.

Euro PRICE At the moment

The desk beneath exhibits the share change of Euro (EUR) towards listed main currencies right this moment. The Euro was the strongest towards the New Zealand Greenback.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.04% | 0.10% | -0.71% | 0.03% | 0.33% | 0.25% | -0.43% | |

| EUR | -0.04% | 0.14% | -0.65% | 0.14% | 0.30% | 0.34% | -0.36% | |

| GBP | -0.10% | -0.14% | -1.10% | 0.00% | 0.16% | 0.22% | -0.50% | |

| JPY | 0.71% | 0.65% | 1.10% | 0.79% | 1.22% | 1.21% | 0.43% | |

| CAD | -0.03% | -0.14% | -0.00% | -0.79% | 0.09% | 0.22% | -0.49% | |

| AUD | -0.33% | -0.30% | -0.16% | -1.22% | -0.09% | 0.08% | -0.60% | |

| NZD | -0.25% | -0.34% | -0.22% | -1.21% | -0.22% | -0.08% | -0.93% | |

| CHF | 0.43% | 0.36% | 0.50% | -0.43% | 0.49% | 0.60% | 0.93% |

The warmth map exhibits share adjustments of main currencies towards one another. The bottom forex is picked from the left column, whereas the quote forex is picked from the highest row. For instance, in case you choose the Euro from the left column and transfer alongside the horizontal line to the US Greenback, the share change displayed within the field will characterize EUR (base)/USD (quote).

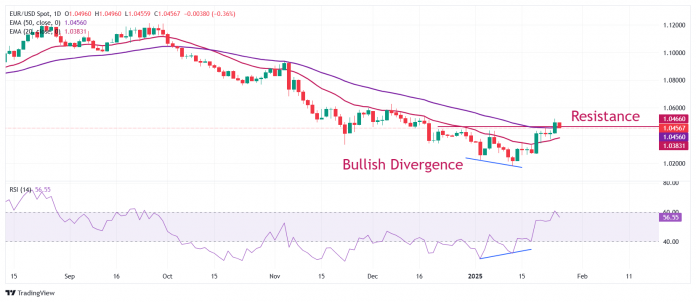

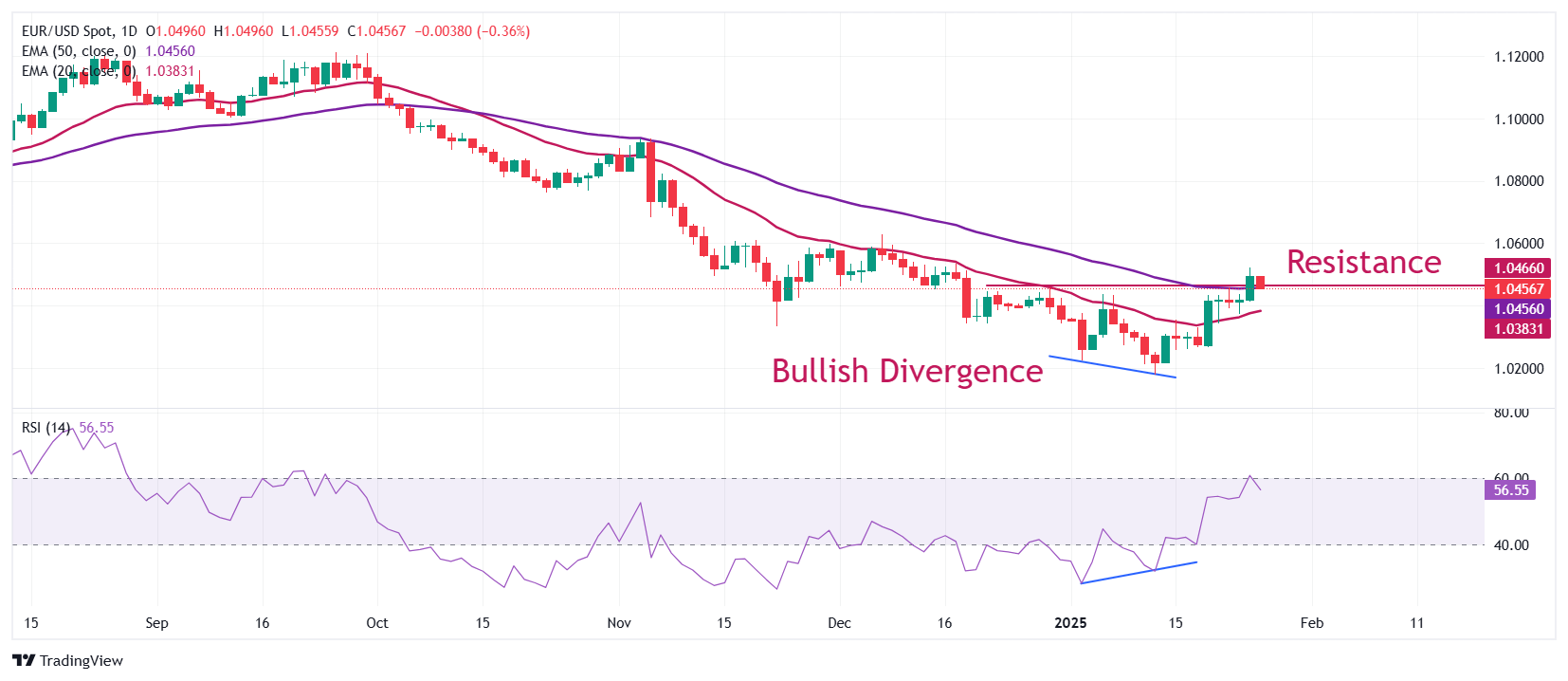

Technical Evaluation: EUR/USD holds key 20-day EMA

EUR/USD falls to close 1.0450 on Monday after posting a contemporary month-to-month excessive close to 1.0520 on Friday. The most important forex pair wobbles across the 50-day Exponential Transferring Common (EMA), which trades close to 1.0460. The near-term outlook of the pair stays agency because it holds the 20-day EMA, which trades round 1.0383.

The pair entered a bullish reversal after breaking the January 6 excessive of 1.0437, which confirmed a divergence between the asset’s worth and the 14-day Relative Power Index (RSI). On January 13, the RSI shaped the next low, whereas the pair made decrease lows.

Wanting down, the January 20 low of 1.0266 would be the key help zone for the pair. Conversely, the December 6 excessive of 1.0630 would be the key barrier for the Euro bulls.

Financial Indicator

ECB Charge On Deposit Facility

One of many European Central Financial institution‘s three key rates of interest, the speed on the deposit facility, is the speed at which banks earn curiosity after they deposit funds with the ECB. It’s introduced by the European Central Financial institution at every of its eight scheduled annual conferences.

Subsequent launch: Thu Jan 30, 2025 13:15

Frequency: Irregular

Consensus: 2.75%

Earlier: 3%