Gold surged to contemporary document highs whereas the U.S. greenback tanked throughout the board following a weak CPI print and lingering commerce pressure with China.

European shares rallied arduous on Trump’s tariff pause, however U.S. equities gave again some good points as yield spikes and inflation fears rattled sentiment.

Listed here are main headlines and asset strikes you’ll have missed within the final buying and selling classes:

Headlines:

- U.Ok. RICS home worth stability for March: 2.0% (10.0% forecast; 11.0% earlier)

- Japan PPI for March: 4.2% y/y (4.2% forecast; 4.0% earlier); 0.4% m/m (0.3% forecast; 0.0% earlier)

- Australia Melbourne Institute client inflation expectations for April: 4.2% (3.6% forecast; 3.6% earlier)

- RBA Governor Bullock performed down the chance of an outsized charge reduce for Might on account of commerce conflict

- China client worth index for March: -0.4% m/m (-0.4% forecast; -0.2% earlier); -0.1% y/y (0.0% forecast; -0.7% earlier)

- China producer worth index for March: -2.5% y/y (-2.0% forecast; -2.2% earlier)

- European Union President von der Leyen introduced a pause on reciprocal tariffs

- U.S. preliminary jobless claims for the week ending April 5: 223.0k (226.0k forecast; 219.0k earlier)

- U.S. authorities clarified that the efficient “flooring” tariff charge on Chinese language items is 145% as a substitute of 125%

- FOMC voting member Austan Goolsbee: Charge cuts nonetheless potential if economic system will get again on observe

- FOMC alternate member Lorie Logan warned on Thursday that tariff-induced inflation should not change into everlasting

Broad Market Worth Motion:

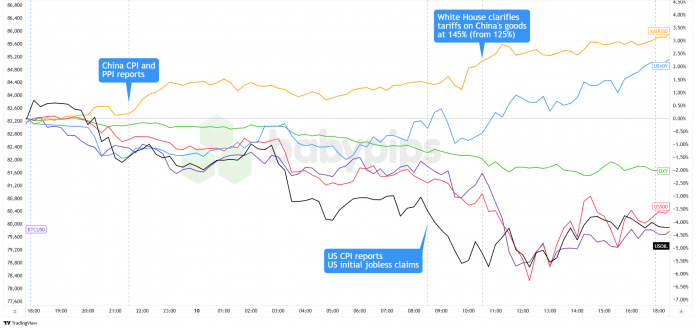

Greenback Index, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingView

The main belongings have been all around the charts after Trump walked again a part of his tariff bombshell. The U.S. initially slapped “reciprocal tariffs” on a broad vary of imports, however Trump later introduced a 90-day pause for many international locations whereas sustaining a baseline 10% charge. China was the foremost exception, going through an enormous tariff hike to 145%, which set off severe market whiplash.

European shares ripped larger on the tariff pause, with the DAX up 4.5%, the CAC 40 gaining 3.8%, and the FTSE 100 including 3.0%. U.S. equities rallied arduous too, up almost 10% on Wednesday, solely to provide again 3.5% on Thursday as doubts crept in about whether or not the rally had legs.

Treasury yields spiked, with the 10-year yield nearing 4.5%, fueling chatter that bond market strain helped nudge Trump towards easing up. A stable 30-year public sale introduced some calm, whilst some analysts began throwing across the phrase “bond vigilantes” once more.

Gold stole the present, notching its greatest single day achieve since April 2020 and smashing via document highs above $3,170 as buyers ran for canopy. WTI oil, in the meantime, dropped greater than 3% to round $60 on renewed worries about international demand.

Even bitcoin was not spared, slipping from $83,000 to $79,000 as crypto merchants braced for extra macro-driven turbulence.

FX Market Conduct: U.S. Greenback vs. Majors:

Overlay of USD vs. Main Currencies Chart by TradingView

The U.S. greenback suffered its worst drop since November 2022, with its bearish momentum build up as markets digested a mixture of gentle information and rising international unease.

The slide started after Japan’s hotter-than-expected PPI gave the greenback a short carry, however sentiment shortly turned after China’s CPI confirmed deflation for a second straight month. The gentle print added to considerations about international demand, dragging the greenback decrease in Asia.

Losses deepened in Europe as merchants offered off the Dollar forward of key US information. EUR/USD climbed previous 1.1000, whereas USD/CHF tumbled under 0.8250 – its lowest since 2011 – because the greenback’s secure haven enchantment got here underneath fireplace amid rising commerce tensions.

The true blow got here when U.S. CPI information missed throughout the board. Headline inflation unexpectedly fell 0.1%, whereas core CPI barely budged. The greenback offered off sharply, particularly towards the Swiss franc, which gained almost 4%.

The greenback saved its losses even with the 10-year bond yield nearing 4.5%, signaling deeper worries about U.S. fiscal stability and the danger of overseas outflows as commerce tensions with China linger regardless of Trump’s softer tariff stance.

Upcoming Potential Catalysts on the Financial Calendar:

- Germany ultimate CPI for March at 6:00 am GMT

- U.Ok. GDP for February at 6:00 am GMT

- U.Ok. items commerce stability for February at 6:00 am GMT

- U.Ok. stability of commerce for February at 6:00 am GMT

- Swiss client confidence for March at 7:00 am GMT

- ECB President Lagarde to provide a speech at 9:45 am GMT

- U.Ok. NIESR month-to-month GDP for March at 11:25 am GMT

- U.S. PPI for March at 12:30 pm GMT

- FOMC member Musalem to provide a speech at 2:00 pm GMT

- College of Michigan U.S. client sentiment and inflation expectations for April at 2:00 pm GMT

- FOMC member Williams to provide a speech at 3:00 pm GMT

Friday merchants face one other busy day, with U.Ok. GDP and commerce information more likely to drive pound strikes, whereas ECB President Lagarde’s remarks might sway the euro throughout early European hours.

Within the U.S., PPI and FOMC speeches might information coverage expectations, whereas non-data headlines might yield plot twists for bond markets and broader threat urge for food.

As at all times, keep nimble and don’t neglect to take a look at our model new Foreign exchange Correlation Calculator when taking any trades!