Markets displayed principally uneven & divergent patterns on Tuesday as the shortage of a recent main catalyst meant merchants continued to navigate political upheaval in France, Japan’s management transition, and the continuing U.S. authorities shutdown.

Try the headlines and financial updates you will have missed within the newest buying and selling classes!

Headlines & Knowledge:

- New Zealand NZIER Enterprise Confidence for September 30, 2025: 18.0% (19.0% forecast; 22.0% earlier)

- Australia Westpac Client Confidence Change for October 2025: -3.5% to 92.1 (3.2% forecast; -3.1% earlier)

- Japan Family Spending for August 2025: 2.3% y/y (1.2% y/y forecast; 1.4% y/y earlier); 0.6% m/m (0.3% m/m forecast; 1.7% m/m earlier)

- Australia ANZ-Certainly Job Advertisements for September 2025: -3.3% m/m (-0.4% m/m forecast; 0.1% m/m earlier)

- Japan Main Financial Index Prel for August 2025: 107.4 (106.4 forecast; 106.1 earlier)

- Germany Manufacturing facility Orders for August 2025: -0.8% m/m (1.5% m/m forecast; -2.9% m/m earlier)

- U.Ok. Halifax Home Value Index for September 2025: -0.3% m/m (0.2% m/m forecast; 0.3% m/m earlier); 1.3% y/y (2.2% y/y forecast; 2.2% y/y

- France Stability of Commerce for August 2025: -5.5B (-4.9B forecast; -5.6B earlier)

- Canada Stability of Commerce for August 2025: -6.32B (-3.5B forecast; -4.94B earlier)

- Canada Ivey PMI s.a for September 2025: 59.8 (51.0 forecast; 50.1 earlier)

- Federal Reserve Governor Stephen Miran thinks the Fed can proceed to chop charges as a result of a possible restricted tariff inflation affect & slowdown in inhabitants development

- U.S. Client Inflation Expectations for September 2025: 3.4% (3.1% forecast; 3.2% earlier)

- New Zealand World Dairy Commerce Value Index for October 7, 2025: -1.6% (1.0% forecast; -0.8% earlier)

- On Tuesday, Federal Reserve Financial institution of Minneapolis President Kashkari mentioned that drastic charge cuts would stoke inflation

- U.S. Client Credit score Change for August 2025: 0.36B (12.0B forecast; 16.01B earlier

Broad Market Value Motion:

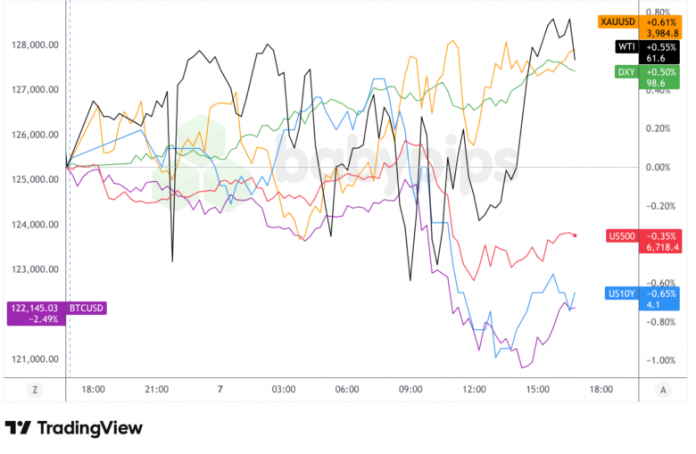

Greenback Index, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingView

Tuesday’s buying and selling session mirrored a scarcity of a recent catalyst throughout the Asia and London classes, whereas the U.S. session noticed punishment for danger takers and beneficial properties for gold and the Dollar. With no main catalysts to level to, it’s doubtless this was extra repositioning and revenue taking after the sturdy danger rally, than a powerful opinion of the place the market might transfer subsequent.

Gold futures settled at $4,004.40, up 0.7%, after reaching an intraday excessive of $4,009 per troy ounce. The value of the valuable steel has surged greater than 50% in 2025, outpacing rallies throughout the pandemic and 2007-09 recession. The recent milestone doubtless displays mounting considerations about fiscal sustainability, central financial institution insurance policies, and geopolitical tensions.

The S&P 500 fell to round 6,715, retreating after a sequence of all-time highs spurred requires a breather amid indicators of purchaser exhaustion. The tech-heavy Nasdaq fell 0.47% as tech giants dragged down the index amid a report that Oracle Corp.’s cloud margins are decrease than many estimates.

Oil was internet greater after a uneven session, doubtless influenced by OPEC+’s early choice to boost manufacturing by a modest quantity, with West Texas Intermediate topping $61 a barrel following a 7.4% hunch final week. The modest 137,000-barrel-a-day increment was nicely beneath a number of the doable figures reported earlier than the choice.

Bitcoin was the largest loser on the session, doubtless pushed by the technical transfer decrease in danger property and extra doubtless some revenue taking after breaking $126K this week as there have been no main crypto associated information to level to.

US 10-year yields dropped two foundation factors to 4.13% as bonds discovered help from stable demand at a $58 billion Treasury public sale.

FX Market Conduct: U.S. Greenback vs. Majors:

Overlay of USD vs. Majors Chart by TradingView

The U.S. greenback demonstrated notable energy all through Tuesday’s buying and selling session, constructing momentum throughout the Asian and London classes earlier than experiencing a modest pullback within the U.S. afternoon. With no main catalysts to level to, it’s doubtless latest unfavorable themes from counter currencies had been the primary contributor to Greenback energy total.

The buck noticed significantly sturdy bullish momentum throughout the transition from Asia to London buying and selling hours. The Japanese yen noticed a dramatic drop, hitting its greatest one-day slide in opposition to the US greenback in 5 months, with the yen sinking 1.9% to commerce at 150.35 per greenback. This transfer got here after Sanae Takaichi received the election as Japan’s new Prime Minister this week, with market individuals frightened her administration may problem extra debt for tax cuts.

The euro weakened 0.3% in opposition to the greenback as French bonds fell following Prime Minister Lecornu’s resignation, with 10-year yields leaping as a lot as 11 foundation factors. The political disaster raised considerations about France’s potential to handle its price range deficit.

Regardless of the continuing U.S. authorities shutdown and combined financial knowledge, the buck maintained its attraction as international uncertainties mounted, and closed the session as the perfect performing foreign money total.

Upcoming Potential Catalysts on the Financial Calendar

- Japan Common Money Earnings for August 2025 at 11:30 pm GMT

- Japan Present Account for August 2025 at 11:50 pm GMT

- Australia RBA Annual Report 2025

- Australia Constructing Permits Remaining for August 2025 at 12:30 am GMT

- RBNZ Curiosity Price Choice for October 8, 2025 at 2:00 am GMT

- Japan Eco Watchers Survey Outlook for September 2025 at 5:00 am GMT

- Germany Industrial Manufacturing for August 2025 at 6:00 am GMT

- U.S. MBA 30-Yr Mortgage Price for October 3, 2025 at 11:00 am GMT

- U.S. MBA Mortgage Functions for October 3, 2025 at 11:00 am GMT

- U.S. Fed Musalem Speech at 1:20 pm GMT

- U.S. Fed Barr Speech at 1:30 pm GMT

- U.S. EIA Crude Oil Shares Change for October 3, 2025 at 2:30 pm GMT

- U.Ok. BoE Capsule Speech at 3:00 pm GMT

- ECB President Lagarde Speech at 4:00 pm GMT

- FOMC Minutes at 6:00 pm GMT

The Reserve Financial institution of New Zealand’s charge choice will probably be carefully watched, with markets anticipating a 25 foundation level reduce because the central financial institution responds to weakening financial circumstances.

The FOMC minutes will present essential insights into the Fed’s September deliberations, significantly relating to the stability between inflation considerations and development dangers.

Any developments on ending the U.S. authorities shutdown may set off vital market strikes, because the deadlock continues to delay important financial knowledge releases and raises considerations about federal employee layoffs.

Fed speeches all through the week will probably be scrutinized for clues concerning the October assembly, particularly given the divergent views amongst policymakers concerning the applicable tempo of charge changes.

Keep frosty on the market foreign exchange mates and don’t neglect to take a look at our Foreign exchange Correlation Calculator when taking any trades!