Jerome Powell’s candid commentary factors to the inventory market’s largest menace.

For greater than a century, no asset class has come near matching the annualized return of shares. This 12 months, we have witnessed the broad-based S&P 500 (^GSPC 0.01%), ageless Dow Jones Industrial Common (^DJI 0.51%), and innovation-inspired Nasdaq Composite (^IXIC -0.28%) explode to a number of record-closing highs.

However simply because the inventory market has proved traditionally unstoppable over multidecade durations, that does not imply getting from Level A to B is with out moments of “journey.”

Because the S&P 500, Dow Jones, and Nasdaq Composite have soared to rarified territory, so have inventory valuations. With the rise of synthetic intelligence (AI) fueling extraordinary progress for Wall Avenue’s most influential companies, traders have, collectively, been keen to show a blind eye to historic valuation markers.

Fed Chair Jerome Powell talking with President Trump. Picture supply: Official White Home Picture by Daniel Torok.

However Federal Reserve Chair Jerome Powell might have spoiled the get together by saying the quiet half out loud relating to inventory valuations.

Fed Chair Jerome Powell simply highlighted the largest historic danger to Wall Avenue

On Sept. 23, Powell gave a speech in Rhode Island the place he fielded questions concerning the inventory market and the way the Fed’s Board of Governors account for fairness valuations in financial coverage. Although the chair of the nation’s central financial institution usually avoids interjecting his opinion on the inventory market, he made a considerably candid commentary:

We do have a look at general monetary situations, and we ask ourselves whether or not our insurance policies are affecting monetary situations in a means that’s what we’re attempting to attain. However you are proper, by many measures, for instance, fairness costs are pretty extremely valued.

The emphasis is these six phrases: “fairness costs are pretty extremely valued.” When the pinnacle of the Fed is making observations concerning the historic priciness of shares, sweeping issues underneath the rug or kicking the can now not turns into an possibility.

S&P 500 P/E 22.8x-the highest this century JPM

30yr avg: 17.0x pic.twitter.com/U1T5XkZdZZ

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) October 2, 2025

For what it is value, Powell is not alone in cautioning Wall Avenue, traders, and on a regular basis People about probably inflated asset values. In December 1996, famed Fed Chair Alan Greenspan delivered a speech on the American Enterprise Institute, the place he launched the now well-known phrase “irrational exuberance” to explain a fast improve in asset valuations throughout the creation and proliferation of the web.

Whereas Greenspan rightly acknowledged {that a} game-changing technological development (the web) had despatched broad market valuations hovering, the S&P 500, Dow Jones Industrial Common, and Nasdaq Composite did not hit their dot-com peak till March 2000 — greater than three years after Greenspan delivered his “irrational exuberance” speech.

In different phrases, the international progress potential AI brings to the desk is an unquantified variable that has the potential to, not less than briefly, assist traditionally excessive inventory valuations.

However no mistake, historical past has a (to this point) flawless observe report in terms of dear inventory markets — and Fed Chair Jerome Powell is keenly conscious of it.

That is the second-priciest inventory market during the last 154 years

To be goal, there isn’t a one-size-fits-all method to valuing particular person shares or the broader market. The distinction of opinion between traders over what’s low cost and what’s dear is what makes the inventory market a market within the first place.

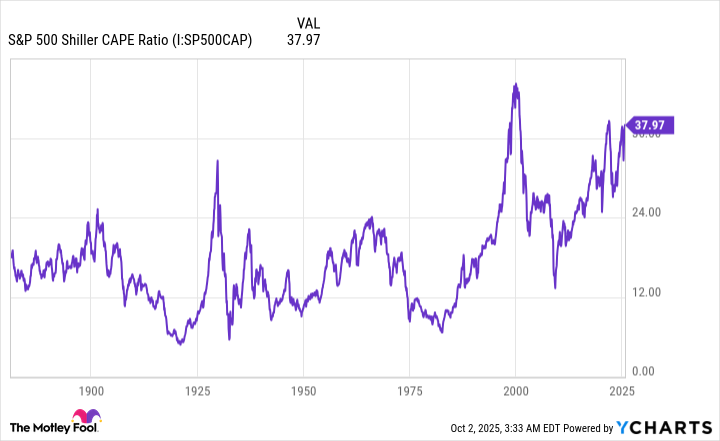

However there may be one valuation measure that leaves nearly no room for argument: the S&P 500’s Shiller price-to-earnings (P/E) Ratio, which you may additionally discover known as the cyclically adjusted P/E Ratio, or CAPE Ratio.

The S&P 500’s Shiller P/E is predicated on common inflation-adjusted earnings over the prior 10-year interval. Whereas the conventional P/E ratio, which takes under consideration trailing-12-month earnings, might be simply tripped up by financial downturns, the flexibility of the Shiller P/E to account for a decade of earnings historical past successfully negates the affect of shock occasions. It is the closest factor we’ve got to an apples-to-apples valuation device when trying again greater than a century.

S&P 500 Shiller CAPE Ratio knowledge by YCharts.

When back-tested to January 1871, the S&P 500’s Shiller P/E has averaged a a number of of 17.29. It is value noting that Shiller P/E multiples have been fairly constantly larger than the 154-year common studying for the reason that mid-Nineties, which is when the web broke down info obstacles for on a regular basis traders and gave them the boldness to put money into higher-growth companies.

As of the closing bell on Oct. 1, the Shiller P/E chimed in with a studying of (drumroll) 40.04. That is only a stone’s throw away from its peak of 40.15 throughout the present bull market, and represents the second-highest a number of throughout a steady bull market courting again 154 years.

The one time shares have been collectively pricier than they’re now was within the months main as much as the bursting of the dot-com bubble. In December 1999, the Shiller P/E peaked at 44.19.

The rationale this valuation knowledge is significant is as a result of the Shiller P/E has an uncanny potential to foretell the longer term. Although it isn’t a timing device in any means — as famous, shares remained traditionally dear for years earlier than the dot-com bubble burst — all 5 prior readings above 30 had been finally adopted by pullbacks within the S&P 500, Dow Jones Industrial Common, and/or Nasdaq Composite starting from 20% to 89% (throughout the Nice Despair).

It is changing into downright not possible to brush a Shiller P/E a number of of 40 underneath the rug, no matter how briskly a handful of megacap corporations are projected to develop within the coming years.

Picture supply: Getty Photographs.

Time is the silver lining for traders

If historical past had been to rhyme in some type within the not-too-distant future, traders can anticipate a 20% or significantly larger decline in Wall Avenue’s main inventory indexes.

However the wonderful thing about historical past is that it is a door that swings, disproportionately, in each instructions.

The Shiller P/E has decisively proven that prolonged valuation premiums aren’t well-tolerated by Wall Avenue or traders, which finally results in vital draw back for the S&P 500, Dow Jones, and Nasdaq Composite. But historic precedent additionally reveals that inventory market cycles are undeniably nonlinear.

In June 2023, the S&P 500 formally entered the present bull market by rising greater than 20% from its 2022 bear market backside. That is when Bespoke Funding Group posted the information set you see beneath that in contrast the calendar-day size of each S&P 500 bull and bear market courting again practically 94 years to the beginning of the Nice Despair (September 1929).

It is official. A brand new bull market is confirmed.

The S&P 500 is now up 20% from its 10/12/22 closing low. The prior bear market noticed the index fall 25.4% over 282 days.

Learn extra at https://t.co/H4p1RcpfIn. pic.twitter.com/tnRz1wdonp

— Bespoke (@bespokeinvest) June 8, 2023

It is value declaring that 27 separate cases the place the S&P 500 fell not less than 20% following a bull market had been logged by Bespoke. This implies bear markets are comparatively regular and inevitable occasions.

Extra importantly, the common bear market caught round for simply 286 calendar days, which works out to roughly 9.5 months. Additional, not one of the 27 bear markets for the reason that Nice Despair started endured longer than 630 calendar days.

On the opposite finish of the spectrum, the common S&P 500 bull market has lasted 1,011 calendar days (about two years and 9 months), with the present bull market, extrapolated to current day, marking the 14th bull market since September 1929 that is endured longer than the lengthiest bear market.

Time is the silver lining for traders. Given ample time, Wall Avenue’s main indexes can recuperate their short-term losses and finally (based mostly on what historical past tells us) push to new heights.