Bitcoin Value Weekly Outlook

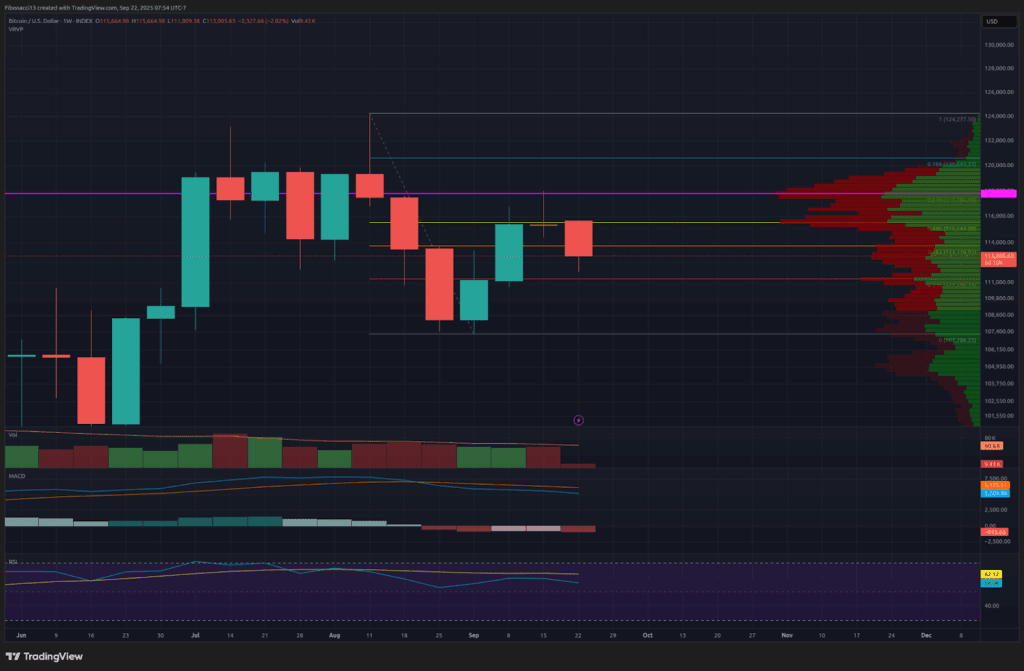

Bitcoin worth closed final week at $115,333, rejecting the $118,000 resistance stage. After three straight weeks of positive factors, Bitcoin bulls lastly misplaced steam — and the Fed’s price reduce wasn’t sufficient to interrupt $118,000.

The U.S. Federal Reserve reduce the important thing rate of interest by 25 foundation factors as anticipated, which offered a lift for markets to shut out the week, nevertheless it wasn’t sufficient. Bitcoin worth made a transfer to $118,000 on Thursday after the Fed’s announcement, however was pushed again simply shy of this important resistance stage. Sunday’s shut gave us a taking pictures star doji candle for the week, signaling a possible reversal in worth motion heading into this week. The bears have lastly stepped in to restrict bitcoin’s positive factors after a 3-week rally by the bulls. We might even see some renewed energy by the bears this week as they try to push the worth down to check the latest help ranges.

Key Assist and Resistance Ranges Now

Trying downward, we’re eyeing the $111,300 stage as a possible help stage. Bitcoin almost hit that help stage already after the large sell-off Sunday evening. Beneath a bitcoin worth of $111,300, we are going to as soon as once more look to the 21 EMA, which is at the moment at $109,500, getting into this week. If the worth closes under the 21 EMA, it’s unlikely the $107,000 low will maintain, and we must always look to the $105,000 stage to behave as help.

Value crashed straight by the $113,800 help stage on Sunday evening, however we are going to search for bitcoin to shut above this stage to present some renewed energy to the bulls this week. The subsequent resistance stage above right here is $115,500. If we will handle to determine these ranges as help, we are going to look to make one other try on the important $118,000 resistance stage.

Outlook For This Week

Bitcoin noticed a large sell-off simply after the weekly shut on Sunday evening, which introduced the bitcoin worth all the way in which all the way down to $111,800.

There are two methods to view this motion. Speedy worth corrections like this typically happen in bullish environments, so it’s potential the low this week is already in, and we might anticipate to see extra bullish worth motion by the rest of this week. The opposite risk is that that is only the start of a renewed downtrend, by which case we might anticipate a slight bounce from the lows over the subsequent day or so, adopted by continued bearish worth motion to shut out the week. So, to take care of bullish bias this week, we wish to see worth regain the $113,800 stage, whereas the bears will try to push worth down previous the $111,300 help stage to take care of bearish bias.

Market temper: Bearish — after rejecting $118,000 with a shooting-star doji candle, the bears are again in management in the intervening time.

The Subsequent Few Weeks

Increasing our view on bitcoin worth motion into the subsequent few weeks, we are going to look to determine a better low on the weekly chart. If we will get any sort of reversal earlier than the worth will get all the way down to the $107,000 low, the bulls will get this increased low and can look to take over as soon as once more from the bears.

The MACD oscillator remains to be in a barely bearish place after crossing bearish on the finish of August. This could help the bears in retaining the worth subdued whereas it’s in place. Bulls shall be in search of the MACD to cross again bullish within the coming weeks to present them a bit extra energy and assist to beat the $118,000 resistance stage.

Terminology Information:

Bulls/Bullish: Consumers or buyers anticipating the worth to go increased.

Bears/Bearish: Sellers or buyers anticipating the worth to go decrease.

Assist or help stage: A stage at which the worth ought to maintain for the asset, no less than initially. The extra touches on help, the weaker it will get and the extra probably it’s to fail to carry the worth.

Resistance or resistance stage: Reverse of help. The extent that’s more likely to reject the worth, no less than initially. The extra touches at resistance, the weaker it will get and the extra probably it’s to fail to carry again the worth.

EMA: Exponential Shifting Common. A transferring common that applies extra weight to latest costs than earlier costs, lowering the lag of the transferring common.

Oscillators: Technical indicators that adjust over time, however sometimes stay inside a band between set ranges. Thus, they oscillate between a low stage (sometimes representing oversold situations) and a excessive stage (sometimes representing overbought situations). E.G., Relative Power Index (RSI) and Shifting Common Convergence-Divergence (MACD).

MACD Oscillator: Shifting Common Convergence-Divergence is a momentum oscillator that subtracts the distinction between two transferring averages to point development in addition to momentum.