BitMart Analysis, the analysis arm of BitMart Alternate, has printed a brand new report on the rising pattern of issuer-owned stablecoin blockchains, analyzing how main stablecoin suppliers like Tether, Circle, and Ethena are shifting from worth attachment to direct worth seize. As stablecoin transaction volumes soar—reaching over $287 billion in circulation and producing tens of millions in on-chain charges—issuers are more and more launching their very own devoted blockchains to reclaim misplaced financial upside, scale back reliance on third-party infrastructure, and improve compliance. Initiatives like Tether’s Plasma and Steady, Circle’s Arc, and Ethena’s Converge are introducing stablecoin-native chains with options like zero-gas transfers, native compliance tooling, and cross-border settlement infrastructure. This report explores how these chains are poised to disrupt present platforms like Tron and Ethereum, and why this dual-engine mannequin—the place stablecoins and blockchains converge—might outline the following part of world digital finance.

1. Present State of the Stablecoin Market

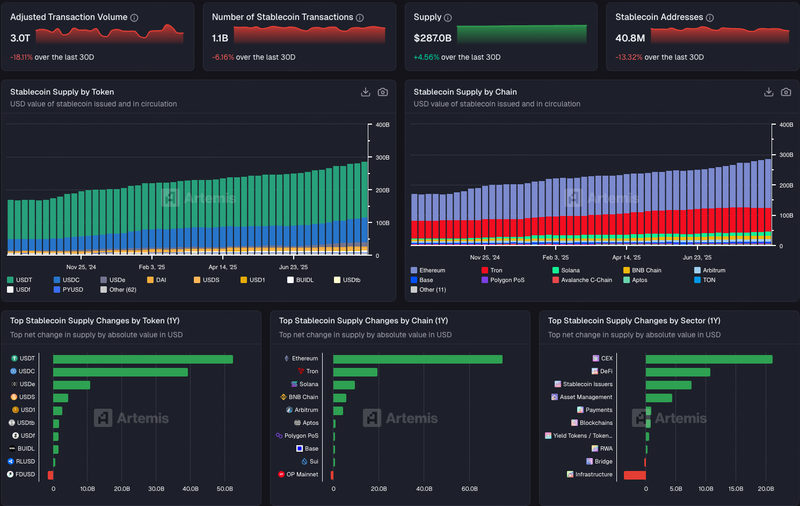

With regulatory frameworks for stablecoins step by step taking form, stablecoins have up to now yr develop into core infrastructure for each the crypto monetary system and cross-border funds. Whether or not serving retail traders’ buying and selling wants or enabling establishments in clearing, settlement, and compliance pilots, stablecoins more and more perform as “digital {dollars}.”As of September 2025, the overall circulation of stablecoins reached $287 billion, with a extremely concentrated market construction. Tether’s USDT holds roughly 59.6% of the market share (over $170.9 billion market cap), adopted by Circle’s USDC at 25% ($74.2 billion). Collectively, the 2 account for practically 85% of the market. On the identical time, new entrants comparable to USDe, USDS, USD1, and USDf are rising quickly into the mainstream.

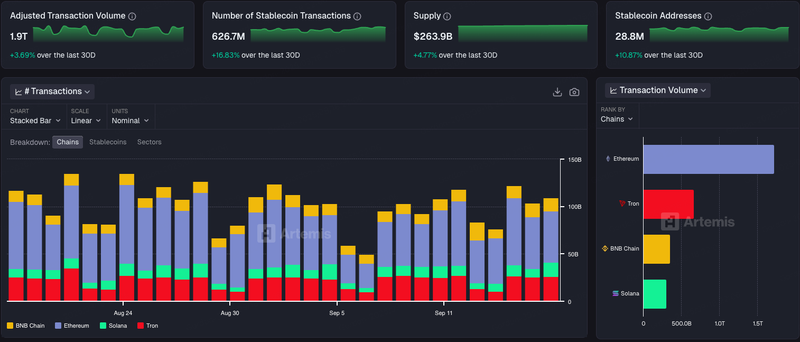

The growth of stablecoins has immediately benefited underlying blockchains. Previously month alone, there have been practically 626 million stablecoin transfers on-chain, dominated by Ethereum, Tron, Solana, and BNB Chain. On Tron, for instance, stablecoin transfers totaled about 69.8 million, with common charges of $0.14–$0.25 per transaction, producing $9.7–17.4 million in month-to-month payment income—all captured by the chain, not the issuer. Over time, this uneven worth distribution has develop into more and more problematic: each stablecoin switch generates income for blockchains, whereas issuers seize nearly none of it. Tron alone earns over $100 million yearly from charges linked to USDT, however Tether itself sees no direct profit.

This imbalance is pushing issuers to launch their very own blockchains. Circle launched Arc in 2025 with a deal with compliance and funds. Tether launched Plasma and Steady, whereas Ethena launched Converge, a hybrid DeFi-compliance chain. Collectively, these strikes mark the start of a brand new part the place stablecoins and proprietary blockchains collectively drive the trade, reshaping each worth seize and ecosystem design.

2. Why Stablecoin Issuers Are Constructing Their Personal Blockchains

The motivation behind issuers launching blockchains is to shift from worth dependence to worth seize. By controlling infrastructure, they’ll optimize stablecoin utilization, scale back exterior prices, and open new enterprise fashions. Key drivers embrace:

-

Decreasing Dependence, Enhancing Seize

Exterior blockchains acquire from excessive stablecoin exercise, whereas issuers see little incremental income. Proprietary chains enable issuers to retain charges and ecosystem worth. -

Improved Person Expertise

Present methods require ETH, TRX, or different tokens for fuel. Devoted chains allow stablecoin-as-gas, eradicating the necessity for customers to carry further tokens. -

Strengthened Compliance and Institutional Entry

Proprietary chains can embed compliance instruments (AML/KYC, blacklists, audits), decreasing limitations for banks and enterprises and enhancing regulatory alignment. -

Diversified Enterprise Fashions

Past reserve curiosity, issuers can earn from transaction charges, ecosystem purposes, and developer networks. For instance, Arc focuses on cross-currency settlement; Steady and Plasma goal funds; Converge bridges DeFi with compliance.

3. Main Issuer-Owned Stablecoin Blockchains

Tether’s Twin Technique: Plasma and Steady

Plasma is a Bitcoin sidechain purpose-built for funds, backed by $24M in funding from Bitfinex and Framework, with its governance token XPL valued at round $6.5B in pre-market buying and selling. Its core power lies in zero-fee USDT transfers, bolstered by EVM compatibility and Bitcoin’s UTXO safety mannequin. Plasma additionally introduces built-in privateness options and allows BTC bridging, unlocking low-slippage swaps and collateralized lending alternatives, making it a singular hybrid of Bitcoin safety and Ethereum flexibility.

Steady, in contrast, is an unbiased Layer 1 fee chain centered on USDT as native fuel, providing zero-gas P2P transfers to scale back consumer friction. It runs on StableBFT consensus with 0.7-second block occasions and on the spot finality, with future upgrades deliberate for DAG-based scalability. Absolutely EVM-compatible and developer-friendly with SDKs and APIs, Steady additionally focuses on consumer expertise by supporting card binding, social logins, and readable addresses. Its go-to-market technique is to leverage free transfers as an adoption driver, step by step increasing into cross-border funds, company treasury, DeFi micropayments, and service provider fee networks.

Arc (Circle)

Arc, developed by Circle, is a compliance-focused Layer 1 blockchain that makes use of USDC as its native fuel and affords full EVM compatibility. It introduces a Paymaster channel enabling fuel charges to be paid with different stablecoins or tokenized fiat, making transactions extra versatile for enterprises. Leveraging Circle’s institutional credibility and deep ties to conventional finance, Arc offers a sturdy suite of instruments for tokenizing real-world property comparable to actual property and equities, whereas additionally supporting enterprise-grade digital fee methods. By embedding regulatory compliance into its infrastructure, Arc lowers the entry barrier for conventional establishments, providing a safe and compliant pathway into blockchain-based finance.

Converge (Ethena + Securitize)

Converge, a collaborative mission between Ethena and Securitize, is designed as a hybrid DeFi-compliance blockchain optimized for RWA settlement. It achieves sub-100ms block occasions by integrating Arbitrum and Celestia, making certain each pace and scalability. On the compliance facet, Converge adopts USDe and USDtb (backed by the BUIDL fund) as fuel property, embedding stability and institutional belief immediately into the community’s operations. Safety is bolstered by a permissioned validator community (CVN) that requires ENA staking and enforces necessary KYC/KYB, aligning its framework with the stringent necessities of institutional contributors.

4. Future Outlook

In the long term, issuer-owned blockchains will problem incumbents like Ethereum and Tron. Their stablecoin-native design—zero-fee transfers, stablecoin fuel, compliance options, and institutional settlement instruments—affords distinct benefits. The fast uptake of Plasma’s staking actions underscores market urge for food for such fashions.

That mentioned, Ethereum, Solana, and others will stay central for innovation, advanced DeFi, and open ecosystems. The probably near-term final result is complementary specialization: issuer chains dominate funds and settlements, whereas general-purpose chains host broader innovation. The biggest disruption threat lies with Tron, whose dominance depends closely on USDT; if Tether migrates exercise to Steady, Tron’s core benefit may erode.

General, the emergence of issuer-owned stablecoin chains marks a brand new dual-engine part for crypto markets—combining stablecoin utility with blockchain infrastructure. This shift may reshape world fee and settlement methods, whereas concurrently forcing conventional finance to rethink its function within the evolving digital economic system.

About BitMart

BitMart is a premier world digital asset buying and selling platform with greater than 12 million customers worldwide. Constantly ranked among the many high crypto exchanges on CoinGecko, BitMart affords over 1,700 buying and selling pairs with aggressive charges. Dedicated to steady innovation and monetary inclusivity, BitMart empowers customers globally to commerce seamlessly. Be taught extra about BitMart at Web site, comply with their X (Twitter), or be part of their Telegram for updates, information, and promotions. Obtain BitMart App to commerce anytime, wherever.

Threat Warning:

The data supplied is for reference solely and shouldn’t be thought-about a advice to purchase, promote or maintain any monetary asset. All data is supplied in good religion. Nevertheless, we make no representations or warranties, specific or implied, as to the accuracy, adequacy, validity, reliability, availability or completeness of such data.

All cryptocurrency investments (together with returns) are extremely speculative in nature and contain vital threat of loss. Previous, hypothetical or simulated efficiency just isn’t essentially indicative of future outcomes. The worth of digital currencies might rise or fall, and there could also be vital dangers in shopping for, promoting, holding or buying and selling digital currencies. It is best to rigorously think about whether or not buying and selling or holding digital currencies is appropriate for you primarily based in your private funding aims, monetary state of affairs and threat tolerance. BitMart doesn’t present any funding, authorized or tax recommendation.