- The GBP/USD weekly forecast is mildly bearish amid central financial institution divergence.

- The Center East disaster continues to weigh on the pound, including good points to the US greenback.

- Market individuals set eyes on PMI readings and US GDP and inflation knowledge.

The British pound managed to partially get well its losses towards the US greenback after the pair plunged to the month-to-month low of 1.3400. The draw back got here after the greenback picked up energy amid escalating Center East stress. Furthermore, the diverging central financial institution alerts additionally weighed on the GBP/USD.

–Are you curious about studying extra about subsequent cryptocurrency to blow up? Examine our detailed guide-

The week started with the shockwaves coming from the Iran-Israel warfare that deteriorated the worldwide threat sentiment. The fears of oil provide disruption through the Hormuz Strait triggered a broader threat aversion that pushed safe-haven flows to the US greenback. The greenback’s restoration was additional supported by the hawkish Fed tone because the Fed held charges unchanged and reiterated knowledge dependence for the following fee cuts.

President Trump maintained an aggressive stance towards Iran, calling for unconditional give up. He authorised navy motion towards Iran however saved it on maintain for 2 weeks earlier than taking a decisive motion. This quickly de-escalated the stress and supplied some short-term help to the chance property.

This sentiment shift allowed the pound to get well from the month-to-month lows. In the meantime, the Financial institution of England’s dovish tone was already priced in. The central financial institution held charges on maintain at 4.25%, with the BoE governor hinting at future cuts. Nevertheless, the MPC vote cut up gave a hawkish sign as six members voted in favor of a maintain whereas three members voted for a lower.

Nonetheless, the pound’s restoration was overshadowed by the weaker UK retail gross sales knowledge that confirmed a 2.7% decline in Might, elevating issues concerning the UK’s shopper demand.

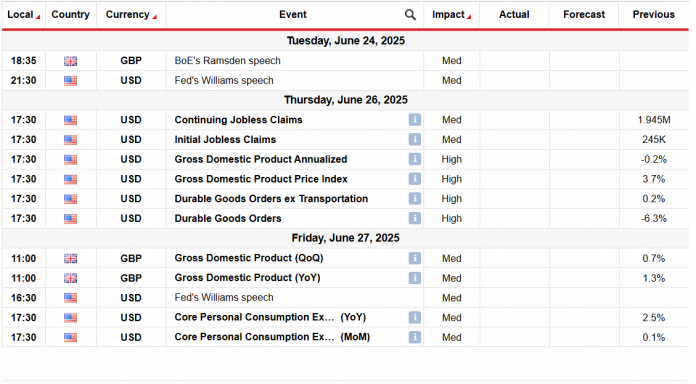

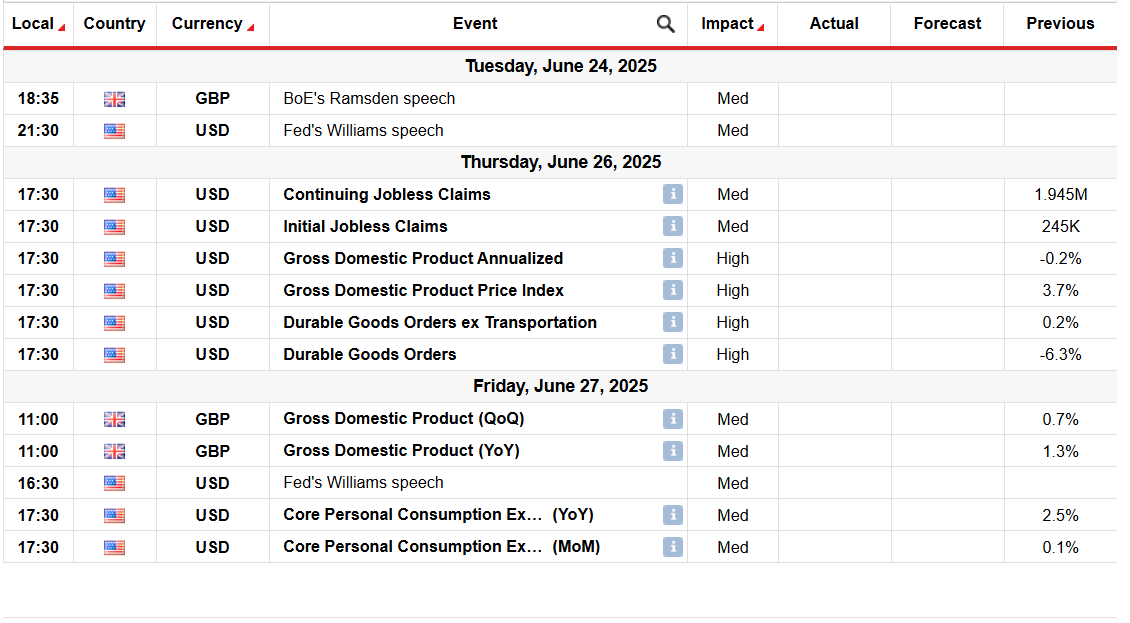

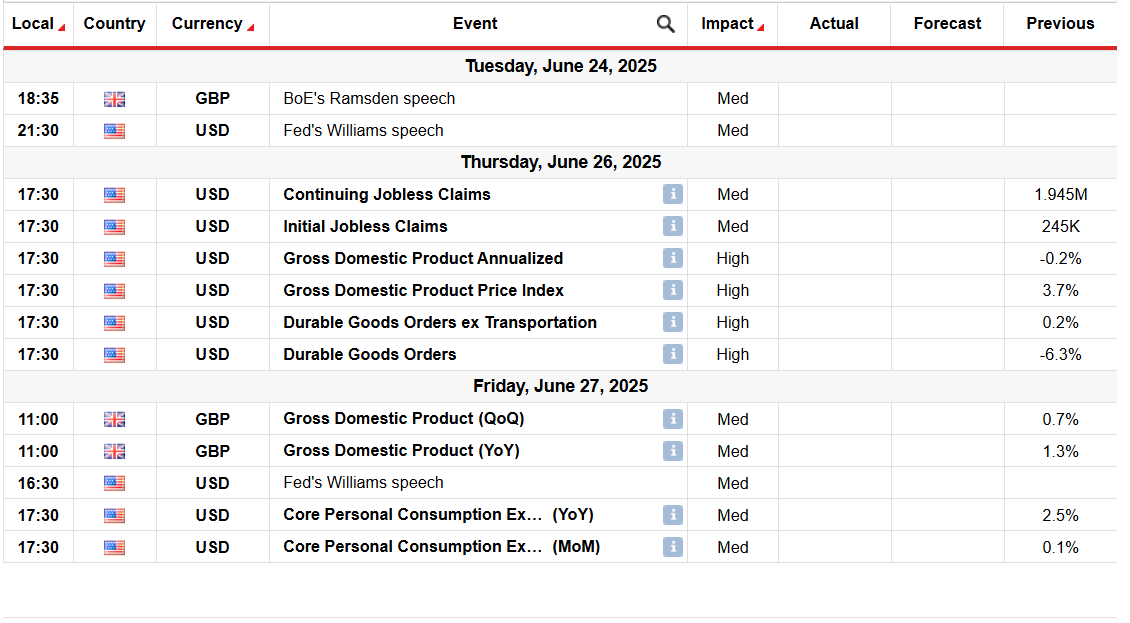

Key Occasions for the GBP/USD Subsequent Week

Trying ahead, the merchants will primarily deal with central financial institution commentary and PMI readings from each side of the Atlantic. The US Core PCE Index, US GDP, and Sturdy Items Orders knowledge are additionally essential to look at.

GBP/USD Weekly Technical Forecast: Patrons Exhausted Beneath 20-SMA

The GBP/USD each day chart exhibits a slight bearish situation as the worth stays beneath the 20-day SMA degree. Earlier within the week, the worth briefly broke the important thing help zone at 1.3400 however managed to get well. Nevertheless, the worth examined the 20-day SMA and reversed the good points on Friday. It exhibits an indication of patrons’ exhaustion. Nonetheless, the foremost help of 1.3400 continues to help the pair.

–Are you curious about studying extra about foreign exchange indicators? Examine our detailed guide-

Breaking the 1.3400 degree could convey the 1.3340 degree as a goal forward of 1.3265. The each day RSI is close to 50, displaying no clear bias in the intervening time. Nevertheless, the chance of a draw back breakout is greater.

Seeking to commerce foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You must think about whether or not you may afford to take the excessive threat of dropping your cash.