Gold (XAU/USD) trades little modified on Wednesday, consolidating positive aspects close to a three-week excessive as buyers undertake a wait-and-see method forward of an important US congressional vote to finish the record-long authorities shutdown. On the time of writing, XAU/USD is buying and selling round $4,130, with market contributors staying on the sidelines amid subdued danger urge for food.

The US Home of Representatives is about to vote afterward Wednesday on a stopgap funding invoice geared toward reopening the federal government and ending the record-long shutdown. The proposal would maintain most federal companies funded by January 30, 2026, whereas extending funding for some departments till September 30, 2026.

Indicators of progress towards restoring authorities operations have helped stabilize danger sentiment. Traders are actually turning their focus to the upcoming launch of delayed US financial information as soon as the federal government reopens, which may provide clearer steerage on the Federal Reserve’s (Fed) financial coverage path.

Regardless of restricted upside momentum, dovish Fed expectations and protracted geopolitical dangers maintain Gold supported. Latest personal employment information have bolstered indicators of a cooling labor market, boosting bets that the Fed may pivot towards price cuts, conserving XAU/USD nicely bid on dips.

Market movers: Home vote and Fed commentary steer sentiment amid mild US calendar

- A gentle rebound within the US Greenback (USD) is limiting upside in Gold. The US Greenback Index (DXY), which gauges the Buck’s worth towards a basket of six main currencies, is buying and selling round 99.60, snapping a five-day dropping streak after hitting a two-week low on Tuesday.

- The Senate’s 60-40 bipartisan vote on Monday to move the non permanent funding invoice marked a key step towards ending the record-long shutdown. The progress has eased near-term fiscal worries, though buyers stay cautious till the Home confirms last approval.

- Latest personal employment figures supplied a combined however typically softer outlook for the US labor market. ADP information launched on Tuesday confirmed that the US misplaced a mean of 11,250 private-sector jobs within the 4 weeks ending October 25, in contrast with a mean lack of 14,250 within the previous month.

- In the meantime, final week’s ADP Employment Change report indicated that non-public payrolls rose by 42,000 in October, beating expectations for a 25,000 achieve and reversing the 29,000 decline recorded in September. In the identical interval, the Challenger Job Cuts report revealed that US employers introduced 153,074 job cuts in October, the best month-to-month complete since 2003.

- Easing international commerce tensions surrounding the US tariff regime has lowered a few of the safe-haven enchantment of Gold. Nonetheless, sentiment stays cautious because the US Supreme Court docket examines the legality of the Trump administration’s tariff measures, a ruling that might reshape future commerce coverage.

- Wanting forward, a lightweight US financial calendar on Wednesday is more likely to maintain buying and selling subdued, leaving buyers targeted on feedback from a number of Fed officers for contemporary coverage cues.

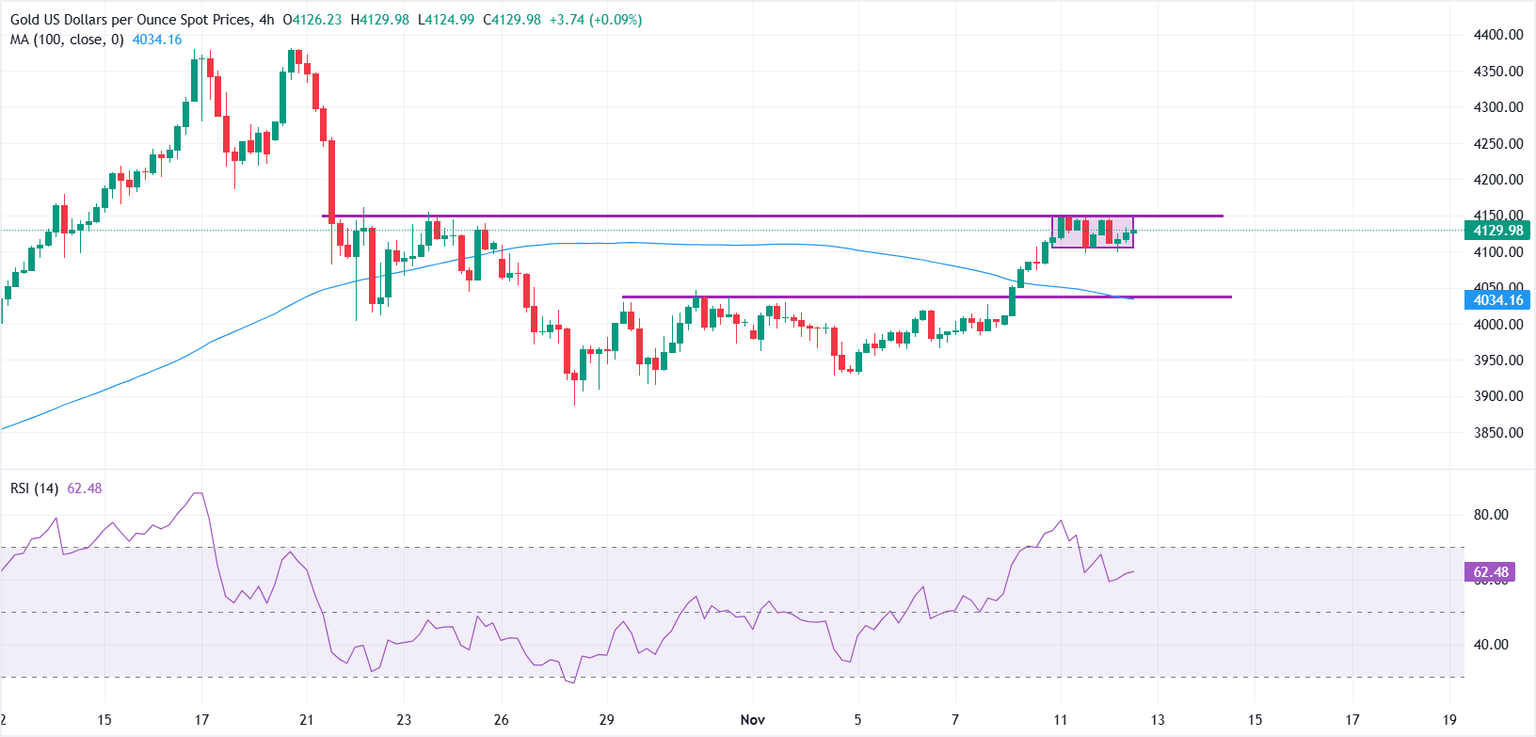

Technical evaluation: XAU/USD sideways beneath $4,150

Gold costs are consolidating in a good vary on the 4-hour chart, with $4,150 appearing as fast resistance and $4,100 providing near-term assist. The worth motion displays dip-buying curiosity across the $4,100 mark, underpinned by a supportive macro backdrop and technical construction.

A decisive break above $4,150 may open the door for a transfer towards $4,200, and doubtlessly set the stage for a retest of the all-time excessive close to $4,381. On the draw back, failure to carry $4,100 would shift focus to the $4,050–$4,030 assist zone, which aligns with the 100-period SMA.

The Relative Power Index (RSI) sits close to 62, retreating from overbought territory, suggesting a short-term cooldown in momentum. Nevertheless, it stays above impartial, indicating the broader bias nonetheless leans bullish as merchants put together for a possible breakout.

Gold FAQs

Gold has performed a key position in human’s historical past because it has been broadly used as a retailer of worth and medium of trade. At present, aside from its shine and utilization for jewellery, the valuable metallic is broadly seen as a safe-haven asset, that means that it’s thought of a superb funding throughout turbulent occasions. Gold can also be broadly seen as a hedge towards inflation and towards depreciating currencies because it doesn’t depend on any particular issuer or authorities.

Central banks are the largest Gold holders. Of their purpose to assist their currencies in turbulent occasions, central banks are likely to diversify their reserves and purchase Gold to enhance the perceived power of the financial system and the forex. Excessive Gold reserves is usually a supply of belief for a rustic’s solvency. Central banks added 1,136 tonnes of Gold value round $70 billion to their reserves in 2022, in keeping with information from the World Gold Council. That is the best yearly buy since information started. Central banks from rising economies akin to China, India and Turkey are rapidly rising their Gold reserves.

Gold has an inverse correlation with the US Greenback and US Treasuries, that are each main reserve and safe-haven property. When the Greenback depreciates, Gold tends to rise, enabling buyers and central banks to diversify their property in turbulent occasions. Gold can also be inversely correlated with danger property. A rally within the inventory market tends to weaken Gold value, whereas sell-offs in riskier markets are likely to favor the valuable metallic.

The worth can transfer resulting from a variety of things. Geopolitical instability or fears of a deep recession can rapidly make Gold value escalate resulting from its safe-haven standing. As a yield-less asset, Gold tends to rise with decrease rates of interest, whereas increased value of cash often weighs down on the yellow metallic. Nonetheless, most strikes depend upon how the US Greenback (USD) behaves because the asset is priced in {dollars} (XAU/USD). A robust Greenback tends to maintain the worth of Gold managed, whereas a weaker Greenback is more likely to push Gold costs up.