- Gold barely down in late buying and selling, nonetheless up 0.40% for the week amid geopolitical tensions.

- Blended US financial information; larger Housing Begins, decrease Constructing Permits minimally impression Bullion.

- Fed Governor Waller’s dovish feedback recommend potential for early charge cuts.

Gold’s value dropped late within the North American session, however it’s set to complete the week with positive aspects of over 0.40% as market gamers await the inauguration of US President-elect Donald Trump. Though the XAU/USD trades at $2,701, down 0.44%, buyers continued to purchase the golden steel resulting from political uncertainty.

The valuable steel continues to be pushed by geopolitics and politics in the US (US). Though US Treasury bond yields within the stomach of the curve remained unchanged, Bullion patrons didn’t push costs larger to guide further positive aspects forward of the weekend.

The US financial schedule confirmed that Housing Begins jumped double digits, although Constructing Permits contracted in December. Gold barely reacted to the information, as a lot of the information revealed throughout the week, led by Retail Gross sales featured on Thursday, recommend the financial system is stable.

The US Greenback Index (DXY), which tracks the USD’s efficiency in opposition to a basket of six friends, surged 0.35% to 109.34.

Different information revealed throughout the Asian session confirmed that China’s financial system hit a 5% Gross Home Product (GDP) development charge in 2024, in line with the Nationwide Bureau of Statistics.

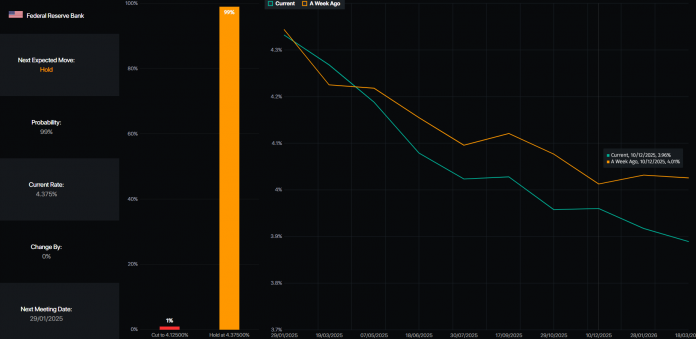

On Thursday, Fed Governor Christopher Waller tilted dovish and commented that the US central financial institution might decrease borrowing prices sooner and quicker if the disinflation course of evolves.

Market individuals are pricing in near-even odds that the Fed will minimize charges twice by the tip of 2025 and see the primary discount in June.

Supply: Prime Market Terminal

Subsequent week, the US financial docket will characteristic the US Presidential Inauguration, the discharge of Preliminary Jobless Claims and Flash PMIs information.

Each day digest market movers: Gold value pressured forward of the weekend

- Gold fell as actual yields remained agency on Friday. Measured by the 10-year Treasury Inflation-Protected Securities (TIPS) yield, was just about unchanged at 2.18%.

- The US 10-year Treasury bond yield was unchanged at 4.618%, a headwind for the golden steel.

- US Housing Begins jumped from 1.294 million to 1.499 million in December, a leap of 15.8% MoM.

- Constructing Permits for a similar interval shrank as permits dipped from 1.493 million to 1.483 million, a 0.7% drop.

- The most recent inflation information and Fed Waller’s feedback pressured the US Greenback, as merchants had grown assured the Fed would minimize charges sooner somewhat than later. Waller didn’t rule out a minimize within the March assembly as inflation “is getting near what our 2% inflation goal could be.”

XAU/USD technical outlook: Gold maintain agency close to $2,700

Gold costs fell amid the shortage of catalysts forward of the weekend. Nonetheless, patrons should hold XAU/USD’s costs above $2,700, to allow them to stay hopeful of pushing the yellow steel towards the December 12 excessive of $2,726. As soon as surpassed, the subsequent cease could be $2,750, adopted by the all-time excessive at $2,790.

However, patrons’ failure to attain the beforehand talked about final result might imply Gold would possibly take a look at the January 13 swing low of $2,656, adopted by the confluence of the 50 and 100-day Easy Transferring Averages (SMAs) at $2,639 – $2,642.

Gold FAQs

Gold has performed a key function in human’s historical past because it has been extensively used as a retailer of worth and medium of trade. Presently, aside from its shine and utilization for jewellery, the valuable steel is extensively seen as a safe-haven asset, which means that it’s thought of a superb funding throughout turbulent instances. Gold can also be extensively seen as a hedge in opposition to inflation and in opposition to depreciating currencies because it doesn’t depend on any particular issuer or authorities.

Central banks are the largest Gold holders. Of their purpose to help their currencies in turbulent instances, central banks are inclined to diversify their reserves and purchase Gold to enhance the perceived power of the financial system and the foreign money. Excessive Gold reserves could be a supply of belief for a rustic’s solvency. Central banks added 1,136 tonnes of Gold value round $70 billion to their reserves in 2022, in line with information from the World Gold Council. That is the very best yearly buy since data started. Central banks from rising economies comparable to China, India and Turkey are shortly growing their Gold reserves.

Gold has an inverse correlation with the US Greenback and US Treasuries, that are each main reserve and safe-haven belongings. When the Greenback depreciates, Gold tends to rise, enabling buyers and central banks to diversify their belongings in turbulent instances. Gold can also be inversely correlated with threat belongings. A rally within the inventory market tends to weaken Gold value, whereas sell-offs in riskier markets are inclined to favor the valuable steel.

The value can transfer resulting from a variety of things. Geopolitical instability or fears of a deep recession can shortly make Gold value escalate resulting from its safe-haven standing. As a yield-less asset, Gold tends to rise with decrease rates of interest, whereas larger price of cash normally weighs down on the yellow steel. Nonetheless, most strikes rely upon how the US Greenback (USD) behaves because the asset is priced in {dollars} (XAU/USD). A powerful Greenback tends to maintain the worth of Gold managed, whereas a weaker Greenback is more likely to push Gold costs up.