- Gold value jumps over 1% on Friday on renewed US debt issues.

- Markets are at unease that US President Trump’s spending invoice will add much more to US debt.

- Gold sees a weekly achieve of round 4%, absolutely recovering from the earlier week’s fall.

Gold (XAU/USD) value extends its weekly features, buying and selling close to $3,329 on the time of writing on Friday, up almost 1% on the day, on a brand new tailwind for the secure haven valuable steel. The spending invoice from United States (US) President Donald Trump handed by the Home of Representatives on Thursday and is now on its technique to the Senate. Merchants are nervous that the spending invoice will solely add extra US debt, whereas revenue from tariffs stays to be seen as sufficient to supply funding for all of the spending.

The most effective place to trace these issues is the US 30-year benchmark fee. Yields in that maturity rallied to five.15% on Thursday from 4.64% firstly of Might, a greater than one-year excessive because the 5.18% seen on the finish of December 2023. Including all issues up, the latest downgrade on US credit standing from company Moody’s, and now this spending invoice, which provides $3.8 billion to the US debt, merchants and market individuals demand a better premium or return earlier than contemplating shopping for US debt bonds, which pushes US yields greater, the Financial Occasions experiences.

Day by day digest market movers: China gold rush picks up once more

- Yields on 10-year US Treasuries have pushed greater this week, topping 4.5%. In earlier years, such a transfer would have been a significant headwind for Gold because it doesn’t pay curiosity, with bullion costs and yields sometimes shifting inversely. That correlation has now weakened, Bloomberg experiences.

- “Gold is more likely to stay range-bound within the close to time period,” stated Justin Lin, an analyst at World X ETFs. “Nevertheless, ongoing geopolitical tensions and rising issues concerning the US fiscal outlook proceed to supply underlying assist”, Bloomberg experiences.

- China’s onshore, gold-backed Change Traded Funds (ETFs) noticed inflows resume as costs rebounded, in keeping with a report by China Securities Journal. Some 20 Gold ETFs listed on Chinese language bourses obtained inflows of about 370m Yuan on Might 21, the report stated, Bloomberg experiences.

- If output doubles as deliberate, Ghana expects to rake in $12 billion a yr from small-scale Gold manufacturing. Gold exports from Ghana have surged as worldwide costs have soared, and far of that growth is right down to small mines and artisanal manufacturing. This yr, the federal government arrange a regulator to deal with all Gold shopping for and promoting, hoping to spice up foreign-currency reserves and curb black-market buying and selling, Reuters experiences.

Gold Worth Technical Evaluation: Holding at these ranges

The US debt market is coming into wild waters from right here on out. The ballooning debt, together with uncertainty on the revenue of tariffs and different measures lagging to fund the spending invoice, makes the US debt a heavy weight for markets to bear. This interprets into a better yield demanded for buyers to be satisfied to purchase the issued debt, creating uncertainty that sends Gold greater and would possibly see extra room to go.

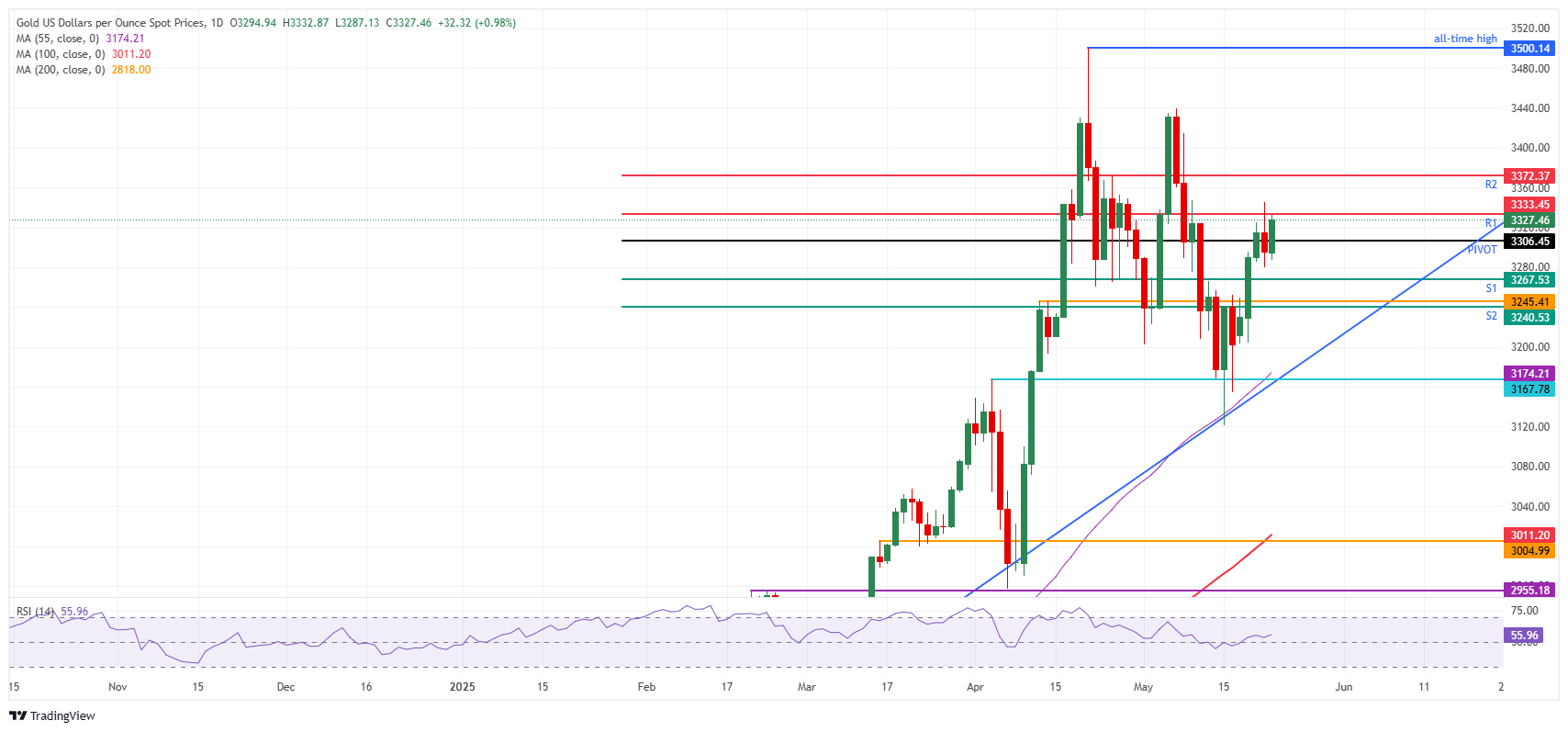

On the upside, the R1 resistance at $3,333 is the primary stage to look out for because it already appears to be like toppish within the European buying and selling session for now. The R2 resistance at $3,372 follows not far behind and will open the door for a return to the $3,400 spherical stage and doubtlessly additional course to new all-time highs.

On the opposite aspect, some thick-layered assist emerges in case the Gold value declines. On the draw back, the every day Pivot Level is available in at $3,306, safeguarding the $3,300 massive determine. Some middleman assist might come from the S1 assist at $3,267. Additional under, there’s a technical pivotal stage at $3,245, roughly converging with the S2 assist at $3,240.

XAU/USD: Day by day Chart

Inflation FAQs

Inflation measures the rise within the value of a consultant basket of products and providers. Headline inflation is normally expressed as a share change on a month-on-month (MoM) and year-on-year (YoY) foundation. Core inflation excludes extra risky components comparable to meals and gas which might fluctuate due to geopolitical and seasonal components. Core inflation is the determine economists give attention to and is the extent focused by central banks, that are mandated to maintain inflation at a manageable stage, normally round 2%.

The Shopper Worth Index (CPI) measures the change in costs of a basket of products and providers over a time period. It’s normally expressed as a share change on a month-on-month (MoM) and year-on-year (YoY) foundation. Core CPI is the determine focused by central banks because it excludes risky meals and gas inputs. When Core CPI rises above 2% it normally ends in greater rates of interest and vice versa when it falls under 2%. Since greater rates of interest are constructive for a forex, greater inflation normally ends in a stronger forex. The other is true when inflation falls.

Though it might appear counter-intuitive, excessive inflation in a rustic pushes up the worth of its forex and vice versa for decrease inflation. It is because the central financial institution will usually elevate rates of interest to fight the upper inflation, which are a magnet for extra international capital inflows from buyers on the lookout for a profitable place to park their cash.

Previously, Gold was the asset buyers turned to in occasions of excessive inflation as a result of it preserved its worth, and while buyers will usually nonetheless purchase Gold for its safe-haven properties in occasions of utmost market turmoil, this isn’t the case more often than not. It is because when inflation is excessive, central banks will put up rates of interest to fight it.

Greater rates of interest are unfavorable for Gold as a result of they enhance the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or putting the cash in a money deposit account. On the flipside, decrease inflation tends to be constructive for Gold because it brings rates of interest down, making the brilliant steel a extra viable funding different.