- Gold eased beneath $4,000 as merchants booked income following document highs, easing geopolitical tensions.

- Persistent coverage instability and rising inflation considerations reaffirm gold’s safe-haven enchantment.

- Merchants intently monitor Fed speeches and the Michigan Client Index for additional coverage and route cues.

The gold outlook reveals a pause within the uptrend, correcting beneath the $4,000 mark as merchants took income after the current document highs above $4,060. The retreat stemmed from easing geopolitical tensions after the US negotiated a ceasefire between Israel and Hamas. The danger sentiment has improved, decreasing safe-haven demand. Regardless of this pullback, the medium-term outlook for gold stays optimistic resulting from assist from a number of macroeconomic components.

–Are you to study extra about automated foreign currency trading? Verify our detailed guide-

From the US, lingering uncertainty concerning the rate of interest retains XAU/USD on edge. Though the greenback edged larger this week, expectations of the Federal Reserve persevering with its easing cycle amid the declining employment knowledge and chronic inflation considerations proceed to cap draw back dangers.

The continued US authorities shutdown, Fed rate-cut bets, and European political instability assist gold costs. Buyers proceed to pursue security towards coverage and financial uncertainty.

Moreover, the central banks’ buy of gold, rising inflation, and declining confidence in conventional currencies have elevated costs. The continued geopolitical tensions, reminiscent of Russia-Ukraine friction and commerce worries, preserve the safe-haven demand whereas offsetting the optimism from the Gaza ceasefire.

Regardless of intermittent profit-taking, analysts anticipate the gold correction to be modest because it safeguards towards financial value pressures and coverage uncertainty. A good macroeconomic demand and a gradual investor curiosity in security assist gold.

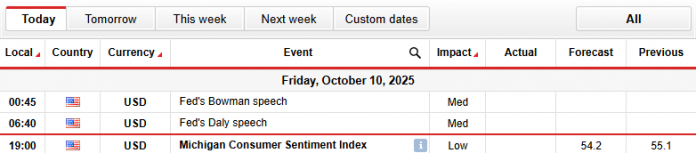

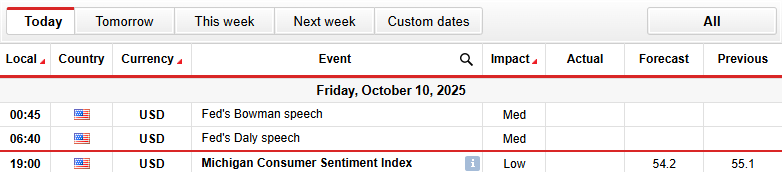

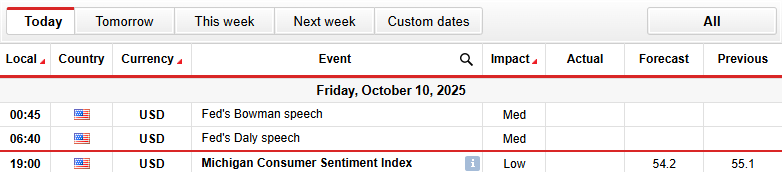

Gold Key Occasions Forward

- Fed’s Bowman speech

- Fed’s Daly speech

- Michigan Client Sentiment Index

Merchants are looking forward to the Fed’s Bowman and Daly speeches and the Michigan Client Sentiment Index for insights into the expectations for the US financial coverage.

Gold Technical Outlook: Stabilizing Beneath $4,000 inside Uptrend

The XAU/USD 4-hour chart suggests the worth is stabilizing after a powerful rally. It trades close to $4,000, on the time of writing, after dipping to $3,950 in a single day. The steel stays above the important thing MAs besides the 20-period MA. The assist stage for gold lies round 50-MA close to $3,930, adopted by 100-MA at $3,832, and the 200-MA close to $3,694. These indicate that the broader uptrend stays agency.

–Are you to study extra about foreign exchange indicators? Verify our detailed guide-

The RSI stays close to 65. Whereas it signifies a optimistic momentum, it additionally hints at doable overbought situations if the rally persists. A gentle break above $4,000 might set off additional upside, with quick resistance at all-time highs close to $4,060 forward of $4,100.

Trying to commerce foreign exchange now? Make investments at eToro!

67% of retail investor accounts lose cash when buying and selling CFDs with this supplier. It is best to contemplate whether or not you’ll be able to afford to take the excessive threat of dropping your cash.