- Gold weekly forecast is bullish amid geopolitical stress.

- Cooling US inflation knowledge, which weighs on the greenback, boosted demand for gold.

- Market contributors are actually eyeing the FOMC assembly minutes.

The gold weekly forecast turns strongly bullish, with a watch on testing the all-time highs round $3,500. The current geopolitical stress stemming from the Israel-Iran battle drove the worth above $3,400 stage, marking a contemporary multi-week prime at $3,445 earlier than pulling again in a while Friday.

-If you’re excited about foreign exchange day buying and selling then have a learn of our information to getting started-

The softer US greenback demand, amid cooler US CPI knowledge, boosted gold’s uptrend. The stage is now set for the valuable steel for a risky subsequent week as merchants anxiously watch for the Fed’s coverage assembly.

The yellow steel remained sideways because the week started, capped by optimism across the US-China commerce talks in London. Negotiators agreed on a framework to protect the tariff truce and ease export controls, together with these on uncommon earth metals. The US President’s announcement to calm down management on many Chinese language merchandise additionally lifted the chance sentiment, limiting the upside for gold.

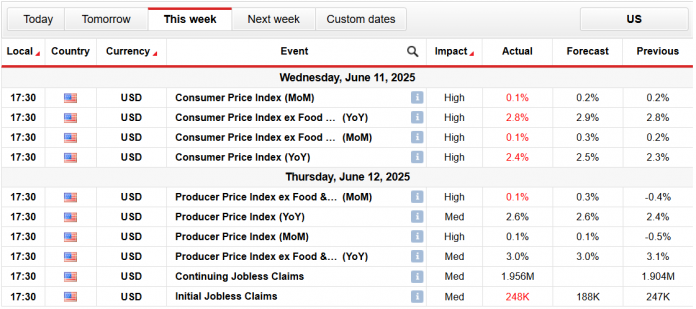

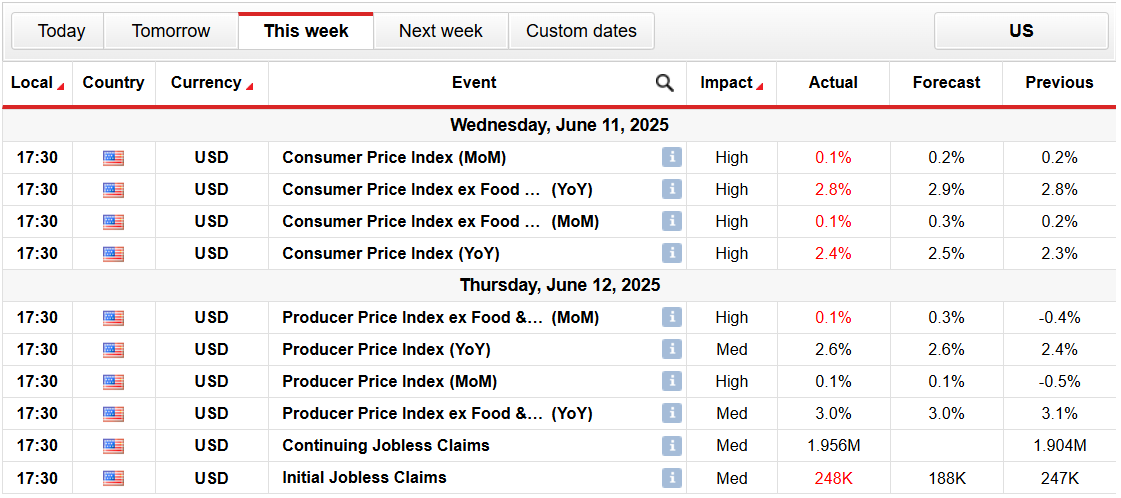

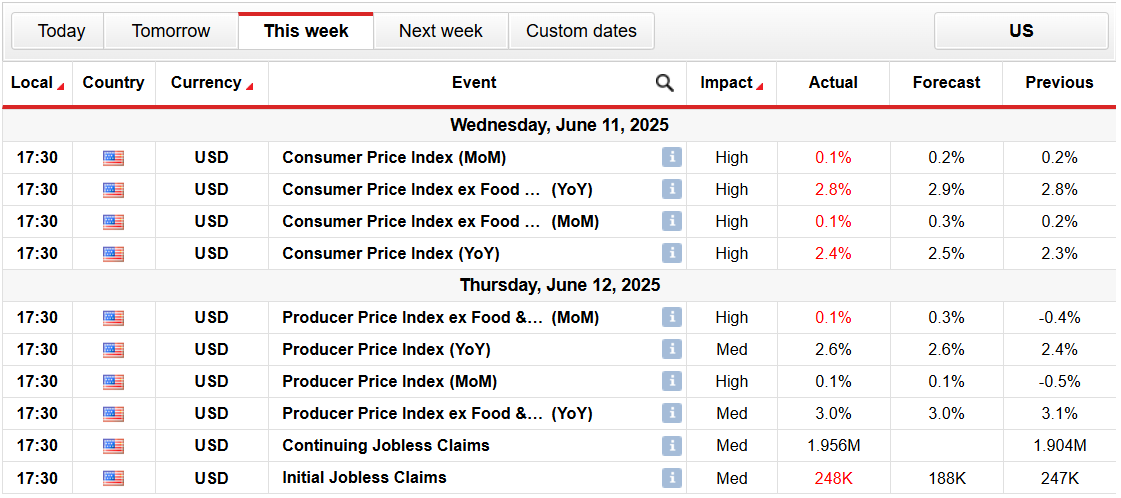

The momentum shifted in favor of gold throughout midweek because the US CPI knowledge for Might slipped, with headline inflation at 0.1% m/m and a couple of.4% y/y. The core inflation additionally missed the estimate. The information triggered a pointy decline within the US greenback, leading to a 1% acquire on Wednesday. The bullish pattern continued on Thursday because the US PPI and jobless claims knowledge had been weak sufficient to maintain promoting strain on the Buck. The information fueled hypothesis in regards to the Fed’s extra dovish stance.

Nevertheless, the decisive catalyst was Israel’s assault on Iran’s nuclear facility and navy officers. Israeli PM introduced the launch of “Operation Rising Lion,” noting the assault would proceed till wanted. Iran additionally retaliated and warned the US and Israel of extreme repercussions. The state of affairs despatched the gold worth above $3,400.

Main Occasions for Gold Subsequent Week

All eyes are actually on the Federal Reserve’s rate of interest selections and the up to date launch of the Abstract of Financial Projections (SEP) on Wednesday. Though no change in rates of interest is anticipated, the brand new dot plot is vital to observe. The US greenback can weaken additional if the Fed officers reiterate their name for 2 price cuts by the tip of 2025. A hawkish tilt, signaling one minimize, might strengthen the Buck, and gold can see a pullback.

Fed Chair Jerome Powell’s commentary will even be intently watched. A dovish tone might speed up the greenback promoting, pushing gold to contemporary all-time highs.

Gold Weekly Technical Forecast: Bulls Pushing to $3,500

The every day chart of gold reveals the worth has briefly damaged a double prime at $3,440. The draw back stays nicely supported by the 20-day SMA and a rising RSI at 63.0. The value is slowly heading in the direction of $3,500 (all-time excessive).

-Are you in search of one of the best AI Buying and selling Brokers? Verify our detailed guide-

On the flip facet, the $3,400 stage stays a powerful help for the gold forward of the $3,320 space the place the 20-day SMA resides. Breaking beneath the extent might drift in the direction of $3,300.

Seeking to commerce foreign exchange now? Make investments at eToro!

67% of retail investor accounts lose cash when buying and selling CFDs with this supplier. It is best to think about whether or not you may afford to take the excessive danger of shedding your cash.