Ethereum (ETH) is buying and selling at essential ranges after a pointy rally from $3,800 to $4,700 in only a few days, marking one in every of its strongest strikes in latest months. The swift rebound highlights renewed power from bulls, who now seem firmly in charge of the market’s short-term route. As ETH approaches key resistance zones, analysts are carefully watching whether or not the second-largest cryptocurrency can maintain its momentum and make sure a breakout above the present vary.

Associated Studying

This spectacular transfer isn’t just pushed by market sentiment but additionally by sturdy on-chain fundamentals. Institutional participation in Ethereum continues to rise, with inflows from funds and treasuries steadily growing over the previous weeks. In the meantime, staking exercise stays excessive, suggesting that long-term traders are displaying confidence in ETH’s community safety and yield potential regardless of volatility in broader markets.

The mixture of rising institutional demand and sustained staking confidence supplies a strong basis for Ethereum’s subsequent section of development. If bulls keep management and value holds above $4,500, analysts consider ETH could possibly be gearing up for an additional leg increased, doubtlessly getting into a brand new growth cycle because the broader crypto market follows Bitcoin’s renewed bullish momentum.

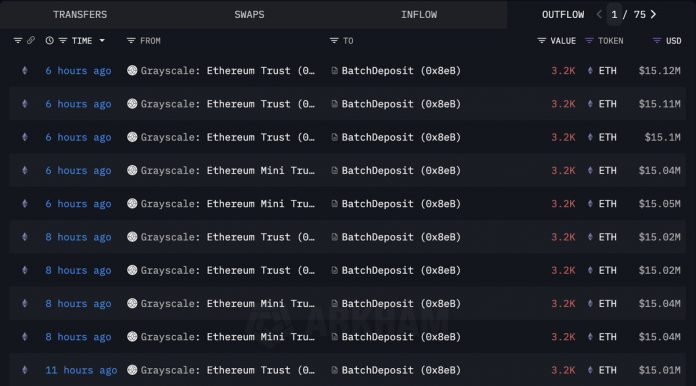

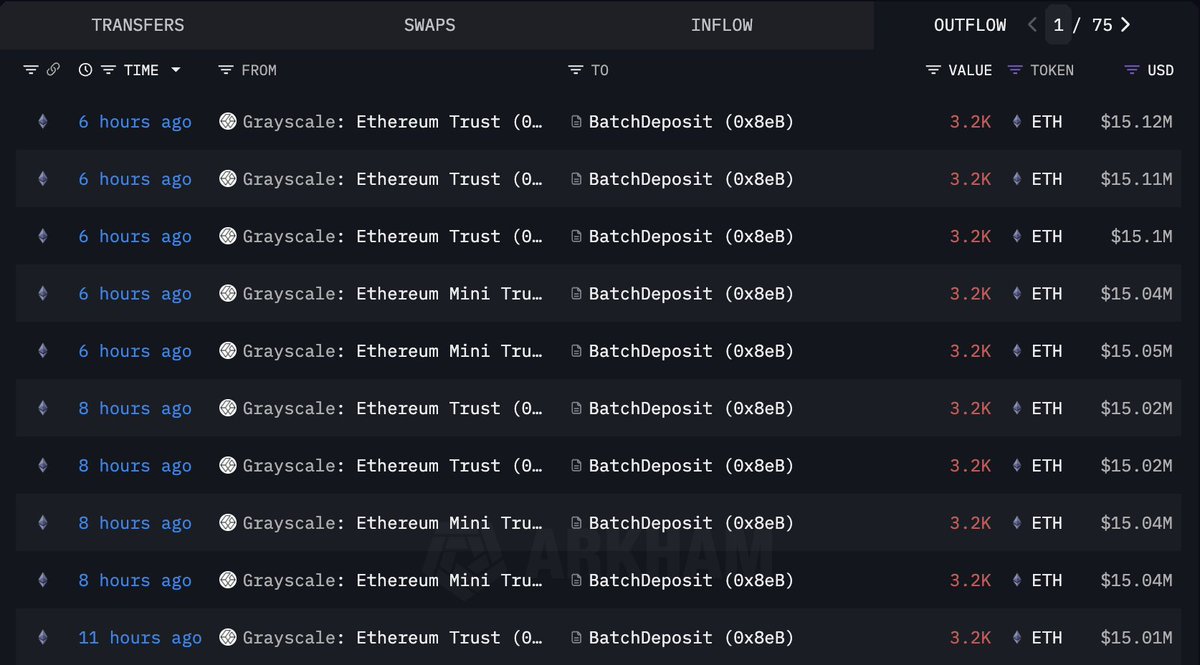

Grayscale Stakes $150M in Ethereum

In response to onchain information from Lookonchain, Grayscale (ETHE and ETH ETF) staked 32,000 ETH, value roughly $150.56 million, earlier immediately. This transfer represents one of many largest institutional staking transactions in latest weeks and indicators rising confidence amongst main gamers in Ethereum’s long-term worth proposition. The choice to allocate such a big quantity of ETH to staking underscores the continued institutional perception in Ethereum’s twin position as each a know-how platform and a yield-generating asset.

Staking Ethereum locks cash inside the community, successfully decreasing liquid provide whereas contributing to community safety and stability. When giant holders like Grayscale commit such capital, it demonstrates conviction within the sustainability of Ethereum’s staking financial system and its position inside future monetary infrastructure. Analysts interpret this as a powerful bullish sign, particularly amid rising institutional demand for tokenized belongings and DeFi publicity constructed on the Ethereum community.

Furthermore, Grayscale’s transfer aligns with the broader pattern of institutional staking development, the place funds and asset managers more and more leverage staking yields in its place earnings technique. This reinforces Ethereum’s place because the spine of decentralized finance and a key element of institutional crypto portfolios.

Mixed with renewed bullish sentiment throughout the crypto market, Grayscale’s staking determination provides weight to the narrative that Ethereum stays undervalued relative to its basic power and adoption. If momentum sustains, this occasion might mark the start of a brand new accumulation section — one pushed not by hypothesis, however by institutional conviction in Ethereum’s evolving financial and technological dominance.

Associated Studying

Bulls Regain Momentum Above $4,600

Ethereum is at the moment buying and selling round $4,688, displaying renewed bullish power after a pointy restoration from the $3,800 area earlier this month. The chart highlights a transparent upward construction, with ETH reclaiming each the 50-day and 100-day transferring averages, confirming a short-term pattern reversal. Patrons have regained management, and the value now approaches the essential resistance zone between $4,700 and $4,800, which beforehand marked a significant rejection space in late August.

A decisive each day shut above $4,700 might pave the best way for a check of $5,000, doubtlessly resulting in a brand new section of value discovery if momentum holds. The sustained increased lows since late September additional point out accumulation moderately than distribution, suggesting that traders are positioning for continuation moderately than taking earnings.

Associated Studying

From a broader perspective, Ethereum’s latest surge coincides with Bitcoin’s transfer above all-time highs and rising institutional participation. This correlation, mixed with Grayscale’s latest 32,000 ETH stake, reinforces the bullish case for ETH’s medium-term outlook. Nonetheless, short-term merchants ought to monitor the $4,400 help, as a breakdown under this degree might delay additional upside. General, Ethereum’s technical construction seems to be robust, with clear momentum and market confidence returning because it eyes one other breakout try.

Featured picture from ChatGPT, chart from TradingView.com