Each of those firms are seeing income climb.

For those who’re concerned about shares that rely on the buyer, you might have a variety of decisions, from journey and leisure to e-commerce and meals and drinks. And that is simply to call just a few.

Although sure economies could also be extra favorable than others for some of these firms, a top quality client items inventory has what it takes to win over the long term, making it a fantastic asset to purchase and maintain at any cut-off date.

Carnival (CCL -2.96%) (CUK -2.74%), the world’s largest cruise operator, and Chewy (CHWY 0.17%), an e-commerce pet provides large, match the invoice. Each of those firms have seen income climb in latest occasions and provide buyers a powerful long-term outlook. However, should you might purchase just one at present, which one must you select? Let’s discover out.

Picture supply: Getty Photographs.

The case for Carnival

Carnival had it tough just a few years in the past. The early days of the pandemic drove its operations to a halt, and consequently, the corporate constructed up an enormous wall of debt simply to remain afloat (excuse the pun).

However this cruising chief has made quite a lot of progress since then. It has changed older ships with new fuel-efficient vessels, put into place a technique to spice up on-board spending, and targeted on repaying debt — particularly variable-rate borrowings.

All of this, together with normal demand for cruises, have helped income to take off in latest quarters. Within the newest interval, for instance, the corporate delivered report income of $6.3 billion and reached its highest-ever degree of buyer deposits at $8.5 billion.

Superior bookings for cruises subsequent 12 months met the report ranges of this 12 months — and at report excessive fares. So, vacationers are desirous to decide to a cruise trip, whilst costs go up.

These successes have helped Carnival beat the monetary targets in its turnaround plan a 12 months and a half sooner than anticipated: The adjusted return on invested capital has reached its highest degree in additional than 20 years.

On prime of this, at present’s decrease rates of interest ought to make it simpler to repay debt, and decrease charges are additionally supportive of the buyer. So, as potential passengers really feel much less strain on their wallets, they could plan extra cruises.

The case for Chewy

The favourite firm of pets — from cats to iguanas — could also be Chewy, a web based vendor of meals, treats, toys and different pet wants. And this has made their house owners significantly loyal.

We see this via Autoship, a Chewy service that permits prospects to decide on an computerized reorder and delivery for his or her favourite merchandise. Autoship accounts for 83% of general gross sales, and what I like is that it presents buyers visibility on future gross sales.

Chewy reached the milestone of profitability just a few years in the past and has seen income progressively advance, too. Within the latest quarter, the corporate reported a rise of greater than 8% in gross sales to $3.1 billion, and Autoship gross sales climbed 15%.

The corporate additionally has made an vital transfer lately to broaden its income stream with the opening of Chewy veterinary clinics. This choice permits the corporate to introduce its e-commerce providers to prospects who may not have been accustomed to them. So, over time, it may well develop its income via vet visits and pet house owners turning into prospects of its e-commerce website.

The corporate’s monetary well being is one other optimistic level. It has no debt and ended the newest quarter with greater than $590 million in money. Although Chewy faces competitors from big-box retailers and others within the area, Autoship’s numbers present the corporate has been in a position construct a loyal buyer base — an vital issue that might assist it win over the long run.

Which is the higher purchase?

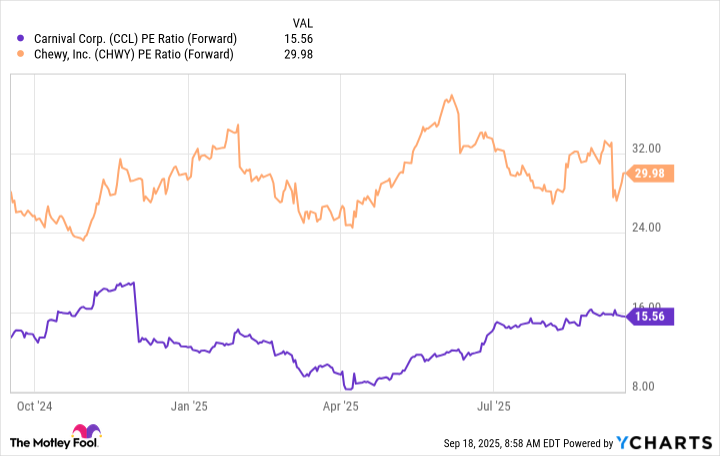

As talked about, each of those shares might make a fantastic addition to a client items portfolio. With regards to valuation, Carnival is cheaper, buying and selling at 15 occasions ahead earnings estimates in contrast with a 29 a number of for Chewy. However Carnival’s valuation additionally has climbed from a lot decrease ranges earlier within the 12 months.

CCL PE Ratio (Ahead) information by YCharts; PE = prce to earnings.

Nonetheless, I might contemplate each gamers moderately priced at present, so valuation would not be the factor to push me towards one or the opposite.

What would sway me at present — and at any cut-off date — is the query of debt. Decrease rates of interest are positively excellent news for Carnival, however the firm’s excessive debt degree stays a danger.

I like the truth that Chewy is debt free, and that, no matter rates of interest, makes it a inventory I might favor. So, although I believe each of those gamers might add worth to a portfolio over the long term, if I might solely purchase one proper now, I might go for Chewy.