Each of those corporations are nice. However there is a clear winner.

Semiconductor large Nvidia (NVDA -0.85%) and synthetic intelligence (AI) kingpin Palantir Applied sciences (PLTR -2.14%) are two of probably the most compelling know-how shares out there. Nvidia harnessed demand for its graphics processing models (GPUs) to develop into the most important firm on this planet, with a $4.4 trillion market capitalization. Palantir, in the meantime, is utilizing its synthetic intelligence platform to essentially change how governments and industrial companies function. The inventory is up greater than 500% within the final 12 months and is the best-performing inventory within the S&P 500.

In my opinion, you possibly can’t go incorrect with both of those tech shares. However in a one-on-one matchup, which comes out on prime?

Let’s take a look at each corporations earlier than rendering a verdict.

Picture supply: Getty Photographs.

Nvidia

Nvidia’s GPUs are the engine behind this mammoth firm. Whereas they was finest identified for offering the graphics in computer systems, now GPUs are generally utilized by corporations which might be constructing huge knowledge facilities to run synthetic intelligence-powered platforms, together with massive language fashions wanted for generative AI.

Nvidia has the lion’s share of this enterprise, with Jon Peddie Analysis estimating that it has roughly 92% of the market share. And as Nvidia is anticipating spending on knowledge facilities to speed up from $250 billion in 2023 to $1 trillion yearly by 2028, there is a huge alternative at hand.

As well as, main tech corporations like Microsoft, Alphabet, and Meta Platforms are spending closely and are even growing their capital expenditure spending on their knowledge facilities. That is why I am anticipating a stable earnings report from Nvidia when it experiences its earnings for the present quarter, and why I am anticipating the inventory to pop but once more after the numbers are launched.

Palantir Applied sciences

Palantir received its begin just a little greater than 20 years in the past as a knowledge mining firm to supply real-time analytics and insights. As a authorities contractor, it is lengthy been valued by the navy for its analytic know-how that helps commanders make real-time choices in battle. To the general public eye, Palantir largely flew beneath the radar for years till in 2011, when it was credited for serving to U.S. forces discover and remove Sept. 11 mastermind Osama bin Laden.

Palantir works by drawing info from many sources, resembling satellite tv for pc imagery. By sifting by and digesting that info, it may carry out instantaneous evaluation that may assist governments perform. Based on its CEO, Alex Karp, “Palantir was based on the assumption that the USA, its allies, and companions ought to harness probably the most superior technical capabilities for his or her protection and prosperity.”

As its capabilities expanded by the launch of its generative AI-powered Synthetic Intelligence Platform (AIP), Palantir is shortly bringing in further non-military authorities contracts. It has new contracts with the Federal Aviation Administration, the Facilities for Illness Management and Prevention, the State Division, and the Inside Income Service. Within the firm’s just-released second quarter earnings report, U.S. authorities income elevated 53% within the final 12 months, reaching $426 million.

Business income is rising even quicker, up 93% within the second quarter on a year-over-year foundation and reaching $306 million. Purchasers embody Walgreens Boots Alliance, AT&T, Basic Mills, United Airways, and others, and Palantir is doing all the pieces from making manufacturing extra environment friendly to managing provide chains and serving to corporations scale.

Palantir closed 157 offers within the second quarter valued at greater than $1 million, with 66 of them greater than $5 million and 42 of them no less than $10 million. As extra corporations deliver Palantir’s platform on-line and share how they’re bettering their companies, Palantir’s platform will develop into vital for a lot of establishments.

The decision

I am not gonna lie. It is a robust one. I really like each of those corporations, and I believe each are destined to extend.

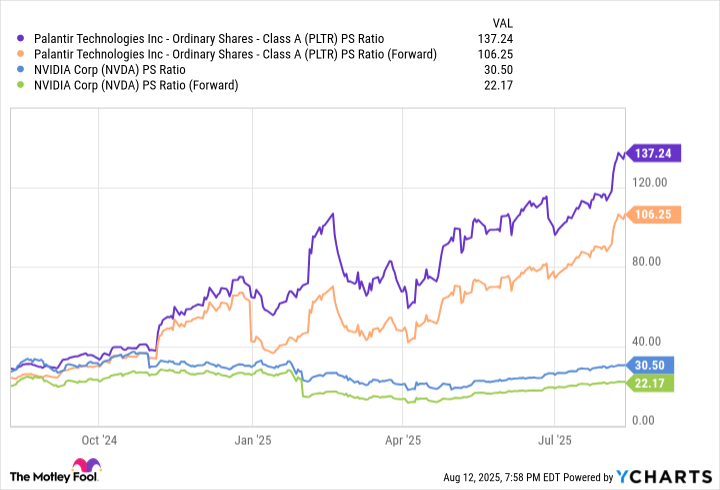

But when I’ve to decide on one, then the valuations of each corporations will break the tie. On the time of this writing, Nvidia is richly valued each in its price-to-earnings (P/E) ratio of 59 and its ahead P/E of 42, however Palantir is available in at an unhealthy 623 and 288, respectively.

The price-to-sales ratio, which compares market capitalization to income, is arguably an much more correct measurement as each of those corporations are pouring income again into the enterprise. And Nvidia is by far the strongest there, too.

PLTR PS Ratio knowledge by YCharts

So, my winner on this hypothetical battle is Nvidia by a nostril. However each shares are nice ones to have, and so they’ll each anchor my portfolio for the foreseeable future.

Patrick Sanders has positions in Nvidia and Palantir Applied sciences. The Motley Idiot has positions in and recommends Alphabet, Meta Platforms, Microsoft, Nvidia, and Palantir Applied sciences. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.