The crypto markets are seeing a optimistic impulse. The Fed introduced a 25 foundation level price minimize. The rate of interest went all the way down to 4% from 4.25%. And this 12 months, analysts count on much more price cuts.

That’s excellent news for the crypto sector, because it turns into cheaper to borrow cash. Which means that extra liquidity turns into obtainable. Now, a few of that liquidity will trickle into crypto.

So, millionaire desires are about to change into actuality. Particularly for those who maintain AAVE. Therefore, on this video, I’ll look into what number of AAVE will make you a millionaire.

What IS Aave ($AAVE)

Aave ($AAVE) is likely one of the largest, if not THE largest lending protocol in DeFi. It launched in 2017 as ETHLend on Ethereum. In 2020, it was rebranded to Aave. These days, you’ll find it on 17 totally different EVM chains. Moreover, from August 2025 it’s additionally obtainable on the primary non-EVM chain, Aptos.

Aave is reside on @aptos. pic.twitter.com/azgKS0JKFc

— Aave (@aave) August 21, 2025

On Ethereum, it ranks second for TVL, after Lido, the liquid ETH staking platform. That’s a reasonably spectacular feat. Its TVL is $36.34 billion. That’s nearly twice as a lot as quantity 3, EigenLayer and really near Lido, which has $39.5 billion in TVL.

Aave’s TVL began to develop in early November 2024. It went from $13 billion to its present TVL of $36 billion. That’s nearly a strong 3x. With the present bull market across the nook, the TVL is sure to develop much more.

Its founder is Stani Kulechov and to this point, Aave has had 3 totally different variations. The present model is V3. A brand new model, V4, is on its method. Nonetheless, extra on that in a second.

A few of its distinctive options are flash loans. With a flash mortgage, you don’t want collateral, however it’s good to repay the mortgage inside the identical transaction. Collateral swapping is one other distinctive characteristic. This lets you change your equipped collateral asset to a different asset. You are able to do this in a single transaction. So, there’s no must withdraw and re-supply your funds. There’s additionally no must pay again your preliminary debt.

Ronnie makes use of Collateral Swaps pic.twitter.com/NQk1wwCo57

— Aave (@aave) March 29, 2023

So, that offers you a little bit of an thought what Aave is all about. Now, let’s check out what has been taking place at Aave not too long ago.

What’s New with Aave?

An enormous information replace for Aave is the launch of V4 in This fall, 2025. At the moment, Aave is at the moment within the last levels of testing the V4 model. Deployment will probably be subsequent in line. I discussed V4 already a second in the past, so let’s take a better take a look at what V4 brings to the desk. This will probably be among the many main DeFi occasions for this 12 months. So, what’s new?

Aave Labs simply revealed the V4 launch roadmap 👻

It highlights milestones accomplished to this point and the upcoming steps as Aave V4 progresses by its last levels of evaluate, testing, and deployment. pic.twitter.com/N5EOlqNFJt

— Aave (@aave) September 15, 2025

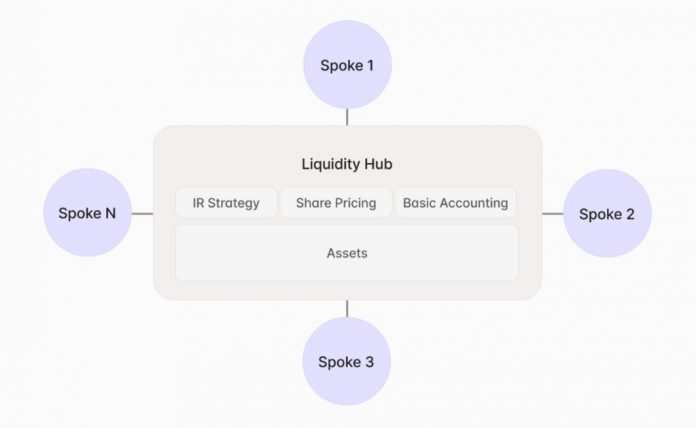

Hub-and-Spoke structure. This may enhance liquidity and scale back gasoline charges by round 30%. The Liquidity Hub works behind the scenes. We, as customers, don’t work together with it immediately. Whenever you provide an asset to V4, it’s saved within the Liquidity Hub. Nonetheless, you work together with numerous Spokes. These will probably be your entry level to the protocol. Test the V4 roadmap right here.

In our final weblog submit, we launched V4’s Hub and Spoke structure.

Completely different Spokes can implement their very own Threat Premium configurations for specialised danger administration.

This permits every Spoke to optimize for its particular use case with out sacrificing liquidity.

— Aave (@aave) July 24, 2025

The Spokes connect with the Liquidity Hubs. Whenever you provide or borrow, it is going to be by a Spoke. Every Spoke has totally different guidelines and danger settings. So, the Spokes deal with all of the interactions and supply numerous settings. For instance, they handle,

- Consumer positions

- Observe collateral

- Combine with worth oracles

- They usually additionally embody security controls. It could actually pause operations if wanted.

Supply: Aave weblog

There’s additionally a Reinvestment Module. This optimizes idle liquidity, which leads to greater LP returns. Moreover, there’s additionally a quicker and safer liquidation engine.

Aave additionally entered the realm of RWA with its Horizon RWA market. This market connects institutional tokenized property with DeFi on Ethereum. It’s an institutional-grade compliance framework that permits overcollateralized lending in opposition to RWAs.

The Horizon RWA market by Aave Labs is reside. pic.twitter.com/veUi9quMxs

— Aave (@aave) August 27, 2025

So, altogether, this could strengthen Aave’s place because the chief in DeFi lending.

Technical Evaluation

Earlier than we will see the place AAVE can go, we have to know the place it has been. So, I begin with the present $AAVE worth of $304. It has a market cap of $4.6 billion, and all tokens flow into, in order that’s wonderful. Its ATH is $661.69, from Might 2021. So, effectively over 4 years in the past. Its present worth is 54% under that ATH.

Over the past 12 months, AAVE is up by 121%. For a protocol of this measurement, that spectacular. It reveals, amongst others, that DeFi continues to be a preferred alternative for traders.

Supply: TradingView

AAVE not too long ago examined a crucial assist stage round $249. After that, we noticed a robust urge to $357 in August. The RSI is at 63, which is sweet. It reveals optimistic momentum with out being within the overbought zone. The image under reveals the RSi.

Supply: Geckoterminal

Present resistance ranges are round $330, $340. Breaking by these could open the best way to $357. As soon as this resistance stage breaks, it might transfer to $370. For this 12 months, which may be the max vary. Nonetheless, it’s seemingly that the bull run continues into 2026, and we could even see extra upwards motion.

How Many AAVE to Grow to be a Millionaire?

So, right here’s the half that you’ve been ready for. How a lot AAVE does it take to change into a millionaire? We noticed already that with Aave, you will have a DeFi big. Moreover, some thrilling updates are about to hit the streets, with its V4.

So, it’s time to start out the nitty-gritty and get the calculator out. I begin, after all, with the present worth. At $304 you want 3289.5 AAVE to change into a millionaire.

On the $330 assist, you will have 3030 AAVE.

Now, let’s transfer to the August prime of $357. Now, 2801 AAVE will make you a millionaire.

I stated earlier that $370 might be the highest for AAVE in 2025. Which means that you want 2702.7 AAVE to get the millionaire tag.

So, if the bull run continues in 2026, how concerning the following costs for AAVE?

- $400 wants 2500 AAVE.

- $500 wants 2000 AAVE.

- $600 requires 1667 AAVE

- $661, its ATH 1513 AAVE

- After this, it’s worth discovery. Let’s go loopy and take a look at $700, this wants 1428.5 AAVE.

- And $800 wants 1250 AAVE.

Do you suppose that AAVE can go greater than $800 on this bull cycle? If that’s the case, let me know within the feedback what your prime for AAVE is. Additionally, do be a part of our social media channels on X and Discord and be a part of our discussions.

Disclaimer

The data mentioned by Altcoin Buzz will not be monetary recommendation. That is for instructional, leisure and informational functions solely. Any info or methods are ideas and opinions related to accepted ranges of danger tolerance of the author/reviewers, and their danger tolerance could also be totally different from yours.

We’re not chargeable for any losses that you could be incur on account of any investments immediately or not directly associated to the data supplied. Bitcoin and different cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.

The submit How Many AAVE to Grow to be a Crypto Millionaire? appeared first on Altcoin Buzz.