One of the vital annoying eventualities in Foreign currency trading is when a commerce appears to be going into revenue, then immediately reverses, knocks out your stop-loss, and instantly begins shifting in the wrong way… proper the place you’ll have preferred to enter.

This isn’t a mistake. This isn’t a failure. That is intentional motion — so-called cease searching, or “looking for stop-losses.”

What’s cease searching and who’s behind it?

Cease searching is value manipulation by massive gamers (institutional merchants, banks, hedge funds) geared toward artificially forcing out a mass of small positions, fixing their losses. After that, the worth reverses within the path that was initially the aim of the big members.

These “traps” are most frequently arrange:

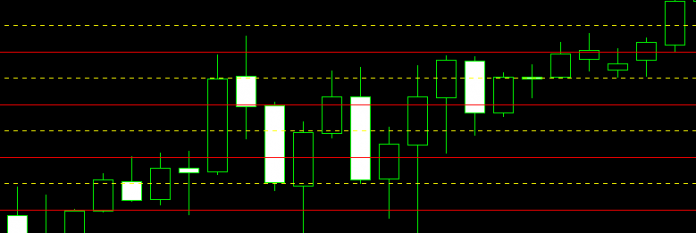

- Close to key help/resistance ranges — particularly if there are a lot of stop-losses accrued there.

- At native highs/lows — after a powerful motion, when merchants are assured within the continuation of the development.

- Close to rounded value ranges (1.1000, 1.2500, and many others.) — the place institutional algorithms know that stops are positioned en masse.

What number of occasions have you ever been knocked out by a stop-loss?

These ranges do not work. They work for the dealer!

Massive gamers do not commerce “blindly.” They know the place the stops of small merchants are — because of knowledge from liquidity aggregators, volumes, and place experiences. And so they use this as a device for entry.

Why do common stop-losses work towards you?

Many learners place stop-loss too shut — “to not lose a lot.” However in a unstable market, particularly on M5–M30 timeframes, the worth continuously “noises” — breaks by native lows and highs to shake out the indecisive.

If you happen to place a cease 10 factors beneath the help stage — you threat being “knocked out” even with a traditional corrective motion.

And in case you use mounted percentages of the deposit — you do not account for the market construction, solely your psychology.

The right way to shield your self? 4 confirmed rules — with classes from Larry Williams

Place stop-loss past a big stage, not by distance

Not “15 factors,” however past the final bar with excessive quantity, past the final native low (for lengthy) or excessive (for brief). This makes your cease logical, not arbitrary.

As Larry Williams wrote: “The market isn’t random — it’s cyclical.” His %R indicator reveals extremes, however he does not commerce on them immediately. He waits for affirmation — the closing of a bar past the extent. The identical goes for the cease: it must be past an actual flip, not past random noise.

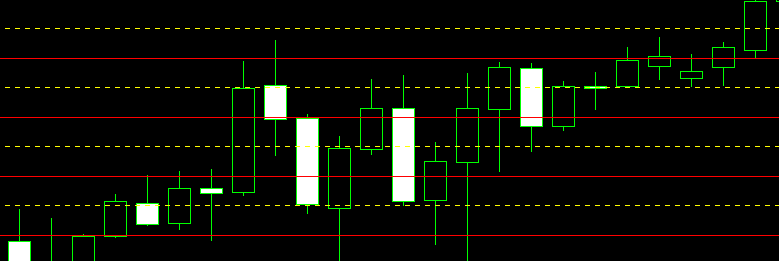

Use large stops on small timeframes

On M5 and M15, the worth can simply “bounce” by 20–50 factors. Place stops at 30–70 factors — this isn’t “extra threat,” however a sensible recognition of volatility.

Williams did not commerce on M1. He mentioned: “Commerce on timeframes the place the market breathes, not wheezes.” His suggestions — M5–H1 — will not be unintentional. On these timeframes, stops work as a result of the market has already handed by “noise filters.”

Keep away from buying and selling in “noisy” hours

Particularly earlier than information, originally and finish of the buying and selling session (for instance, 08:00–09:00 and 16:00–17:00 MSK). Throughout these intervals, liquidity is low — and looking for stops turns into simpler.

This straight echoes what I described within the Sign Histogram indicator: a time filter. Not all hours are equally helpful. If you happen to commerce at occasions when the market “sleeps” or “twitches” — you your self invite the cease hunters.

Commerce on affirmation, not on forecast

Do not enter a commerce as a result of “it looks like the worth will fall.” Enter when the worth has closed past the extent, and the sign histogram (for instance, Sign Histogram) has confirmed a development change.

Larry Williams did not consider in “predictions.” He mentioned: “Do not attempt to be proper — attempt to be wealthy.” His %R does not give an entry sign. It reveals the place the market is overheated. And entry — solely after affirmation by closing. That is the philosophy of survival. Not playing.

Psychology: “I used to be proper!” — and why that is your lure

Probably the most harmful phantasm is considering that “I used to be proper, they only knocked me out.”

However in buying and selling, the right entry isn’t the one which finally turned out to be right. It is the one which matches your system earlier than entry.

If you happen to enter with out understanding the place others’ stops are and with out contemplating the market construction — you are not a dealer. You are a goal.

Larry Williams mentioned: “You do not have to be proper — you need to be wealthy.”

He did not commerce “on hope.” He traded by guidelines. And stop-loss for him isn’t “concern,” however a survival device.

Conclusion: Cease-loss isn’t about loss, however about self-discipline

Cease searching isn’t a verdict. It is a pure a part of the market. Like noise on the chart. Like false breakouts.

Your process is to not keep away from these actions, however to not fall into their kill zone.

Use ranges, not distances.

Commerce in quiet hours.

Affirm alerts.

And keep in mind: essentially the most dependable stop-loss isn’t the one closest to the worth, however the one in the proper place.

And in case you’ve examine Larry Williams — you perceive that true revenue is born not in the mean time of entry, however in the mean time whenever you determine to not enter.

Do not attempt to “guess” the market.

Construct a system that does not rely on what it should do.