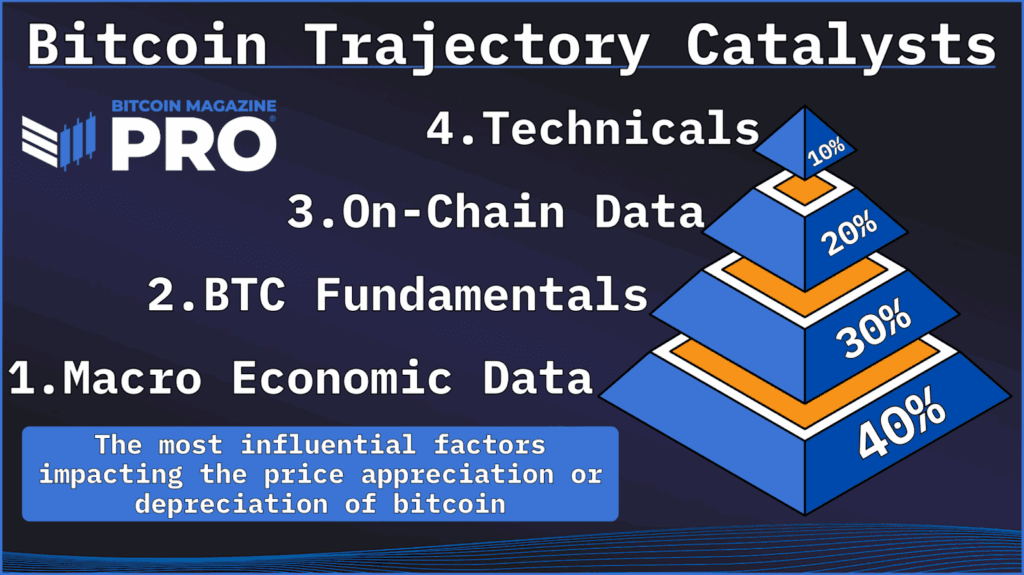

On this week’s evaluation, we discover what occurs when each important Bitcoin information level — from on-chain exercise to macroeconomic liquidity — is merged into one unified mannequin designed to refine bitcoin value prediction. That is the Bitcoin The whole lot Indicator, constructed to seize each key driver of BTC value motion in a single, dynamic framework. However as Bitcoin evolves, and as establishments and international markets reshape its conduct, we’ll additionally take a look at how adapting this mannequin to altering situations could make it much more highly effective.

A Complete Bitcoin Value Mannequin

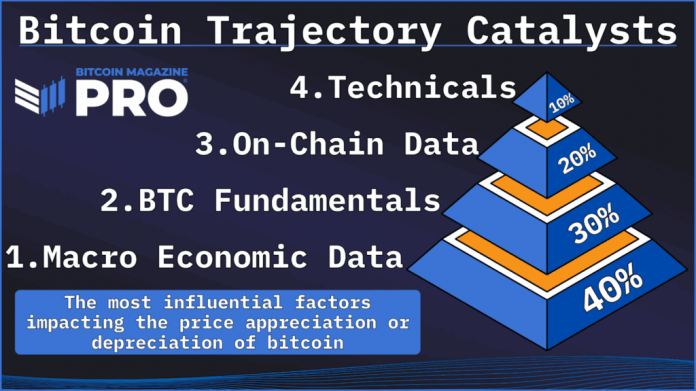

Over time, analysts have created numerous “all-in-one” indicators to measure Bitcoin’s valuation throughout its cycles. Nonetheless, most of them rely too closely on a single information sort — comparable to on-chain exercise, miner profitability, or technical charting patterns — typically ignoring the macroeconomic shifts that now play a vital position in bitcoin value motion.

Our objective was to take a broader strategy by combining all main drivers of Bitcoin’s worth, together with international liquidity, miner expectations, on-chain metrics just like the MVRV Z-Rating and SOPR, community utilization information, and technical alerts such because the Crosby Ratio.

How the The whole lot Indicator Tracks Bitcoin Value Cycles

This confluence of macro, on-chain, and technical information varieties the spine of the Bitcoin The whole lot Indicator, giving a multi-dimensional view of when BTC is traditionally overheated or undervalued. Traditionally, this mannequin has aligned remarkably effectively with bitcoin value cycles, highlighting long-term accumulation and distribution phases.

Evolving Fashions for Correct Bitcoin Value Evaluation

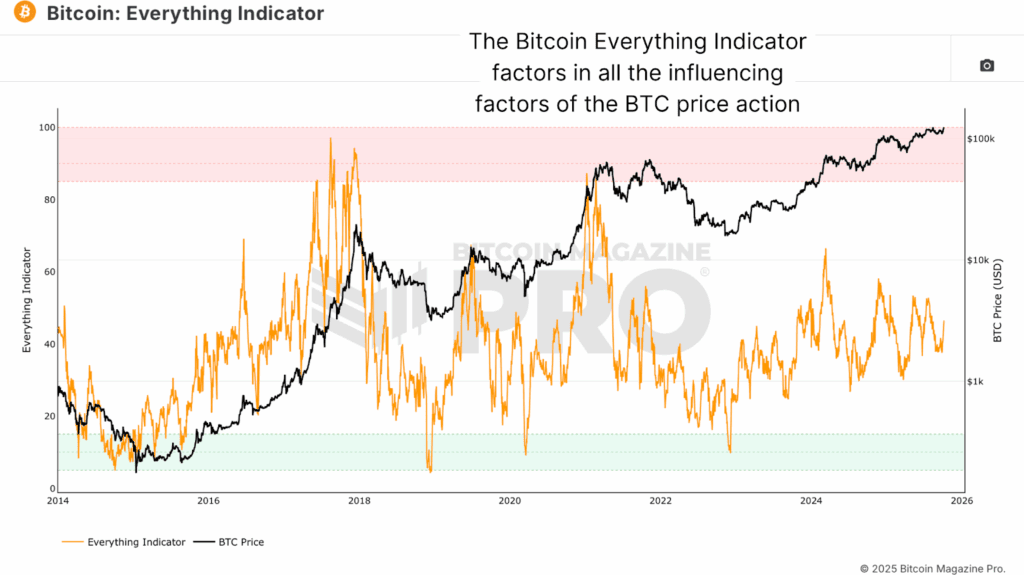

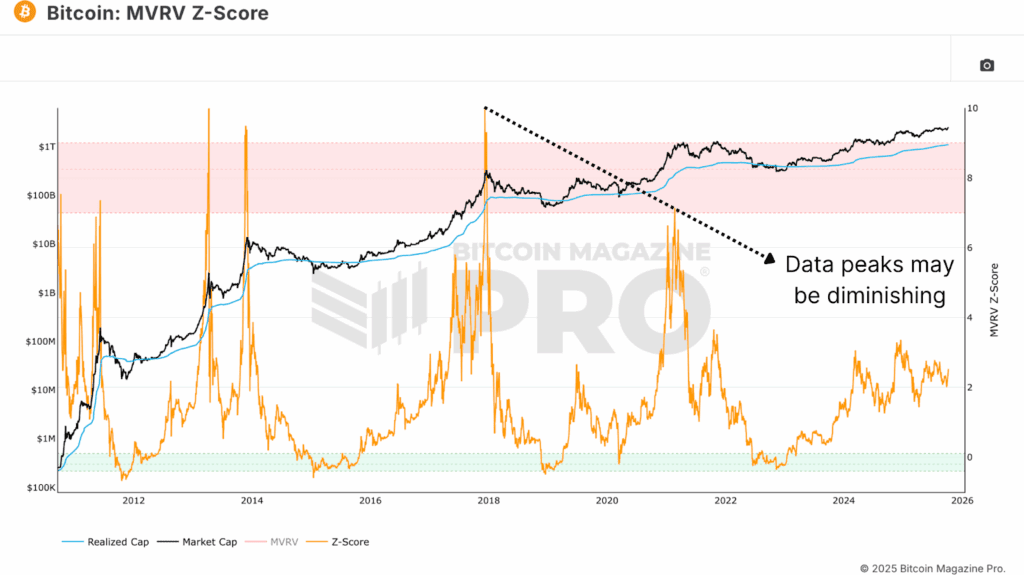

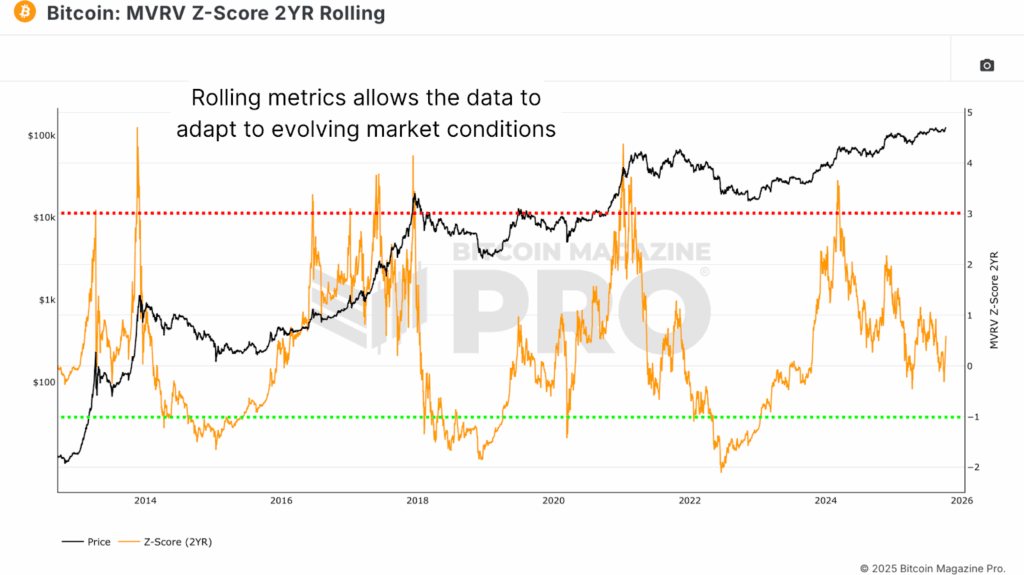

Bitcoin as an asset is consistently evolving, and so should our fashions for correct bitcoin value evaluation. For example, whereas the MVRV Z-Rating has traditionally signaled main tops and bottoms, its peaks have grow to be much less excessive over time as volatility declines and institutional participation will increase.

To adapt, we launched the 2-Yr Rolling MVRV Z-Rating, which makes use of a rolling information window to raised mirror present market dynamics. This strategy reduces lag and normalizes long-term shifts in volatility, serving to enhance bitcoin value forecasting in a maturing market.

The two-Yr Rolling Bitcoin Value Indicator

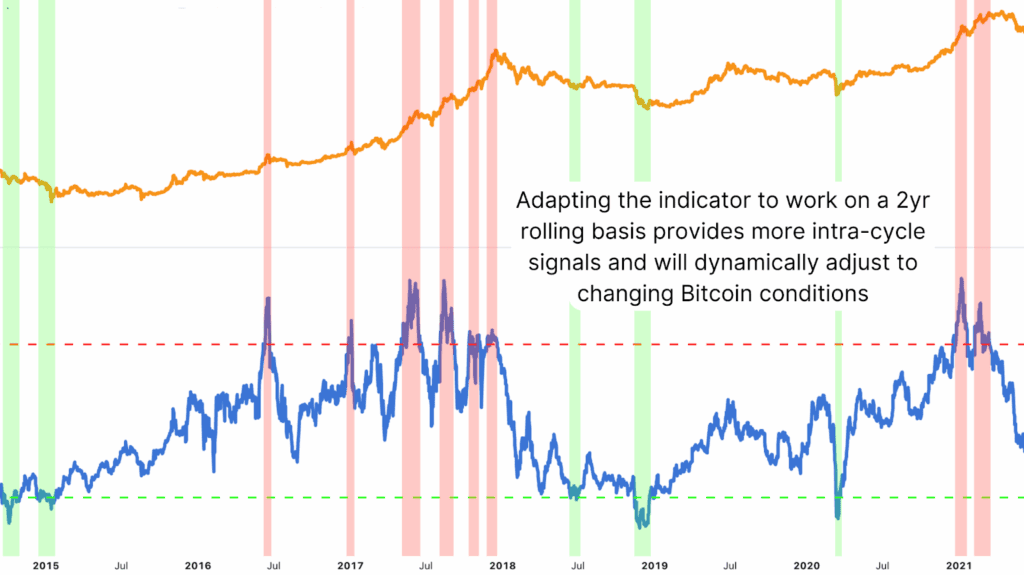

By making use of a 2-year rolling methodology, the The whole lot Indicator removes backward bias and captures real-time momentum in liquidity and on-chain information. This adaptive design helps preserve sensitivity to bitcoin value inflection factors whereas filtering out short-term noise.

The underside 5% zones have traditionally marked prime accumulation phases, whereas the highest 5% zones recognized overheated situations previous main retracements. Within the present cycle, Bitcoin stays beneath that overheated threshold — implying bitcoin value upside potential stays sturdy.

Conclusion: A Dynamic Future for Bitcoin Value Prediction

Bitcoin is now not the purely retail-driven, high-volatility asset it as soon as was. With institutional accumulation, ETF inflows, and even sovereign-level holdings now shaping provide dynamics, the historic amplitude of Bitcoin’s cycles has compressed. This implies conventional fashions, constructed for the period of retail dominance, could also be changing into much less correct.

The Bitcoin The whole lot Indicator supplies one of the vital full photos of Bitcoin’s valuation and cyclical positioning by combining macro, on-chain, and technical components right into a single composite mannequin. By dynamically adapting to new information and recalibrating throughout rolling time frames, this enhanced model of the The whole lot Indicator stays extremely correct in figuring out each cyclical tops and bottoms. At current, the mannequin means that Bitcoin nonetheless has important room to the upside earlier than approaching overheated situations.

For a extra in-depth look into this matter, watch our most up-to-date YouTube video right here: This May Be The Solely Bitcoin Chart You Ever Want

For deeper information, charts, {and professional} insights into bitcoin value tendencies, go to BitcoinMagazinePro.com. Subscribe to Bitcoin Journal Professional on YouTube for extra professional market insights and evaluation!

Disclaimer: This text is for informational functions solely and shouldn’t be thought of monetary recommendation. All the time do your personal analysis earlier than making any funding choices.