Financial institution of America states the U.S. economic system is headed for instability as Donald Trump enters workplace, regardless of the robust employment and retail gross sales information being disseminated. This has introduced renewed give attention to the way forward for the crypto market. Will it thrive?

In accordance with reviews by Jinshi, Financial institution of America mentioned on Jan. 20. that employment information, retail gross sales, and core inflation are holding robust, with core inflation at 3.2%. Nevertheless, this quantity for inflation is above the mark, which suggests the Fed has no room to chop charges any additional.

In December 2024, the Fed reduce charges by 25 foundation factors, following a 25 foundation level reduce in November and a 50 foundation level discount in September. Fed Chair Jerome Powell acknowledged in December assembly that no additional price cuts will happen except financial information improves.

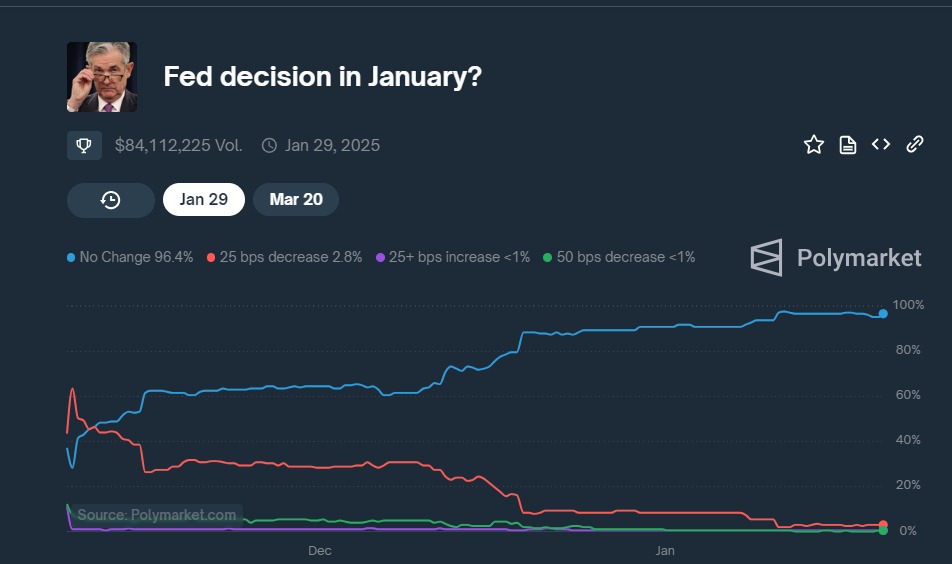

The sentiment in opposition to further price cuts is additional mirrored in Polymarket votes, the place over 96% of bettors consider there can be no price reduce in January.

Now, Financial institution of America believes that with the oncoming presidency and, with it, the Trump 2.0 insurance policies, there could also be excessive safety and monetary uncertainty, and it may have an effect on financial managers in a different way.

Trump’s Protectionist insurance policies

Protectionist insurance policies are authorities actions, i.e., tariffs or taxes on imports and commerce restrictions, undertaken to guard native industries from overseas rivals.

Throughout Donald Trump’s first time period, these had fairly an influence on the inventory market. For example, tariffs on Chinese language items and metal helped U.S. producers with decreased competitors. Nonetheless, they raised prices for corporations that relied on imports, like carmakers and high-tech corporations, as reported by the Tax Basis in Might 2024. Such constantly affected market ups and downs, particularly through the commerce struggle with China.

Reuters additional reported that the identical now may return through Trump’s reemergence with a 60% tariff on Chinese language merchandise, affecting the economic system; it will elevate costs and supply uncertainty to buyers within the world market.

What’s in for the crypto market?

The course of crypto’s future will largely rely upon the interaction between Trump’s insurance policies and Fed’s selections. Whereas protectionist insurance policies usually exert their results on conventional monetary markets by inflation, provide chain disruptions, and investor sentiment, they’ll have a spillover impact on crypto markets.

Protectionist measures normally elevate the prices of products and providers, that are usually handed on to customers by corporations.

For instance, ought to inflation stay elevated, Bitcoin (BTC), usually seen as an inflation hedge, is more likely to proceed gaining traction, particularly because the president has been closely supportive on Bitcoin Reserve. Additional, if the Fed doesn’t reduce charges to curb inflation, crypto would possibly acquire recognition as a retailer of worth.

Whereas many analysts are optimistic a few Bitcoin Reserve within the making, some inside the crypto market are additionally voting in opposition to it. As of Jan. 20, Polymarket voters are solely 57% assured {that a} Bitcoin Reserve can be created inside the subsequent 100 days.

Furthermore, Trump’s crypto-friendly insurance policies may pave the best way for institutional adoption of cryptocurrencies by supporting pro-crypto legal guidelines, doubtlessly curbing litigation in opposition to crypto exchanges that the SEC had imposed beneath the Biden authorities.

All in all, whereas the protectionist insurance policies may hike costs for some imports of tech items, slowing the event of blockchain, Trump’s pro-crypto stance would offset a few of this by its promotion of the expansion of the sector.