In the event you’ve been studying to commerce for some time, I’m certain you’ve come throughout the time period ‘overtrading’.

What does it imply precisely?

Nicely, unsurprisingly, overtrading means being extreme!

However how are you going to detect once you’re overtrading?

And what about under-trading?

In actuality, the explanations behind each are quite a few and very frequent to all merchants.

So, is there something you are able to do about it?

Fortunately, these are exactly the matters I’m going to cowl for you in at the moment’s information!

I’ll share some essential, sensible tips about recognising once you’re overtrading…

…and present you how one can enhance your buying and selling plan that will help you eradicate it altogether!

Particularly, you’ll study:

- What precisely overtrading is, and the beginning resolution to stop it

- How having a market choice places you ready to revenue extra and overtrade much less

- A threat administration method that retains losses from overtrading to a minimal to be able to get again within the sport as quickly as attainable

Sound good?

Then let’s get began…

What Is Overtrading and How You Can Keep away from It

Overtrading happens once you enter extra trades than you’ll be able to moderately deal with.

Now, a typical scenario the place overtrading can happen is once you begin “revenge buying and selling”.

Everybody’s been there…

You expertise a few losses, lose composure, and begin going berserk on the markets…

Earlier than you recognize it, you enter trades totally outdoors your buying and selling technique!

Nicely, that is only one of many conditions the place overtrading can happen.

To place it merely, overtrading is commonly a mixture or a mix of the next:

- Not having a well-defined technique

- Buying and selling at random occasions of the day

- Hopping from one timeframe to a different

- Revenge buying and selling

So, in abstract…

Overtrading largely stems from not realizing what you’re doing!

In different phrases, it happens once you deal with buying and selling as a sport or playing as an alternative of a enterprise.

At this level, the beginning of the answer ought to be clear by now:

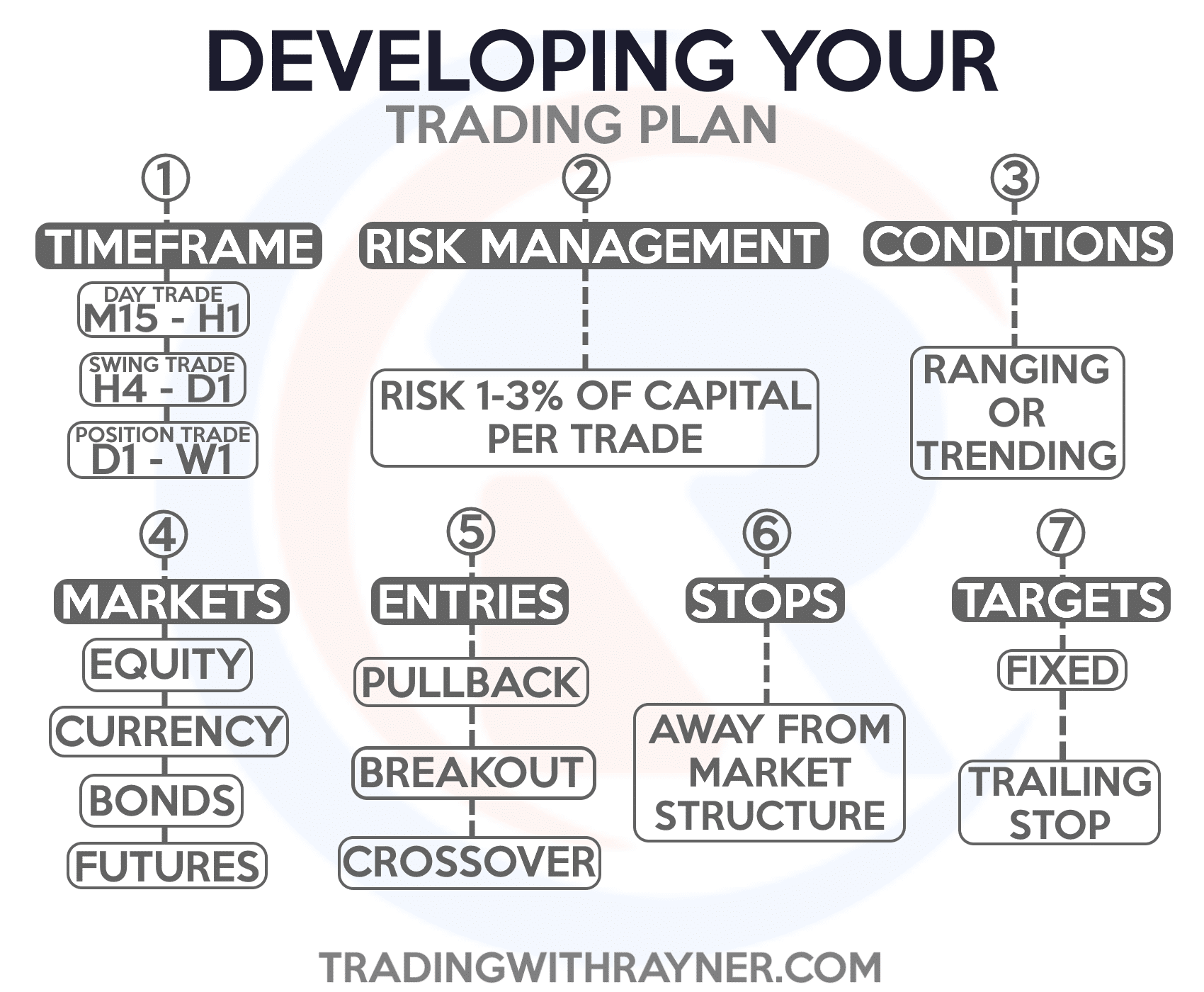

Develop a well-defined buying and selling plan

I do know it’s simpler stated than executed, as there are various methods to commerce the markets.

However retaining this template in thoughts will at all times put you forward…

In fact, there are various methods to strategy the markets, so the kind of buying and selling plans will fluctuate from one dealer to a different.

You’ll be able to even try an in-depth information on some examples right here.

Mainly, sustaining a well-established buying and selling plan will assist you remedy 50% of the signs that trigger overtrading.

So now it’s possible you’ll ask…

“What’s the opposite 50% to assist stop overtrading?”

Easy…

Develop a well-defined buying and selling routine.

This half is simply as necessary as growing a buying and selling plan.

Why?

It separates merchants into those that deal with buying and selling as playing and those that deal with it as a enterprise!

Having a well-defined buying and selling routine helps you perceive the precise time to commerce.

Say you’re somebody who trades off the next timeframe, such because the day by day timeframe…

…properly, you solely have to examine the charts as soon as a day at a particular time.

However should you’re somebody who trades a decrease timeframe, such because the 15-minute timeframe or much less…

…how usually do you assume it’s finest to examine the charts?

Surprisingly… the worst factor you are able to do is to commerce all day!

That’s proper!

Simply since you scalp the markets doesn’t imply it’s best to commerce on a regular basis.

(The important thing in your case is to solely commerce when there’s liquidity.)

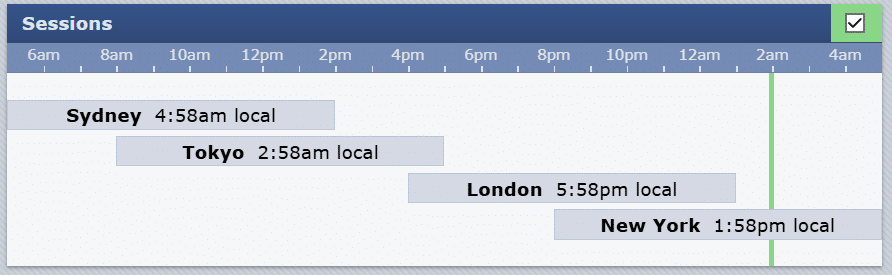

One good instance is barely buying and selling the London-New York session overlap…

Supply: Foreign exchange Manufacturing unit

Which means if I commerce the decrease timeframes, I solely commerce between 8 pm and 1 am (at the least in my time zone)

And also you is likely to be questioning…

“Why this particular session?”

“Why not Sydney and Tokyo overlap?”

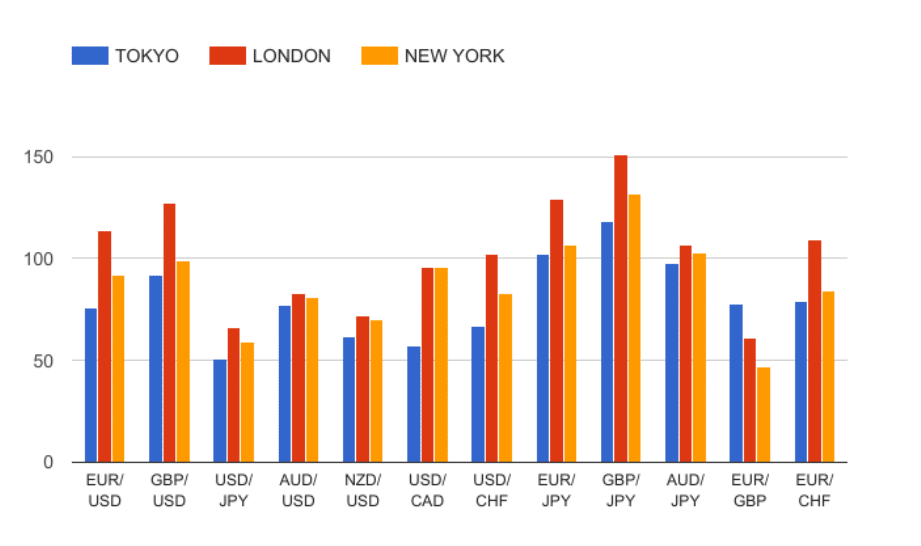

Nicely, it’s the volatility, as you’ll be able to see under…

Supply: Babypips

The market strikes probably the most through the London and New York session.

Take GBPJPY, for instance, which had a large-pip motion of round 150 pips through the London session!

To sum this half up, right here’s a cheat sheet you’ll be able to confer with relying on what timeframe you commerce:

- Each day timeframe = Examine as soon as a day at a constant time

- 1-hour to 4-hour timeframe = Examine as soon as each 4 hours

- 30-minute timeframe and under = Actively commerce solely throughout high-volatile market periods

Keep in mind, the decrease the timeframe you select to commerce, the extra necessary market choice will probably be.

Understanding when and when to not commerce places your head on an goal degree, and this can assist you keep away from overtrading within the markets.

Now, let’s go deeper, we could?

As a result of despite the fact that I’ve shared some broad ideas with you, the query stays…

“How precisely are you able to inform once you’re overtrading?”

Let me provide you with extra context within the subsequent part…

Market Choice Strategies That Nearly Get rid of Overtrading

Right here’s the factor…

Shifting the definition of overtrading to solely having too many open trades can exclude a number of edge circumstances.

I imply, there are buying and selling strategies the place having 20 open trades at a time might be helpful!

Then again, there are some buying and selling strategies with a most open commerce rely of 5 and even much less…

So, what are these buying and selling methodologies, it’s possible you’ll ask?

They’re proper right here:

- Pattern Following (H4 – D1)

- Intraday Buying and selling (M5 – M30)

There are extra buying and selling strategies on the market, however for now, let’s discover these two in additional depth…

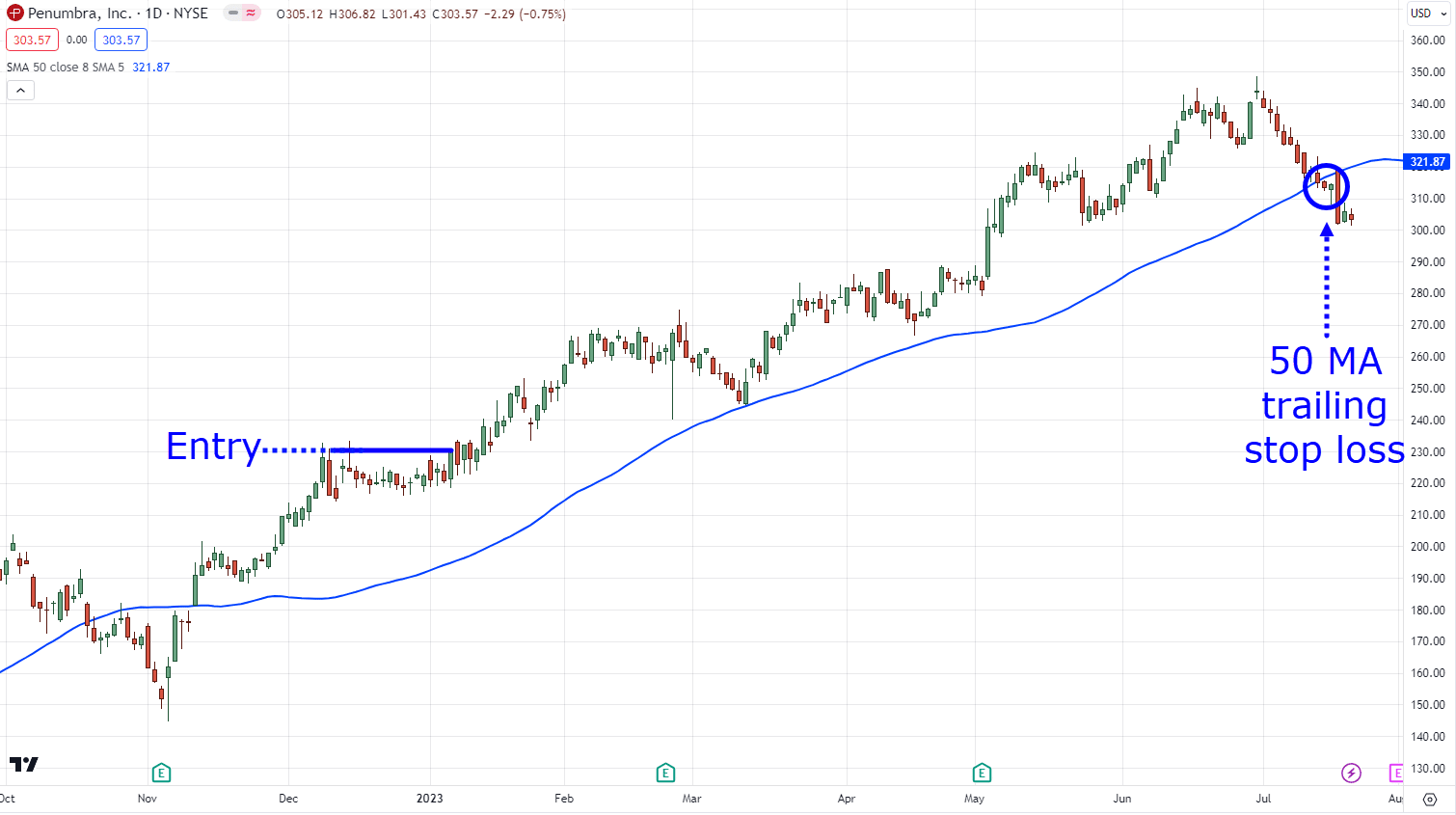

Pattern Following (H4 – D1)

At this level, it’s possible you’ll already be conversant in development following, the place you attempt to seize the development so long as you’ll be able to…

And as you’ll be able to see, if the development goes in your favor, your commerce can final for months!

(even on only one commerce!)

But, limiting your max open trades to round 3 or 5 will bottleneck your portfolio.

Since following a development can probably final for weeks and even months, extra diversification is smart for this buying and selling methodology.

In reality, it may probably imply 10-20 open trades at a time!

As a development follower, which means that it pays so that you can not solely take a look at the Foreign exchange markets…

…but additionally look into commodities, indices, agriculture, and bonds.

This provides you with entry to a big selection of uncorrelated markets to commerce.

Then again, what about intraday buying and selling?

Intraday Buying and selling (M5 – M30)

With this buying and selling methodology, you have to be an energetic market sniper.

What do I imply?

Market choice

The extra energetic your buying and selling portfolio is on the foreign exchange market, the extra necessary it’s so that you can choose your markets rigorously.

However… the place do you even start, proper?

How do you choose markets to commerce?

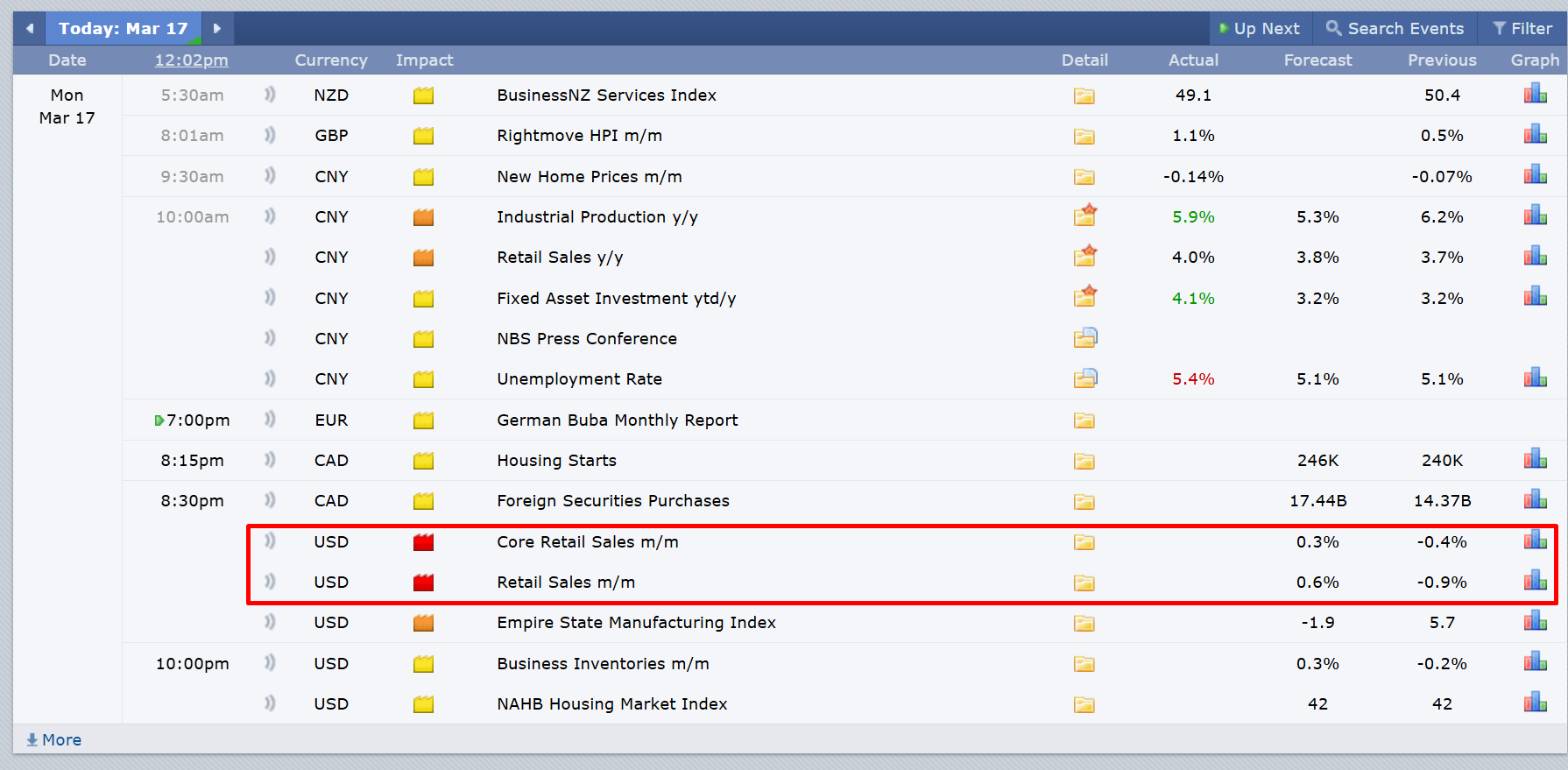

Nicely, it may be a mix of a few instruments, however one methodology that I usually use is to commerce after high-impact information…

I’m certain you’ve heard a few occasions that it’s best to attempt to “keep away from” buying and selling high-impact information.

In a method, that’s true!

You don’t wish to gamble which method the information will go and commerce earlier than the information launch…

…the bottom line is to commerce the “response” to that information.

Do you get me?

When the information comes out, you don’t wish to be within the commerce.

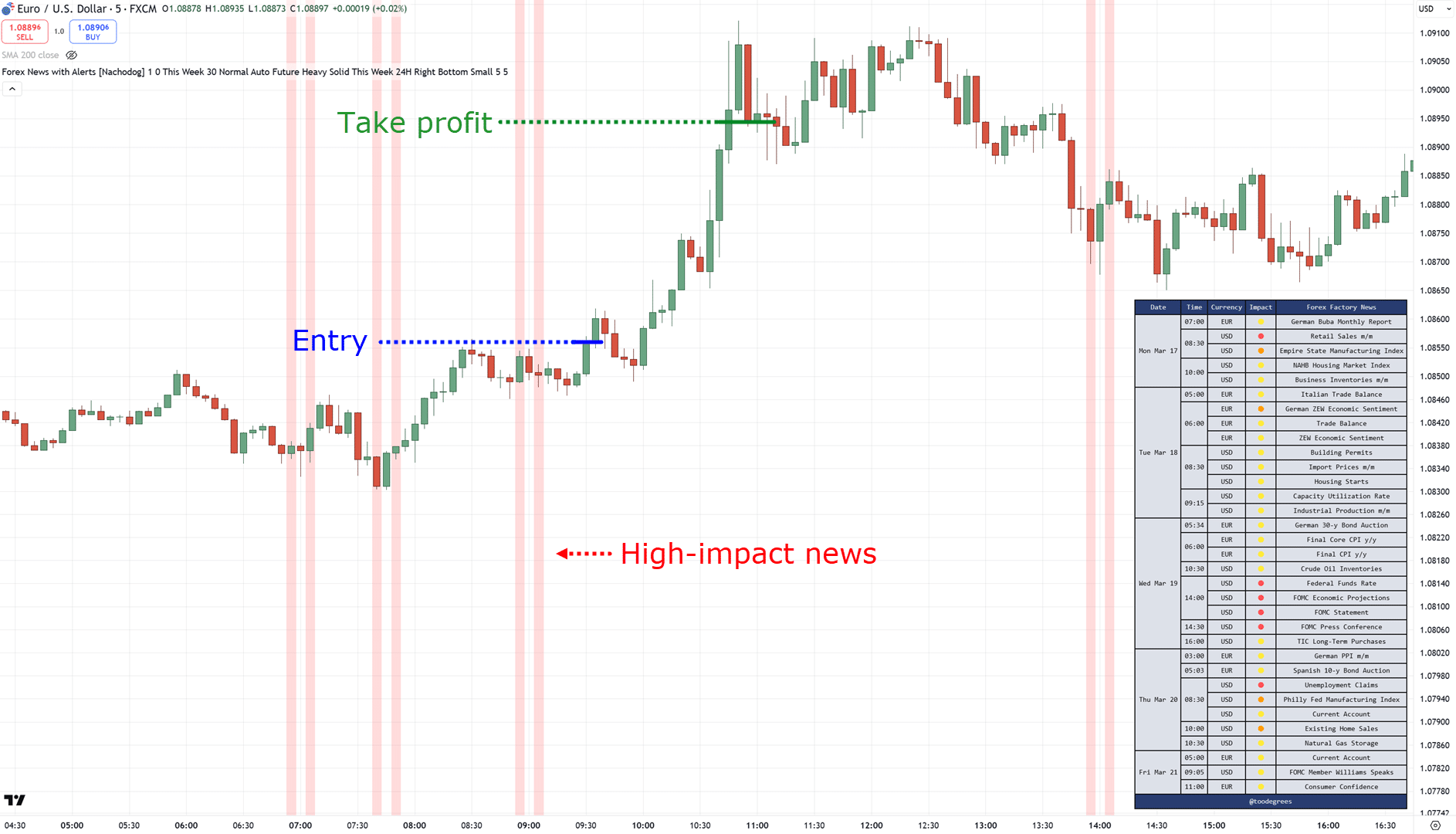

Right here’s an instance of EURUSD within the 5-minute timeframe…

As you’ll be able to see, you’d solely wish to reap the benefits of the setup after the information.

It’s all about ready for the response.

In fact, there are occasions when the market barely budges on information releases, however it’s value keeping track of nonetheless.

P.S. Credit to Nachodog’s Foreign exchange Information with Alerts indicator on TradingView

Total, the precept is that this…

- The decrease the frequency of your commerce, the extra open trades it’s essential to have (diversification)

- The upper the frequency of your commerce, the less open trades it’s essential to have (focus)

Make sense?

Nice!

Understanding when to commerce and what number of open trades it’s best to have…

…will go an extended technique to eliminating the possibilities of you overtrading the market.

Simply bear in mind the reasoning behind your market choice.

Nonetheless, errors are at all times going to get made.

Each you and I are people – and it’s in our nature!

So what if, regardless of all this, you continue to end up overtrading?

When your feelings run excessive, and also you get up in the midst of revenge buying and selling?

By making use of what you’ve discovered thus far, the possibilities of this taking place are decrease…

…however how are you going to cut back the injury?

Let me share with you within the subsequent part…

A Danger Administration Method to Cut back The Harm of Overtrading

This part is crucial half: submitting to the “human issue” in buying and selling.

Actually, one of the best ways to take care of it’s to carry on the danger administration!

And no…

…not the danger administration you already know, limiting your self to 1% of your account per commerce…

As a substitute, I’m speaking concerning the emergency brake settings!

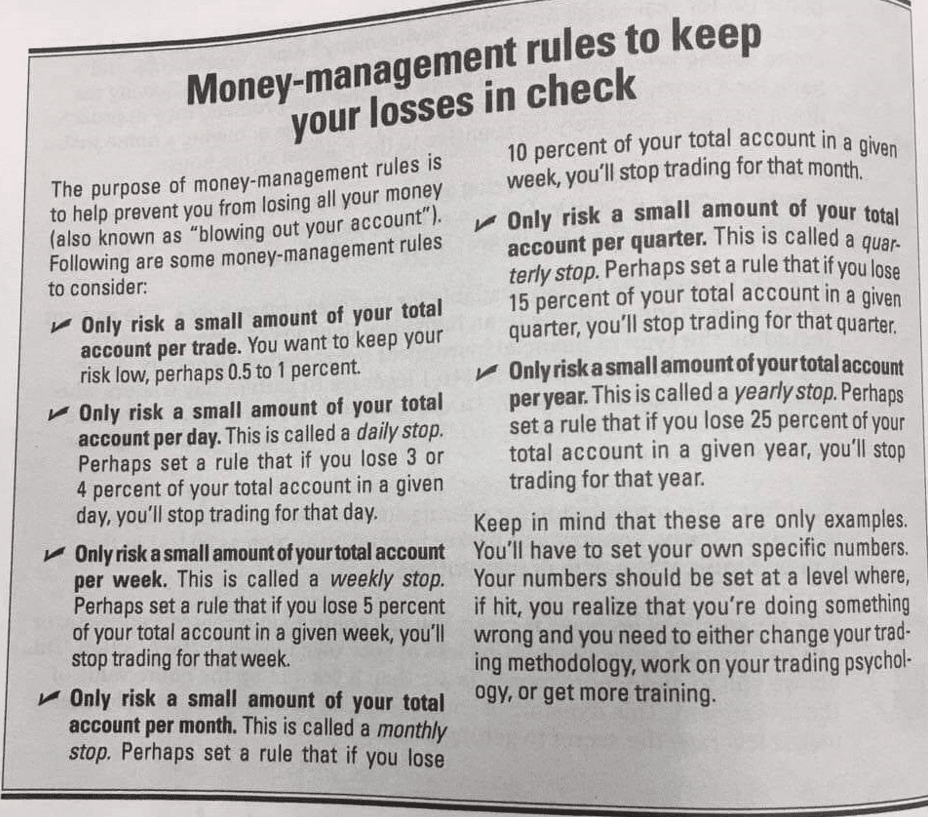

This cheatsheet is a hidden gem…

Supply: Dummy collection, Pattern Buying and selling

Nonetheless, you solely want to make use of one that’s most related to you.

For instance…

In the event you’re an intraday dealer, you then’d wish to add the next parameters:

- 5% Max threat per commerce (commerce cease)

- 5% Max threat per day (day by day cease)

- 10% Max threat per week (weekly cease)

Once more, this can be a worst-case state of affairs, and people values are solely a suggestion…

…you alone know what your persona is like!

However on this case, should you’ve hit that 5% loss for the day as an intraday dealer, cease buying and selling, re-assess your buying and selling journal, and return the following day.

In the event you threat 0.5% per commerce, then this provides you a ton of respiratory room, as it might take 10 shedding trades in a row earlier than you hit that 5%.

Then again, should you’re trend-following on the upper timeframe:

- 1% Max threat per commerce

- 10% Max threat per quarter (quarterly cease)

- 25% Max threat per 12 months (yearly cease)

As you’ll be able to see, a day by day or weekly cease is pointless as your commerce frequency is decrease.

That’s why having a quarterly or yearly cease makes extra sense.

Keep in mind, the premise of this part is the truth that there’s an opportunity that you simply would possibly nonetheless overtrade.

The secret’s to reduce that influence.

It offers you extra respiratory room and an opportunity to remain on this enterprise to hopefully enhance.

Sound good?

So, let’s have a fast recap of what you’ve discovered at the moment…

Conclusion

Overtrading can happen for a lot of completely different causes!

It is likely to be a scarcity of a buying and selling plan, all the way in which to poor buying and selling psychology or threat administration.

However what I would like you to remove from this buying and selling information is an effort to stability all three.

Create sound threat administration, contemplate your buying and selling psychology, and have a well-defined buying and selling plan.

Breaking it down, right here’s what you’ve discovered in at the moment’s information:

- Overtrading can occur once you don’t have a well-defined buying and selling plan or a correct buying and selling routine

- Making a market choice rule dependent in your buying and selling methodology helps decide when it’s best to and shouldn’t commerce, serving to to eradicate

- Having a related most threat cut-off helps cut back the injury of overtrading, making even a “worst-case state of affairs” less complicated to take care of within the total image.

Nicely, that’s just about it!

However now, I wish to hear your facet.

What are some overtrading tales that you’ve got?

Was it after experiencing 5 buying and selling losses in a row and deciding to throw your technique out of the window? (who hasn’t?)

Or was it extra of a big gamble into buying and selling high-impact information earlier than it was launched?

Let me know your story within the feedback under!