Cease loss placement is maybe not probably the most glamorous of buying and selling matters to debate, however it’s a critically essential one. If you happen to have no idea correctly place your cease losses you’ll be in for a really, very tough trip as you commerce the markets. Primarily, for a dealer, all the things hinges on correct cease loss placement and threat administration. If you happen to perceive these two features of buying and selling and method them correctly, making constant cash out there will turn out to be a lot, a lot simpler for you.

Cease loss placement is maybe not probably the most glamorous of buying and selling matters to debate, however it’s a critically essential one. If you happen to have no idea correctly place your cease losses you’ll be in for a really, very tough trip as you commerce the markets. Primarily, for a dealer, all the things hinges on correct cease loss placement and threat administration. If you happen to perceive these two features of buying and selling and method them correctly, making constant cash out there will turn out to be a lot, a lot simpler for you.

Observe: This lesson relies on increased time-frame charts and the ideas will not be relevant to very low time frames which is a special world of buying and selling and never one thing I do or suggest so I can’t touch upon it.

The idea behind inserting cease losses like a professional dealer

The very first thing to grasp and drill into your head about cease loss placement is that you must NEVER place a cease loss based mostly on some random quantity of pips. I do know plenty of merchants do that as a result of I get emails from merchants telling me they use “20 pip stops” or “50 pip stops”, and so forth. and so forth. That is NOT correct cease loss placement and it’s undoubtedly NOT how skilled merchants place their cease losses…

A cease loss ought to usually be based mostly on a stage out there. Value ought to must breach a stage to ‘show’ your commerce mistaken. You need to see value invalidate your view by providing you with fact-based proof you’re mistaken, that proof comes within the type of probably the most logical close by stage of assist or resistance being breached.

You could bear in mind the context of the market you’re buying and selling and decide what stage value must break by earlier than your unique view doesn’t make technical sense anymore. Let’s check out two examples to make this clearer…

The primary instance beneath reveals a random pip quantity cease loss placement, the second instance reveals a cease loss positioned throughout the context of the market and close by ranges. Make word of the tip outcomes of each trades…

Discover within the chart beneath the dealer positioned his cease loss at an arbitrary 50 pip distance from entry. Merchants usually do that as a result of they don’t perceive place stops correctly and in addition as a result of they need to commerce a much bigger place dimension. That is mistaken. You want a logic / chart-based motive to put a cease loss, not only a random pip distance or a pip distance that can help you commerce the dimensions you need. Discover this dealer would have been stopped out for a loss simply earlier than the market shot increased, with out them on board…

Within the subsequent chart, we are able to see how this commerce labored out for the dealer who knew place stops correctly / like a professional and who wasn’t inserting his cease arbitrarily or based mostly on greed (to commerce a much bigger dimension). Discover the cease loss was positioned past the key assist stage and past the pin bar low, giving the commerce good area to work out but in addition being positioned at some extent that might logically invalidate the commerce if value moved past it….

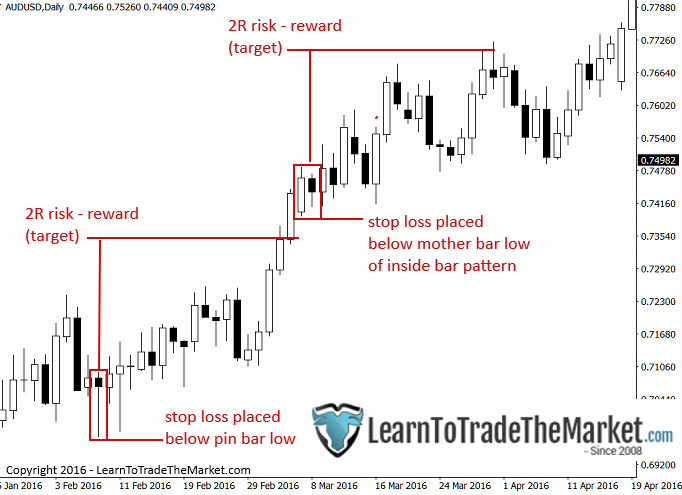

Let’s briefly go over typical cease loss placement on two value motion setups I educate; the pin bar sign and the inside bar sign. You’ll discover, I used a threat reward ratio of two to 1 on every commerce, that is my ‘default’ threat reward. In different phrases, I at all times begin any commerce by seeing if a 2 to 1 (or extra) threat reward is realistically attainable given the market construction and context the sample fashioned inside. For expanded examples, take a look at my lesson on place stops and targets like a professional.

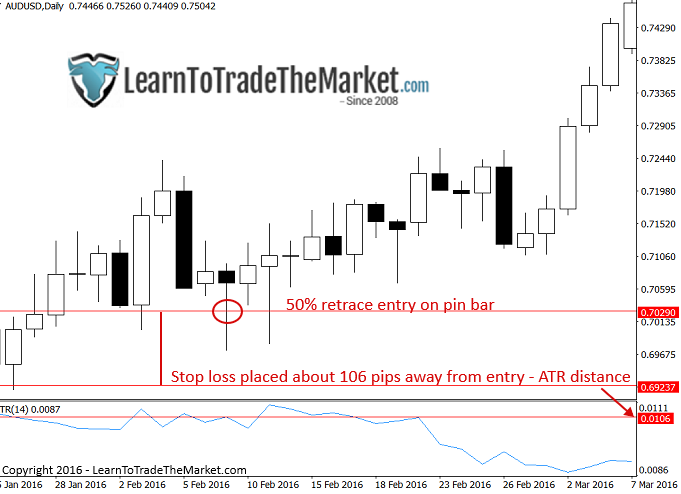

Observe: Pay attention to the typical volatility during the last 7 to 10 days of the market you’re buying and selling. You need your cease no less than half of ATR (common true vary) if no more or you’ll get stopped out because of noise.

The Common True Vary is a software we are able to use to see common market volatility over XYZ days. It’s a good software to make the most of for cease loss placement when no close by key ranges are current. To discover ways to apply and use the ATR software extra in-depth, take a look at my article on the common true vary.

The instance beneath reveals use the ATR for cease loss placement and the way it can maintain you in a commerce regardless of preliminary uneven circumstances after the sample…

Necessary cease loss placement ideas

It’s essential to think about reward or goal potential earlier than taking any commerce. You base the potential goal of a commerce on the cease loss distance. If the cease needs to be too large to ensure that the commerce to have sufficient area to probably work out, and the chance reward potential doesn’t stack up, then it’s normally not one of the best thought to take the commerce.

Danger reward and place sizing are intimately associated to cease loss placement clearly, and essential matters in their very own proper. However, we’re focusing right here on this lesson simply on stops, remember that stops are paramount and take priority over targets, in a manner, stops are a qualifier for the goal and total threat reward and can successfully make it easier to filter trades you must take and mustn’t.

You will need to word that stops ought to at all times stay fixed and might’t be widened, nevertheless targets will be widened, stops ought to solely ever be tightened and moved into break even and trailed, make it possible for’s concrete in your buying and selling plan.

Stops are essential to managing threat as a result of as soon as we discover the cease loss placement we are able to then decide our place dimension on the commerce after which we all know forward of time the price and dangers of the commerce. As a part of our buying and selling marketing strategy, stops are a value of doing enterprise as a dealer, they’re additionally there to power us to get out if we’re mistaken on a commerce, regardless of our emotional bias in the direction of staying in a commerce, which ultimately can price us dearly if we have been to hold onto a loser till we blew out our account steadiness.

Conclusion

A correctly positioned cease loss is really the start line of a profitable commerce. It permits us to proceed with calculating reward targets on trades and place dimension, successfully permitting us to execute our predetermined buying and selling edge with a transparent psychological state and self-discipline. Merchants who don’t give attention to cease loss placement first or put plenty of significance on doing it proper, are doomed to fail and blow out their accounts.

I hope at the moment’s lesson has given you a little bit ‘snapshot’ into how I method cease loss placement. My buying and selling course and members’ space will additional educate you on how I place cease losses and the way I incorporate cease loss placement into my total buying and selling technique. To study extra, click on right here.