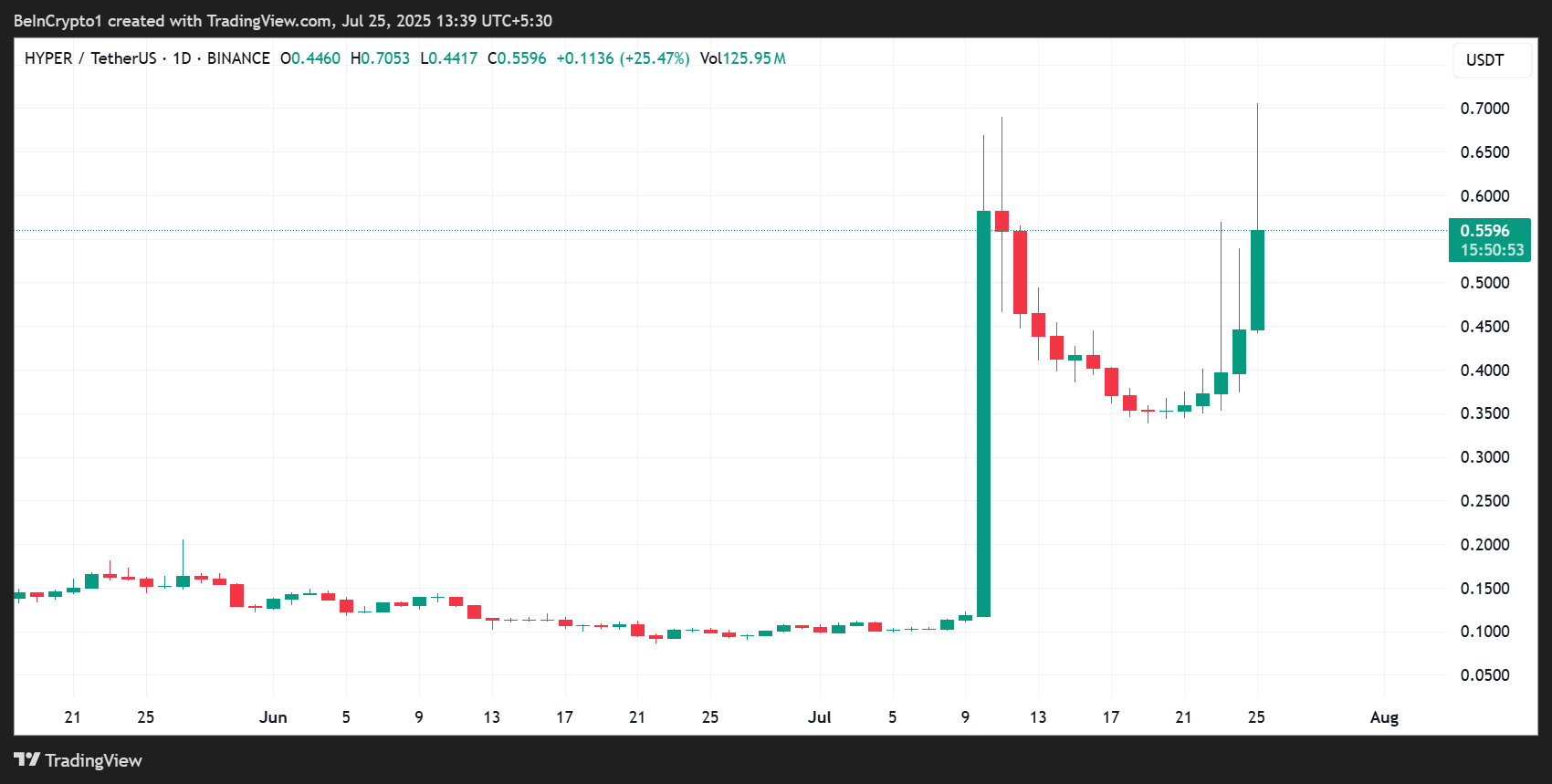

Crypto merchants and buyers responded to Hyperlane’s newest improve, with HYPER, the native token of the interoperability protocol, surging to new highs.

HYPER is among the many prime gainers immediately, posting double-digit positive aspects regardless of Bitcoin and high-liquidity altcoins dropping on Friday.

Hyperlane Unveils Warp Routes 2.0: What Customers Ought to Know

HYPER is up by 25% within the final 24 hours, buying and selling for $0.5596 as of this writing. It marks a modest pullback after Hyperlane’s native token ascended to hit a brand new all-time excessive (ATH) of $0.7053.

The rally follows the launch of Warp Routes 2.0, a robust new liquidity layer meant to simplify cross-chain bridging and rebalancing.

On the coronary heart of Warp Routes 2.0 (HWR 2.0) is native liquidity rebalancing. This mechanism permits decentralized functions (dApps) and blockchains to bridge property from a number of supply chains and routinely stability liquidity utilizing the on-chain protocol Everclear.

Warp Routes 2.0 solves a rising ache level, the operational headache of managing liquidity throughout a number of chains amid a fragmented blockchain area.

The launch eliminates the necessity to route property by means of a central “hub” chain or depend on wrapped tokens and custodial liquidity swimming pools when bridging property. This complexity created dangers, delays, and a poor person expertise (UX).

“… a person can deposit USDC on Base and withdraw it on Arbitrum, whereas the HWR 2.0 Rebalancer routinely strikes funds between chains to maintain issues flowing easily,” Hyperlane explained.

For builders, this improve removes the necessity for customized infrastructure. If a series already runs a Hyperlane deployment, it might instantly plug into HWR 2.0 and begin accepting liquidity from some other supported chain.

This eliminates the necessity to write new contracts, handle off-chain logic, or coordinate with centralized liquidity suppliers.

Hyperlane Worth Outlook Following HYPER ATH

Technical evaluation of the HYPER/USDT chart on the 4-hour timeframe signifies that whereas the altcoin appears to be like bullish, it stays in murky waters because the Hyperlane worth treads inside a provide zone between $0.5131 and $0.6130.

A provide zone is an space in crypto buying and selling the place promoting strain is powerful, probably exceeding purchaser momentum. Optimism abounds, nevertheless, because the HYPER worth nonetheless holds above the imply threshold or midline of the provision zone at $0.5604.

A decisive every day candlestick shut above the imply threshold on the four-hour timeframe may set the tone for HYPER worth to increase its positive aspects. Such a transfer may see it reclaim its all-time excessive above $0.7053, a transfer that will represent a 25% climb above present ranges.

Technical indicators align with the 50, 100, and 200-day Easy Transferring Averages, which give help at $0.3853, $0.3902, and $0.2455, respectively. The help confluence between the 50-day and 100-day SMAs (crimson and inexperienced, respectively) exhibits vital purchaser momentum ready if the worth drops to this degree.

Equally, the RSI (Relative Energy Index) is rising, displaying rising momentum. It’s characterised by increased highs and better lows.

Conversely, if promoting strain will increase and the HYPER worth closes under $0.5604 on the four-hour timeframe, the correction may lengthen. If the $0.5131 help fails to carry, late bulls may discover a potential entry at $0.4154.

Within the dire case, the place the confluence of the 50 and 100 SMAs fails to carry as help, HYPER worth may descend to $0.3407.

Disclaimer

In adherence to the Belief Undertaking pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nevertheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.