Hyperliquid token (HYPE) slipped for a fifth straight session Tuesday, falling about 6% intraday to the $45–$46 and at last rebounding barely at present.

HYPE has rather a lot going for it: low charges on each perps and spot. Additionally no KYC trigger it’s a dex

The transfer provides to per week of regular bleeding, however on-chain and technical indicators trace the selloff may very well be operating out of steam. Right here’s what’s subsequent for Hyperliquid:

Hyperliquid Token: Tight Vary Alerts Subsequent Transfer, Rounding Backside or Fakeout?

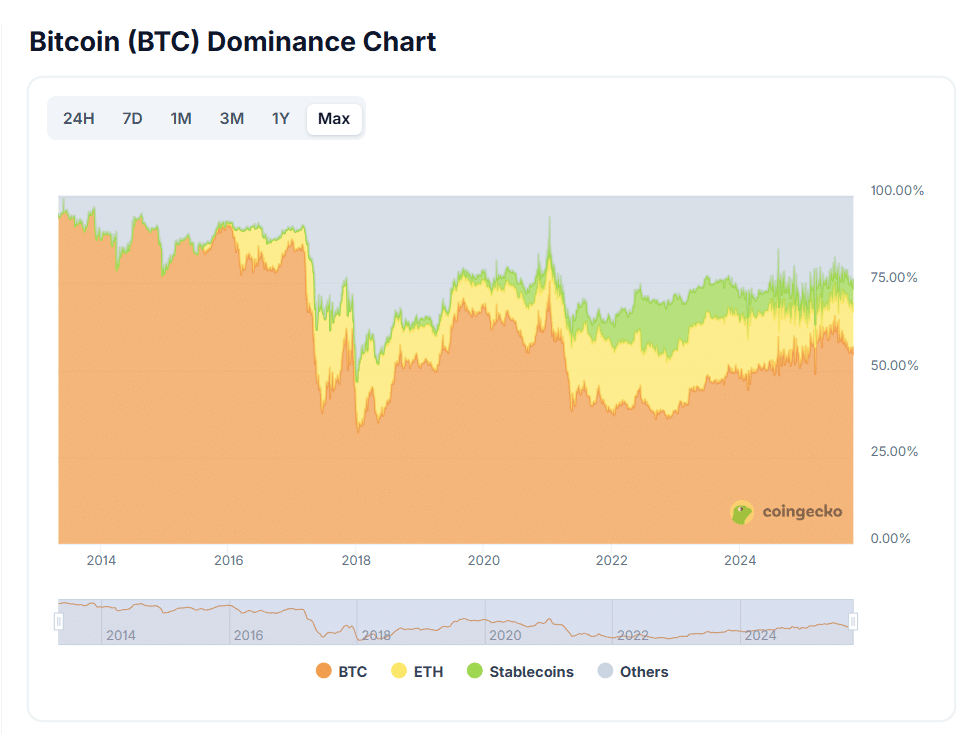

Two extra weeks. That’s when individuals suppose altcoin season is lastly going to interrupt out… perhaps in two extra weeks we’ll be saying that phrase once more. Who is aware of! However because it stands, resistance stays tight for Hyperliquid at $46.50–$47, the place each intraday rally has stalled.

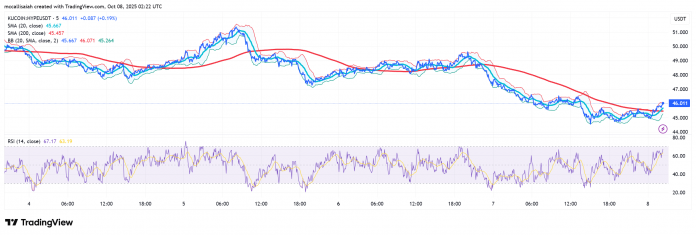

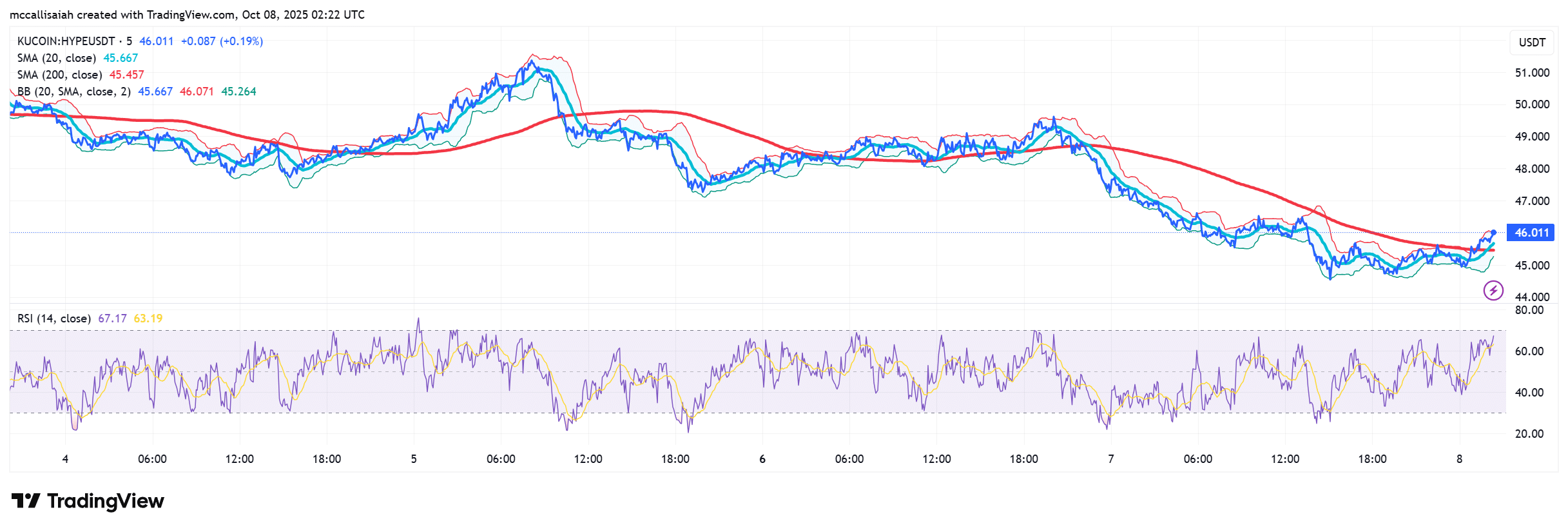

Listed here are another essential technicals:

- Bollinger Bands are narrowing, a setup that usually precedes a breakout

- The shifting averages are lining up too.

- The 20-day and 200-day SMAs simply crossed close to $45.5 in a mini golden cross

On the chart, HYPE is forming what seems to be a rounding backside. A confirmed breakout might goal $47.50–$48. RSI sits at 67, which isn’t overheated but. Shut however not there but. Quantity hasn’t spiked, which hints at quiet accumulation earlier than a decisive transfer.

DISCOVER: Subsequent 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

Hyperliquid Derivatives Flip Bearish as Spot Stays Resilient

In line with Coinglass, the long-to-short ratio for HYPE has dropped to 0.80, its weakest in over a month, displaying that futures merchants are leaning quick into the dip. Momentum indicators additionally lean cautious, with the RSI under 50 and MACD flashing a bearish cross.

Even so, spot markets proceed to carry the road. Value motion has repeatedly discovered footing within the mid-$40s, much like previous consolidation zones that preceded sharp breakouts.

$SUI flips Hyperliquid in day by day DEX quantity pic.twitter.com/gHoGbCHNNL

— ToreroRomero (@Torero_Romero) October 8, 2025

On the draw back, the subsequent key help lies between $39–$40. A clear break there would danger a deeper correction. Conversely, reclaiming $51–$52 would seemingly set off a squeeze greater towards $55–$60.

DISCOVER: 20+ Subsequent Crypto to Explode in 2025

Ultimate Ideas on HYPE: The place Do We Go From Right here?

DeFi Llama knowledge reveals Hyperliquid pulling in about $5M a day in protocol income, which is a gentle stream at the same time as rival perp DEXs dangle incentives. Round 660,000 HYPE (≈$30M) is staked, tightening provide and supporting a possible rebound.

The important thing vary sits between $44 and $49. A detailed above $49 flips momentum bullish towards $52–$55, whereas shedding $46–$47 dangers one other drop to $44 and even $40. With funding charges flat and open curiosity cooling, the setup mirrors previous mid-cycle pullbacks that usually finish with a pointy restoration.

EXPLORE: Singapore Denies Do Kwon’s $14M Refund Demand For ‘Stolen’ Penthouse

Be a part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

Key Takeaways

- Hyperliquid token (HYPE) slipped for a fifth straight session Tuesday, falling about 6% intraday to the $45–$46.

- DeFi Llama knowledge reveals Hyperliquid pulling in about $5 Mn a day in protocol income.

The put up Hyperliquid Token (HYPE) Checks Key Help as Merchants Eye Potential $100 Rebound appeared first on 99Bitcoins.