Billionaire traders Invoice Ackman and Warren Buffett each characteristic a selected “Magnificent Seven” member of their portfolios.

Invoice Ackman is a billionaire investor and serves as CEO to the hedge fund Pershing Sq. Capital Administration. All through the synthetic intelligence (AI) revolution, Pershing Sq.’s major publicity to the inventory market’s newest megatrend has been via a place in Alphabet.

Lately, nonetheless, Ackman made headlines after it was revealed that Pershing Sq. complemented its Alphabet place with one other member of the “Magnificent Seven”: Amazon (AMZN 2.66%). Apparently, Amazon is one of many few expertise shares featured in Warren Buffett’s portfolio at Berkshire Hathaway.

Let’s discover why billionaire traders like Buffett and Ackman could have taken a liking to Amazon. Furthermore, I will break down why the e-commerce and cloud computing big is my high decide amongst AI shares.

How did Amazon appeal to each Buffett and Ackman?

Ackman and Buffett constructed their fortunes in several methods. Buffett is finest recognized for constructing positions in globally acknowledged manufacturers and holding onto these shares over the course of a few years and even many years.

As well as, lots of Buffett’s most profitable investments have come from firms that constantly purchase again inventory or pay a dividend. Lastly, Buffett usually sticks to industries comparable to monetary providers, vitality, and client items — not often exposing Berkshire to extra unstable markets such because the expertise sector.

However, Ackman tends to be a bit extra industry-agnostic in comparison with Buffett. Furthermore, every now and then Ackman may also revenue from extra subtle buying and selling methods that contain derivatives.

One philosophy that Buffett and Ackman do share, nonetheless, is their love for worth shares. Neither investor is thought for chasing momentum or overpaying for a inventory buying and selling with a lofty valuation.

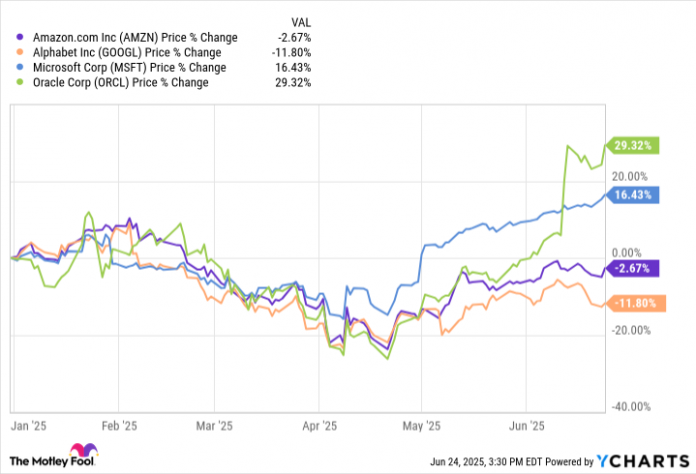

The chart above benchmarks Amazon’s worth motion relative to different megacap AI and cloud computing shares. Whereas every inventory above confronted some strain earlier this 12 months, Amazon’s decline was extra pronounced relative to its friends — particularly all through April. That is when Ackman pounced, shopping for the dip in Amazon inventory throughout a interval of notable valuation contraction.

Moreover, I feel Amazon’s diversified ecosystem spanning on-line procuring, cloud computing, subscription providers, logistics, robotics, grocery supply, streaming and leisure, and extra is one other issue that performed a task within the tech big incomes a spot in each Berkshire’s and Pershing Sq.’s portfolios.

By working throughout so many various finish markets, Amazon is ready to thrive underneath varied financial circumstances whereas additionally interesting to a number of completely different buyer demographics. Buffett and Ackman could favor enterprise fashions like this because it helps mitigate threat components comparable to cyclicality, seasonality, and development unpredictability.

AI has monster potential to rework Amazon

Given the concepts explored above, Amazon could not seem like a standard AI alternative. However over the previous couple of years, Amazon has quietly been reworking its enterprise via a sequence of AI-driven investments.

For starters, the corporate invested $8 billion right into a start-up known as Anthropic. Anthropic has turn out to be a key integration in Amazon Net Providers (AWS), resulting in sustained acceleration throughout income and profitability within the firm’s cloud computing enterprise.

Amazon can also be deploying AI robotics all through its achievement facilities. This transfer has the potential to generate vital value financial savings by bringing new ranges of automation and effectivity to the corporate’s warehouses.

Furthermore, whereas firms like IonQ or Rigetti Computing fetch nearly all of consideration within the quantum computing enviornment, Amazon is growing its personal line of chipsets: Trainium, Inferentia, and Ocelot.

Picture supply: Getty Pictures.

Is Amazon inventory a purchase proper now?

Primarily based on ahead earnings multiples, Amazon inventory is not precisely a cut price proper now. My hunch is that Amazon’s various enterprise and sturdy development prospects could make the corporate seem like extra of a protected haven relative to different unstable, unpredictable alternatives within the AI realm.

AMZN PE Ratio (Ahead) information by YCharts

Even so, I do not assume Amazon has skilled the identical stage of valuation enlargement that a few of its Magnificent Seven friends (e.g., Microsoft, Nvidia) have during the last couple of years.

Moreover, given what number of completely different companies AI stands to disrupt inside the Amazon ecosystem, I feel the corporate is uniquely positioned for sustained intervals of strong development.

With that in thoughts, I feel Amazon nonetheless has vital upside and I see a place within the inventory as a superior alternative in comparison with its friends. Buyers with a long-run time horizon could wish to think about initiating a place in Amazon inventory regardless of its slight premium proper now.

Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Adam Spatacco has positions in Alphabet, Amazon, Microsoft, and Nvidia. The Motley Idiot has positions in and recommends Alphabet, Amazon, Berkshire Hathaway, Microsoft, Nvidia, and Oracle. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.