I’ve owned this meals maker for years and it has struggled since I purchased it. However I do not care and this is why I might purchase it once more at the moment.

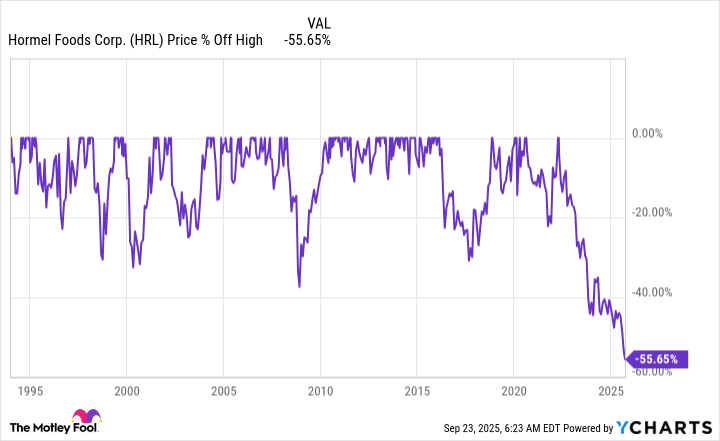

From a top-level view, a shopper staples firm with a traditionally excessive 4.7% yield and a Dividend King standing ought to be very engaging to most earnings traders. After all, the yield is so excessive as a result of the corporate is struggling at the moment, so the inventory, down round 55% from its all-time highs, is deeply unloved.

However I am a longtime shareholder who’s not going wherever. In truth, I’d purchase the shares once more at the moment if I did not already personal them. Here is the corporate and my logic on why it’s a nice buy-and-hold inventory proper now.

I am at present underwater on this meals maker

The corporate I am talking about is Hormel Meals (HRL 1.12%), which I’ve owned since 2017. That stated, I’ve added to my place a number of instances because the inventory languished. At this level, Hormel is my worst-performing funding. I’d even promote it briefly to seize my losses so I can offset positive aspects I’ve elsewhere in my portfolio. All I must do is keep away from the wash sale rule after I purchase it again.

I am not nervous that I am going to miss out on a sudden inventory advance, as a result of it would take time to repair what ails the corporate.

Picture supply: Getty Photographs.

With out going into an excessive amount of element, Hormel’s portfolio of branded meals merchandise is not firing on all cylinders at the moment. To place some numbers on that, quantity by way of the primary 9 months of fiscal 2025 fell 2.5%. Whereas web gross sales rose 1.9%, pushed by worth will increase, the corporate’s prices rose extra rapidly than gross sales, resulting in a fairly massive 6.5% decline in section income.

Issues bought so unhealthy that the board of administrators not too long ago selected to half methods with the CEO, Jim Snee, bringing again his predecessor, Jeffrey Ettinger. Ettinger is working to proper the patron staples maker’s ship and, on the similar time, coaching John Ghingo to take over for him. Shaking issues up by bringing again a well-respected chief might be the correct name, even when the repair right here is more likely to be a multiyear effort.

Given Hormel’s standing as a Dividend King, it appears probably that it’s going to muddle by way of this era. You do not improve your dividend yearly for 50+ years with out having a strong plan that will get executed nicely in each good instances and unhealthy. This can be a unhealthy time, for positive, however the firm is clearly taking motion to get again on monitor.

The ace in Hormel’s shareholder base

I imagine Hormel will get by way of this, however the true query for a dividend investor like me is whether or not or not it may try this and keep its dividend. There are causes to fret about that. For instance, it is not unusual for a brand new CEO to chop an organization’s dividend, taking a kitchen sink method to fixing the issues being confronted. Basically, get each little bit of unhealthy information out so absolutely anything the brand new chief does will find yourself trying like successful. Notably, the trailing-12-month dividend payout ratio has risen steadily because the inventory has declined and is now over 80%.

No surprise why the yield is so excessive. However there is a wrinkle right here that long-term traders ought to perceive. The Hormel Basis, which controls roughly 47% of Hormel’s inventory, is your co-investor. The Hormel Basis makes use of the dividends it collects from Hormel the corporate to additional its philanthropic efforts. It needs a dependable and slowly rising dividend, similar to you in all probability do. That is precisely what I need as a dividend investor.

Since Hormel actually cannot do something massive with out the approval of The Hormel Basis, the dividend is probably going protected. And, simply as necessary, Hormel could make the correct choices for the enterprise, even when they require time to play out. It does not need to make short-term selections to appease the mercurial traders on Wall Avenue. I am glad to sit down tight realizing that The Hormel Basis is on my aspect. And I’d purchase Hormel once more for a similar cause, if I did not personal it.

Issues is probably not as unhealthy as they appear

The monetary efficiency famous above was for the primary 9 months of fiscal 2025. The third quarter of that 12 months was truly not horrible, with quantity up 2.7% 12 months over 12 months. Prices are nonetheless outpacing the corporate’s capability to boost costs, so section income had been off by 3.4%. However the firm’s efficiency is probably not fairly as dire as some traders concern. A sustainable upturn will take time, however the third quarter reveals that issues is probably not as unhealthy as they appear.

The management change, nevertheless, is more likely to result in some enterprise modifications that might make monetary outcomes a bit unstable within the close to time period. However given the corporate’s long-term success, its historic dedication to the dividend, and the involvement of The Hormel Basis, I nonetheless suppose Hormel is a good enterprise nicely price proudly owning at the moment.