Trump’s sweeping tariff insurance policies have traders tense and anxious proper now.

We’re simply 4 months into the yr and there is already been a large number of occasions which have rocked the capital markets.

Again in January, a Chinese language synthetic intelligence (AI) start-up referred to as DeepSeek shook traders to the core as the corporate claimed to construct its fashions on older, much less refined IT architectures than American AI builders had been utilizing. Whereas these fears subsided comparatively rapidly, the market volatility continued because of blended opinions on essential financial knowledge associated to inflation and jobs experiences.

Most lately, the occasion that has triggered the most important stir within the inventory market is President Donald Trump’s new tariff agenda. Since he introduced his world tariff insurance policies on April 2, shares have been whipsawing so dramatically it is turn into each jarring and disorienting for traders to determine what to do.

Throughout occasions like these, a well-known Warren Buffett quote all the time involves thoughts. Let’s assess the magnitude that the tariff information has had available on the market. Extra importantly, we’ll discover the mindset of the “Oracle of Omaha” — which may assist traders average any panic and fearful feelings they might be feeling proper now.

Trump’s tariffs are wreaking havoc on the markets

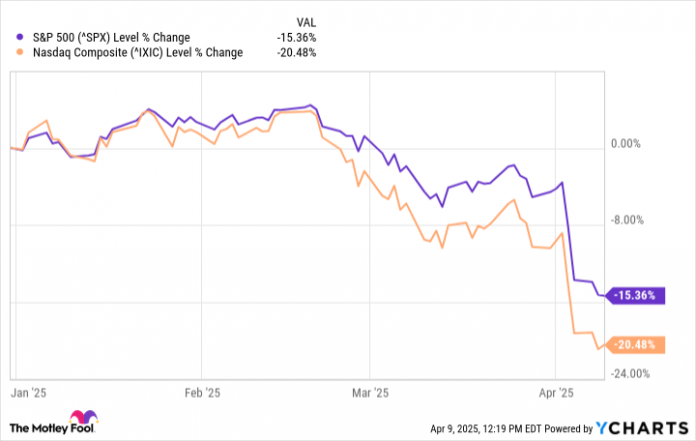

The chart beneath illustrates the returns of each the S&P 500 and Nasdaq Composite to this point this yr. As I alluded to above, there have been a number of drop-offs throughout each indices all through the primary few months of 2025. Nonetheless, the clear anomaly proven beneath is the precipitous decline that occurred in early April — instantly after Trump’s tariff insurance policies grew to become public:

Despite the fact that it is scary, this market dip presents alternative

The inventory market is an interesting case research in human psychology. It is a medium that displays a variety of feelings. When the markets are hovering, most individuals are euphoric. When the markets are crashing (like they’re now), most individuals run for the hills.

However even through the so-called good and unhealthy occasions, there exist a small cohort of individuals generally known as contrarians. These traders go in opposition to the grain; they do not adhere to mainstream methods of considering.

When the inventory market is roaring, a contrarian could turn into involved that valuations have gotten disconnected from the performances of precise companies. In different phrases, contrarians will suppose that persons are investing extra into narratives than concrete fundamentals. Against this, when valuation ranges drop, a contrarian could also be inclined to begin placing cash to work as shares turn into extra engaging at their normalized costs.

Buffett is a well known contrarian. And proper now, I can not cease occupied with his famed line, “You need to be grasping when others are fearful, and also you need to be fearful when others are grasping.” On the floor, that philosophy won’t fully resonate with the typical investor. However beneath, I will make the case for why Buffett’s logic makes a variety of sense.

Picture supply: The Motley Idiot.

Keep in mind to maintain the long run in focus

The chart beneath illustrates the efficiency of the S&P 500 and Nasdaq Composite over the past twenty years. Every of the grey-shaded columns listed in opposition to the efficiency of the S&P and Nasdaq represents a distinct recessionary interval.

Do you discover something? Naturally, proper across the time a recession went into impact, each indices began to fall. Nonetheless, following the recessions each the S&P 500 and Nasdaq began to rise once more — finally reaching new highs.

I am not exhibiting this development as a result of I am predicting a recession. Fairly, I am making the case that the inventory market is kind of a resilient place in the long term — even when feelings can generally drive a variety of the motion within the close to time period. These dynamics underscore that some courageous traders (like Buffett) have been really shopping for throughout historic durations of extended sell-offs and market crashes. In different phrases, some traders have been grasping when most others have been fearful and panic-selling.

I will admit that it is actually tough to establish shares which may be oversold or which might be much less uncovered to tariffs. As an alternative of happening these rabbit holes, I believe a prudent technique is to easily purchase the general market proper now. What I imply by that’s to think about placing some cash to work in exchange-traded funds (ETFs) such because the Vanguard S&P 500 ETF (VOO 0.53%), SPDR S&P 500 ETF Belief, or the Invesco QQQ Belief.

Every of those funds supplies traders with diversified publicity within the type of a number of trade sectors and a wholesome mixture of progress and worth shares. And because the chart above makes clear, the S&P 500 and Nasdaq are likely to exhibit sturdy rebounds following durations of financial turmoil.

I believe that utilizing a method of dollar-cost averaging into these main indices will wind up being a savvy transfer years down the highway.

Adam Spatacco has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Vanguard S&P 500 ETF. The Motley Idiot has a disclosure coverage.