Venezuela, one of many world’s most struggling economies, has seen a significant decline in the usage of its nationwide foreign money in every day life.

With inflation working at greater than 200% a 12 months, individuals now pay for groceries, hire, and even salaries in stablecoins like Tether’s USDT. Domestically, many merely name it the “Binance greenback.”

What started as a device for crypto-savvy customers has become the default cash for hundreds of thousands. Market stalls, small retailers, and even mid-sized companies settle for USDT as a result of it holds worth and is simple to switch. Apartment charges, safety companies, and gardening payments at the moment are quoted in stablecoins as an alternative of bolívars.

Binance Emerges as a Widespread Choice

Formally, Venezuela’s central financial institution units the trade fee at 151 bolívars per U.S. greenback. However in observe, most individuals have a look at Binance or parallel market charges, that are far increased. Distributors and shoppers alike choose the liquidity and consistency of stablecoins. For them, it appears like a extra dependable greenback than money itself.

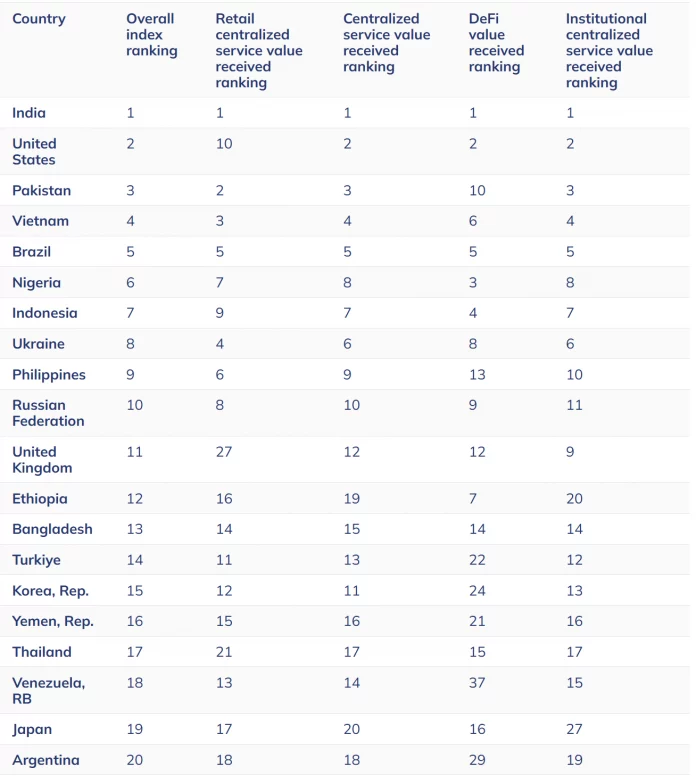

This shift displays a deeper development seen in different struggling economies. In Argentina, Turkey, and Nigeria, stablecoins have additionally develop into well-liked as individuals attempt to escape inflation and capital controls. Crypto analysis agency Chainalysis ranks Venezuela among the many high 20 international locations for crypto adoption, with almost half of small transactions involving stablecoins.

¡En nuestras tiendas estamos aceptando #Criptomonedas como forma de pago! #Bitcoin #DashCcs #Ethereum #Litecoin #BitcoinCash #Venezuela pic.twitter.com/xS9mFlL2zo

— Traki (@TRAKIenganchate) October 11, 2018

The rise of USDT has even touched bigger industries. Oil firms and a few native banks reportedly use stablecoins to skirt sanctions and keep away from restrictions on international foreign money. Capital controls that when locked individuals into the collapsing bolívar now push them towards digital {dollars}.

The Stablecoin Irony

For most individuals, the scenario is ironic. Governments typically warn towards crypto for being risky, but in Venezuela, it has develop into probably the most secure possibility. For a lot of households, holding cash in USDT is the one strategy to plan for the subsequent week, not to mention the subsequent month.

Because the bolívar fades from use, stablecoins are filling the hole. They might not remedy Venezuela’s financial disaster, however for hundreds of thousands, they’re conserving commerce alive when conventional cash now not works.

Disclaimer

The data mentioned by Altcoin Buzz isn’t monetary recommendation. That is for instructional, leisure, and informational functions solely. Any data or methods introduced are the ideas and opinions of the author/reviewers, and their threat tolerance could differ from yours. We’re not accountable for any losses it’s possible you’ll incur resulting from any investments instantly or not directly associated to the knowledge supplied. Bitcoin and different cryptocurrencies are high-risk investments; due to this fact, please conduct your due diligence. Copyright Altcoin Buzz Pte Ltd.

The put up Inflation Soars, Stablecoins Grow to be Venezuela’s Forex appeared first on Altcoin Buzz.