America’s second-largest financial institution and Warren Buffett’s third-largest holding looks like a no brainer.

You may know Financial institution of America (BAC 0.28%) as one of many world’s largest monetary establishments. It’s a well-known consumer-facing financial institution with over $3.2 trillion in property at the moment. You may also realize it for the controversial bailout cash it and its friends obtained following the monetary disaster of 2007-2008.

You may also affiliate Financial institution of America with well-known investor Warren Buffett, who has owned inventory in it via Berkshire Hathaway for years. Financial institution of America is Berkshire’s third-largest holding, accounting for about 12% of its portfolio.

Both manner, many individuals (together with myself) spend money on the businesses they know, making Financial institution of America a sizzling matter. It most likely does not have to be mentioned that Financial institution of America is a get-rich-quick inventory. The corporate is already large, with a $350 billion market cap at the moment.

However can Financial institution of America make you wealthy slowly? Can it compound for many years, probably making you a millionaire over the course of your investing life?

The boom-and-bust nature of the large banks

A financial institution’s enterprise is straightforward at first look. A financial institution pays you curiosity on the cash you deposit. The financial institution takes your cash and loans it to another person at the next rate of interest. The financial institution makes cash (internet curiosity earnings) from the distinction between the curiosity they earn on the mortgage and what they pay on deposits.

Massive banks, comparable to Financial institution of America, are much more advanced. They contact nearly each facet of the economic system, together with private and enterprise banking, mortgages, scholar loans, industrial actual property, and the monetary markets. Banks will be very profitable when the economic system is firing on all cylinders, and other people and companies borrow quite a bit.

But it surely goes the opposite manner, too. When one thing goes flawed within the monetary markets or the economic system, it normally impacts the banks. Keep in mind the housing crash and monetary disaster of 2007-2008? It was partially on account of a bubble in subprime mortgages — to which, you guessed it, Financial institution of America and different massive banks had main publicity. Their heavy losses prompted monetary intervention from the federal government.

The U.S. economic system is a juggernaut over the long run, however generally, issues break for one motive or one other. When this occurs, Financial institution of America and its friends are inclined to really feel it, too. It comes with the territory of being so deeply ingrained on the planet’s largest economic system. This creates a boom-and-bust nature for large banks, and their measurement and notoriety can generally make them a regulatory goal.

Banking meltdowns eat into the inventory’s long-term efficiency

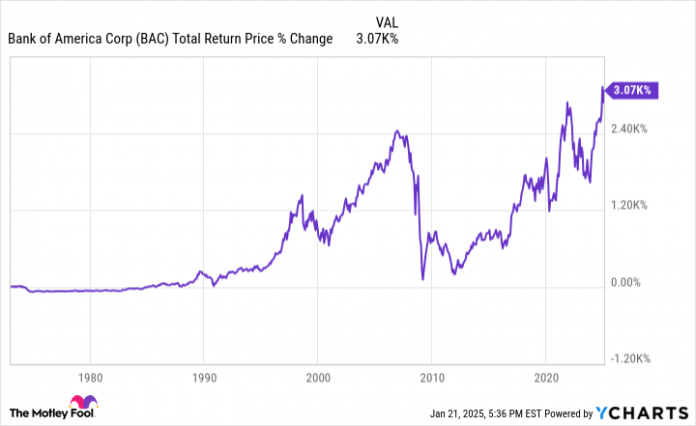

Over time, the occasional disaster or recession has dragged Financial institution of America inventory down.

Within the chart under, you may see that Financial institution of America’s 2008-2009 crash worn out a long time of funding returns. Most financial institution inventory downturns aren’t that extreme, however Financial institution of America inventory is not any stranger to sharp declines. Typically, it may possibly take a number of years to get well.

BAC Whole Return Value knowledge by YCharts.

Even at the moment, there are potential dangers. Rising rates of interest have piled $108 billion in unrealized losses on hold-to-maturity securities onto Financial institution of America’s stability sheet. Now, so long as nothing forces Financial institution of America to the touch these securities, it will not have to understand these losses. Finally, these loans will mature harmlessly.

Nonetheless, traders should not utterly dismiss the danger. Who is aware of what may occur sooner or later? Who foresaw a worldwide pandemic in 2020?

Can Financial institution of America make you a millionaire?

Financial institution of America has been a unbelievable inventory for Warren Buffett since he invested in 2011. However as nice as Buffett is, do not buy Financial institution of America just because he did. Warren Buffett struck a singular deal for most popular inventory and warrants throughout a time of want for the large financial institution. It is not the identical as shopping for frequent inventory on the open market at the moment. Berkshire has trimmed its stake within the firm over the previous 12 months, although Financial institution of America stays a core holding.

The lesson? Do not buy (or promote) primarily based solely on another person’s actions, even these of a legend like Buffett.

There’s quite a bit to love in Financial institution of America. It is nonetheless one of many world’s largest banks and can seemingly continue to grow alongside the U.S. economic system. Analysts count on roughly 10% annualized earnings progress over the subsequent three to 5 years. The corporate pays a secure dividend that yields 2.2% at the moment, making it a strong holding in a diversified portfolio. And, for those who purchased and held via all of the ups and downs, the inventory has returned over 3,000% because the early Nineteen Seventies.

However a millionaire-maker at the moment? In all probability not. Massive banks are too liable to catastrophe, and Financial institution of America is simply too giant and mature now to ship the explosive progress you’d want for life-changing funding returns anytime quickly.

Financial institution of America is an promoting associate of Motley Idiot Cash. Justin Pope has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Financial institution of America and Berkshire Hathaway. The Motley Idiot has a disclosure coverage.