New applied sciences may be thrilling for buyers. Synthetic intelligence. Electrical automobiles. The record goes on. Now, we now have a brand new theme rising: quantum computing. Shares comparable to IonQ (IONQ 7.31%) have soared in latest quarters because of the monumental potential of this expertise, which may deliver a genuinely new sort of pc to marketplace for the primary time in near a century.

Investing in cutting-edge expertise may be worthwhile. Working example, contemplate Nvidia. Nonetheless, for each Nvidia that delivers monster 100-bagger returns to its shareholders, there’ll inevitably be a dozen duds that languish in small-cap territory and even go to zero.

So, which is able to IonQ be: The following nice hypergrowth expertise inventory or a narrative inventory that seems to be all hype?

Quantum computing potential

The world has made nice progress in rising its collective computing energy for the reason that creation of the transistor in 1947. Making semiconductors ever smaller and exponentially extra highly effective has enabled the event of a bunch of applied sciences, from cloud computing to smartphones and even synthetic intelligence (AI), and put them within the palms of the lots.

Nonetheless, present strategies of constructing essentially the most highly effective computer systems are extremely costly. Think about the expertise of ASML, for instance. It makes the lithography machines that play a central (certainly, at present irreplaceable) position in manufacturing superior pc chips, and its most cutting-edge gear prices round $378 million per machine. But these machines are only one a part of an enormous computing sector provide chain. No surprise analysts count on the AI infrastructure market to spend a whole lot of billions of {dollars} a 12 months by 2030.

Quantum computer systems promise a way more environment friendly methodology of high-performance computing. Utilizing properties comparable to quantum superposition, quantum entanglement, and chance amplitudes, early-stage quantum computer systems can remedy sure uncommon and complicated computing issues dramatically quicker than a classical supercomputer would have the ability to.

This can be necessary for just a few causes if researchers and builders can hold advancing quantum computer systems in ways in which make them extra dependable, correct, and cost-effective. Such machines ought to assist scale back the prices of growing new medication and helpful chemical compounds for a bunch of functions, optimizing advanced methods of all types, and advancing our AI fashions.

IonQ is without doubt one of the firms attempting to deliver quantum computing expertise ahead. Purchasers can already entry its first-generation machines through cloud suppliers comparable to Amazon Internet Providers, making it one of many first commercialized quantum computing methods.

IonQ’s massive money burn

The thrill round quantum computing is warranted. In precept, it ought to provide a device that may quickly remedy an array of issues that may take a classical machine years — or centuries — to deal with. Nonetheless, for most typical makes use of of computer systems at the moment, quantum computer systems would not really be an enchancment. This can be a expertise with exceptional long-term promise, however to date, helpful real-world functions have been sparse.

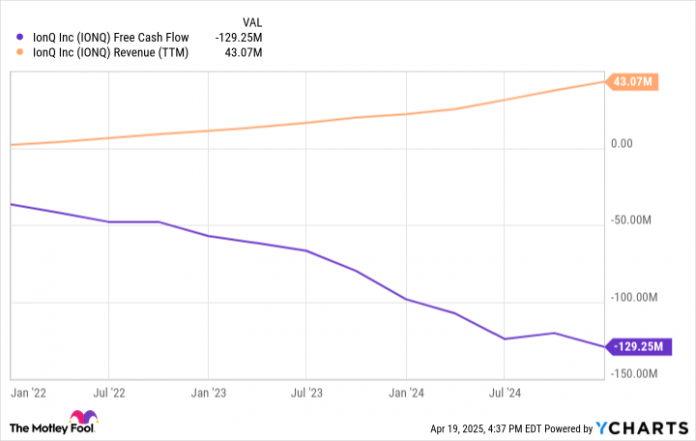

IonQ buyers have to separate the daring objectives of the expertise’s boosters from the underlying actuality of the enterprise at the moment. The corporate is producing lower than $50 million in annual income and burning $129 million a 12 months in free money circulate. With $364 million in money and equivalents on its stability sheet, IonQ has lower than three years earlier than its cushion is used up, and its unfavourable free money circulate has been rising within the mistaken path each quarter. Analysts do not count on quantum computer systems to change into commercialized for an additional decade, if not longer. This presents an issue for IonQ.

Furthermore, IonQ is way from the one quantum computing analysis firm. Amongst its rivals on this race are some with a lot bigger stability sheets like Microsoft and Alphabet. This places it at an obstacle from an investor perspective given how early stage this expertise is. IonQ will virtually definitely have to faucet the capital markets to get the funding it requires to remain afloat — one thing that its large tech rivals won’t must do. Which means the positions of prior shareholders can be diluted.

IONQ Free Money Movement knowledge by YCharts.

The plain reality about IonQ inventory

Investing in early-stage firms may be rewarding. However there’s a advantageous line between investing in an unprofitable firm with confirmed expertise and a science venture. IonQ appears extra like a science venture. Quantum computing might be refined to a stage the place it is prepared for full commercialization, however there isn’t any assure that IonQ can be first to market.

I say all this for example that IonQ is a high-risk inventory to spend money on. But buyers should not correctly factoring the danger into its shares: Its present market capitalization is $6 billion — for an organization that generates lower than $50 million in income yearly and has by no means been worthwhile.

IonQ inventory just isn’t a purchase proper now. I can be rooting for the corporate to succeed, however that doesn’t imply I believe it could be clever so as to add it to your portfolio.

Brett Schafer has no place in any of the shares talked about. The Motley Idiot has positions in and recommends ASML and Nvidia. The Motley Idiot has a disclosure coverage.