Semiconductor chief Nvidia (NVDA -0.26%) rewrote the foundations for pc processors when it launched its graphics processing models (GPUs) in 1999, they usually have since turn out to be the center of synthetic intelligence (AI) methods.

Now, the corporate is rewriting the foundations as soon as once more. In September, it introduced an enormous partnership with OpenAI that entails Nvidia investing as much as $100 billion within the ChatGPT creator.

This deal accommodates far-reaching penalties. By dissecting the implications of the OpenAI partnership, it is potential to find out if now would be the time to purchase Nvidia shares.

Picture supply: Nvidia.

Nvidia’s OpenAI collaborations on the trail to “superintelligence”

The chipmaker’s take care of OpenAI is the newest in an extended historical past between the 2. In 2016, Nvidia CEO Jensen Huang acknowledged GPUs can be splendid for AI, and to make his case, he hand-delivered the world’s first supercomputer designed for synthetic intelligence to OpenAI.

The 2 corporations are additionally partnering with different companies on the Stargate venture, an initiative to construct $500 billion value of AI infrastructure within the U.S. by 2029. And so they’re additionally working collectively on a sister venture, Stargate U.Okay., which plans to make use of as many as 31,000 Nvidia GPUs as OpenAI helps the British authorities broaden AI computing capability.

These initiatives illustrate a serious shift within the information middle business, which Huang describes as AI factories. These are information facilities particularly designed to help the rigorous computing calls for of AI methods.

This business shift led to the newest collaboration between Nvidia and OpenAI. In trade for Nvidia’s $100 billion funding, OpenAI will use the chipmaker’s merchandise to assemble large AI factories required “to coach and run its subsequent technology of fashions on the trail to deploying superintelligence,” in line with Nvidia.

This “superintelligence” entails OpenAI striving to realize synthetic common intelligence (AGI), a theoretical type of AI thought of to be equal to human mental capabilities, reminiscent of creativity and authentic ideas.

How the OpenAI deal affected Nvidia’s inventory

If OpenAI can obtain AGI, it could symbolize a breakthrough probably better than the ChatGPT launch that kicked off the present AI frenzy. To achieve AGI, OpenAI wants super computing energy, therefore its historic partnership with Nvidia.

The endeavor would require a complete of Nvidia GPUs estimated to increase into the tens of millions. This venture provides to the demand it already enjoys from clients, holding the potential to supercharge its gross sales. Consequently, the corporate’s shares soared to an all-time excessive of $191.05 on Oct. 2.

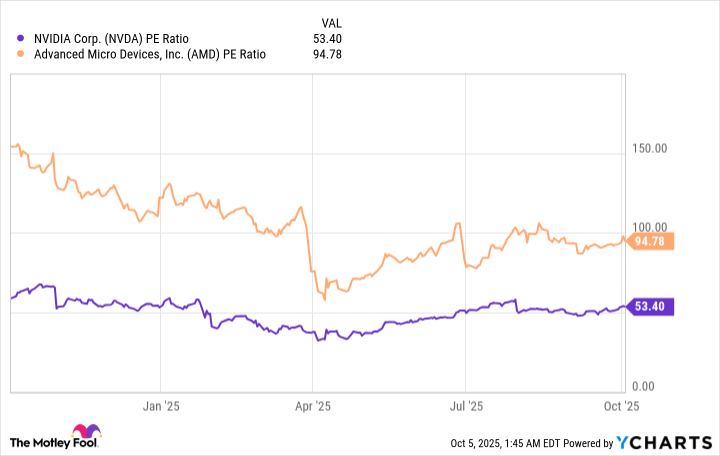

With the rise in Nvidia inventory, it is cheap to surprise if now could be the time to purchase it. To guage this, let’s study its price-to-earnings ratio (P/E) and examine it to Nvidia’s main competitor, Superior Micro Units.

Knowledge by YCharts.

AMD’s P/E a number of has dropped from a 12 months in the past, nevertheless it’s nonetheless effectively above Nvidia’s. This implies the latter firm’s shares are the superior worth.

Evaluating whether or not to purchase Nvidia inventory

Though its inventory valuation is best than AMD’s, Nvidia’s earnings a number of just isn’t low-cost. Arguably, the premium is warranted given its blockbuster take care of OpenAI and its excellent monetary outcomes to this point.

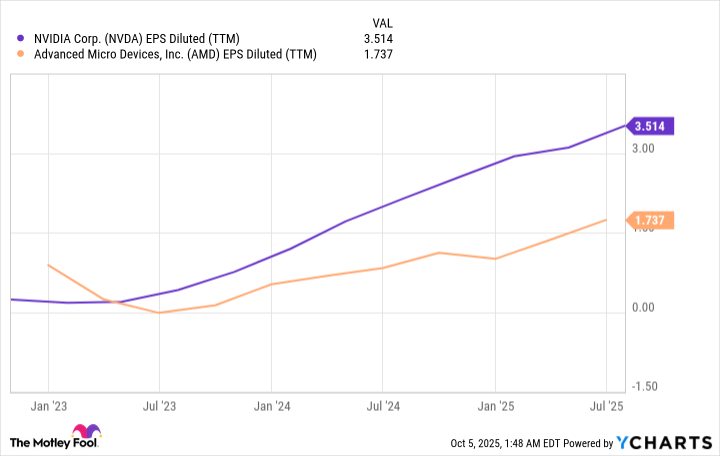

For example, Nvidia’s diluted earnings per share (EPS) have seen wonderful development over the previous few years, since AI demand has supercharged gross sales.

Knowledge by YCharts. TTM = trailing 12 months.

AMD’s diluted EPS has additionally edged up, however not as considerably as Nvidia’s. One other consideration is Nvidia’s sturdy income development within the face of challenges, reminiscent of being barred from China, one of many largest AI markets on this planet.

On account of geopolitical tensions between China and the U.S., Beijing prohibited Chinese language corporations from buying Nvidia merchandise. Regardless of shedding China gross sales, Nvidia’s income in its fiscal second quarter (ended July 27) hit $46.7 billion, a 56% year-over-year improve.

The corporate expects gross sales to continue to grow as an indication it might probably shrug off China’s loss. It forecast fiscal third-quarter income of $54 billion, a major improve from the prior 12 months’s report gross sales of $35.1 billion.

Furthermore, in August, the corporate added $60 billion to its share repurchase authorization. The choice to broaden shopping for again its inventory signifies administration’s confidence within the firm’s future, which is sensible contemplating the magnitude of its initiatives with OpenAI and Stargate.

Given its sturdy monetary outcomes regardless of being locked out of China and its probably game-changing take care of OpenAI, Nvidia is a worthwhile funding to purchase and maintain over the long run. That stated, as a result of its share worth not too long ago hit a report excessive, it could be clever to attend for the inventory to dip a bit earlier than deciding to purchase.