It is time to study the numbers to judge this unstable inventory’s trajectory after it climbed 350% prior to now 12 months.

The area financial system is a captivating funding alternative, however there are restricted pure-play area shares to select from. Elon Musk’s SpaceX is the business chief by a large margin, however it’s not publicly traded. Rocket Lab USA (RKLB 1.40%) has emerged as a scorching various. The inventory has rocketed increased over the previous 12 months. Shares are down 40% from their excessive, and Rocket Lab continues to be up almost 350%.

House is excess of hype; in line with Accenture, the area financial system might develop to $1.8 trillion over the following decade, with greater than 60,000 satellites in orbit by 2030.

Is Rocket Lab for actual, or is that this firm certain to fail in SpaceX’s shadow? Right here is whether or not traders can buy the inventory now.

A smaller area firm that is getting ready for takeoff

SpaceX was valued at $350 billion earlier this 12 months and is the world’s main area launch supplier. It is also identified for its satellite tv for pc constellation, Starlink, which gives web companies worldwide. Rocket Lab is a small fish, comparatively talking, with a market cap of $8 billion at present.

Rocket Lab focuses on small payload area launches using its Electron rocket. It has performed 62 complete Electron launches, together with 16 in 2024, up from 10 in 2023. Rocket Lab has bold plans to behave as an end-to-end area programs supplier, that means it is concerned in launch companies, spacecraft and satellite tv for pc design and manufacturing, and flight companies and software program. It is like a one-stop store for successfully and safely delivering objects to area.

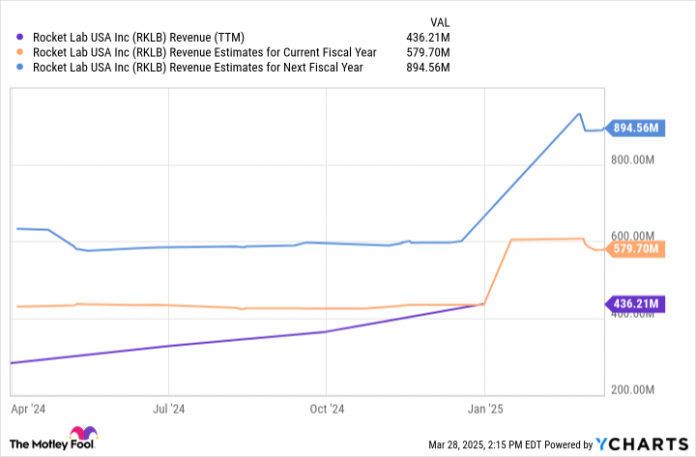

Whole income was $436 million in 2024, and analysts estimate it is going to double to roughly $894 million by 2026. Rocket Lab’s Neutron rocket will probably be essential to that. Neutron is {a partially} reusable rocket designed for bigger payloads than Electron. Basically, Neutron represents Rocket Lab moving into a better weight class that can see it compete extra instantly with SpaceX.

RKLB Income (TTM) knowledge by YCharts

Rocket Lab hopes to conduct Neutron’s debut launch later this 12 months. Rocket Lab and Neutron are within the operating to win launch contracts with the U.S. House Drive that might run by 2029 and complete $5.6 billion in worth. The corporate ended 2024 with a $1.067 billion backlog break up fairly evenly between business and authorities purchasers.

Finally, Rocket Lab’s skill to execute its launches and develop this know-how will decide how effectively it competes with SpaceX and the way the enterprise will do over the approaching years. If area turns into a multitrillion-dollar business, there will probably be no scarcity of alternative.

Here’s a key threat traders have to look out for

Rocket Lab continues to be a younger firm with a lot to show, however it tells an amazing story. Traders have a stable long-term funding thesis right here, however they should not lose sight of share dilution and the way it might influence the inventory’s long-term efficiency. The corporate is burning by money, spending closely on analysis and growth, manufacturing prices related to constructing satellites and rockets, and acquisitions.

In 2024, Rocket Lab’s free money move was adverse $116 million. Money losses are typical for a younger firm, however traders ought to search for enchancment because the enterprise grows to keep away from extreme dilution. Keep in mind, the extra shares there are, the smaller a inventory’s per-share income and earnings will probably be, that means decrease funding upside.

To administration’s credit score, it appears it has tried to maintain dilution down. The diluted share depend has solely risen by 10% because the firm went public through a particular goal acquisition firm (SPAC) merger in 2021. Nevertheless, dilution appears set to select up. The corporate has gathered $401 million in debt, so traders ought to most likely anticipate administration elevating funds through inventory choices extra so than debt shifting ahead. Rocket Lab lately introduced a $500 million share providing, equal to about 6.25% of its present market cap.

Is the inventory a purchase now?

Rocket Lab’s most direct comparability could be SpaceX. In response to Bloomberg, SpaceX obtained a $350 billion valuation in early 2025, valuing the launch portion of the enterprise at $122.5 billion. A analysis report by Payload House, Estimating SpaceX’s 2024 Income, estimated the corporate’s 2024 launch income at $4.2 billion. Once more, these are estimates, however the numbers worth SpaceX’s launch enterprise at a price-to-sales (P/S) ratio of roughly 29.

In the present day, Rocket Lab’s P/S ratio is 21. Traders ought to contemplate that SpaceX is extra established and deserves a premium because the dominant business chief. Nevertheless, these prepared to take a long-term view on the inventory might argue that Rocket Lab is buyable at its present worth. Doubling its income by 2026 would imply the inventory’s valuation turns into less expensive over the following two years.

Think about Rocket Lab a speculative funding that ought to stay a comparatively small place in a diversified portfolio. Nonetheless, the inventory is buyable right here and has some stable upside over the following 5 years if it will probably get Neutron up and operating.

Justin Pope has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Accenture Plc. The Motley Idiot recommends Rocket Lab USA. The Motley Idiot has a disclosure coverage.