What’s the single greatest motive merchants battle to become profitable within the markets? Do you assume it’s lack of expertise or buying and selling talent? Not sufficient cash of their accounts, poor threat administration or the mistaken buying and selling mindset? While these are all points that negatively have an effect on merchants, in my view, the only greatest motive most merchants don’t succeed, is self-sabotage.

What’s the single greatest motive merchants battle to become profitable within the markets? Do you assume it’s lack of expertise or buying and selling talent? Not sufficient cash of their accounts, poor threat administration or the mistaken buying and selling mindset? While these are all points that negatively have an effect on merchants, in my view, the only greatest motive most merchants don’t succeed, is self-sabotage.

You may take any dealer who’s struggling on an actual account, put them on a demo account and they’re going to nearly actually do a lot, significantly better. Why is that? Why is demo buying and selling totally different than reside buying and selling? What do merchants do otherwise on a demo account than an actual account?

The reply is straightforward; they don’t self-sabotage on demo accounts, or no less than so much much less. On a demo account, you do nearly every thing proper, primarily as a result of there isn’t any emotion as a result of there’s no actual cash being risked. However from my expertise, we are able to boil that all the way down to an much more particular occasion; the truth that on a demo account, most merchants will merely set and overlook their trades, way more so than they may on a reside account.

So, what does all this need to do with letting the market take you out? Properly, when merchants exit trades manually, i.e. earlier than their cease loss or goal will get hit, more often than not they’re sabotaging their buying and selling and hurting their possibilities of earning money. More often than not, the proper factor to do is to easily let the market take you out, or let worth hit your cease loss or your goal by itself, with out you manually closing the commerce.

This text will clarify my pondering behind after I resolve to both let the market take me out or after I resolve to intervene…

Why You Ought to Nearly By no means Manually Shut Trades

Okay, right here is the primary and maybe most necessary factor to grasp…

In case you manually shut a commerce when it’s towards you, you might be voluntarily taking a loss. Learn that final sentence once more, possibly even a 3rd time. Buying and selling is about maximizing your winners in order that they offset your shedding trades, that’s the way you become profitable. You’re going to have shedding trades, however you don’t must voluntarily take them, more often than not.

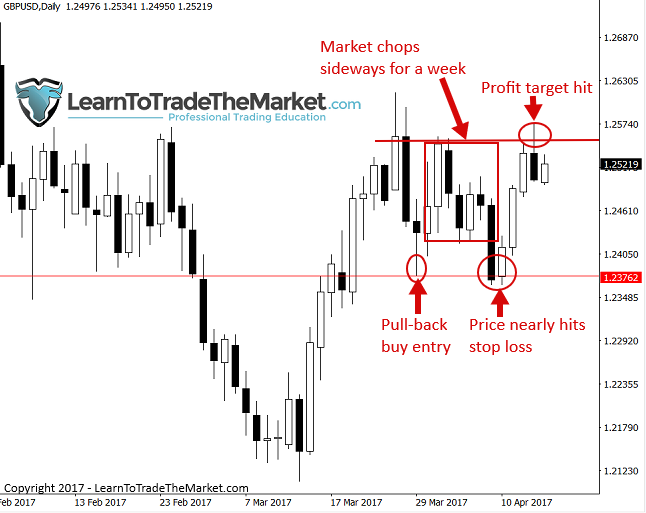

Right here is an instance: A dealer enters a commerce on a demo account, it chops sideways for per week, going nowhere. The following week, it rotates down, nearly stopping him out for a loss, he’s watching a $2,500 drawdown. Now, right here is the important thing distinction; on a demo account that dealer FEELS no motive to shut out the commerce, so he merely leaves or not it’s. He’s pondering logically and clearly and he is aware of if he closes it he’s voluntarily taking a loss that may flip round and turn out to be a win. The following week that commerce begins transferring his means and rockets as much as hit his revenue goal on the week’s finish. Quite than taking almost a $3,000 loss, he booked a $6,000 winner by merely ready, and doing nothing for 2 weeks.

The ethical of that story is that you will need to give a commerce time to work out. Time is an element that you would be able to’t management and the one that offers merchants probably the most bother. Everybody desires to become profitable NOW, however the market may need different plans. You may need to take a seat in your arms for 2 or three weeks, and may you try this on a reside account? That’s the query and the issue you need to clear up when you ever wish to become profitable as a dealer.

- If a commerce doesn’t hit your cease loss, then the commerce concept remains to be legitimate and will nonetheless work out for you. It might imply it consolidates for two weeks, after which takes off to be a 5r winner. Don’t shut it simply because it’s chopping or transferring in direction of your predetermined cease loss.

Examples of letting the market take you out vs. handbook exits

Feelings drive merchants to exit trades earlier than cease losses or revenue targets are hit. The extra crucial of those two is exiting earlier than a cease loss is hit, or voluntarily taking a loss, as a result of these value us big. These trades will usually work out simply after we manually take the loss…

Within the chart beneath, a dealer would have been rewarded for not exiting when worth neared their cease loss. In these conditions, you will need to remind your self it is a recreation of odds, and also you give your self the most effective odds by sticking together with your preliminary commerce plan and letting the commerce play out…

Right here is one other instance of what I name the set and overlook mentality with cease losses….

Within the chart beneath, many merchants would have exited prematurely after the bearish pin bar fashioned. However simply as they took a loss or a really small win, worth was able to explode greater for a 2 or 3R winner and presumably extra. On this case, the horizontal stage at 1240.00 was the extent to look at, not the pin bar low. Simply because there’s a counter-trend pin bar doesn’t imply you have to shut the commerce, in these conditions, I watch key chart ranges as indicators of after I ought to bail on a commerce (not solely worth bars) …

- Keep away from twiddling with trades and keep away from early handbook exists, as an alternative let the market hit the cease loss as you initially positioned it or let the market hit your goal (let the market take you out). In case you need assistance on cease loss placement

Exceptions to the rule…

Keep in mind, worth motion buying and selling isn’t mechanical so there may be all the time an exception to the foundations. On this occasion, that will be the chart’s worth motion suggesting a transparent motive to exit. There are three situations to look at for:

- Opposing worth motion sign – This is usually a warning signal of a reversal that could also be a set off to get out early.

Or…

- The story on the chart is altering. ‘Pay attention’ to what the market is saying, did we shut beneath / above a key stage or transferring common?

Or…

- Did the worth motion sign we entered on clearly fail with the market reversing and shutting beneath or above the worth sample?

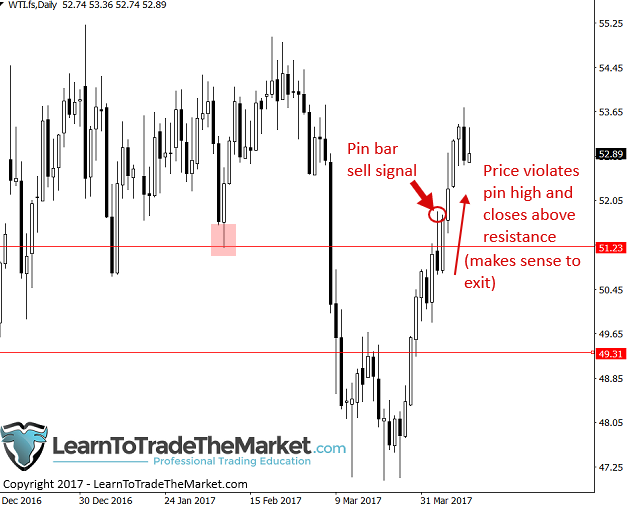

Within the chart beneath, we are able to see an instance of a commerce it made sense to exit. In case you didn’t have your cease proper on the bearish pin bar excessive, as in when you had entered this bearish pin on a 50% retrace or commerce entry trick, you in all probability would have wished to shut it out earlier than it hit your cease when you noticed worth pushing up previous the excessive of the pin bar and shutting above that key resistance at 51.20 space. There may be some discretion concerned right here clearly. However, you’ll get higher at these things by coaching, time and expertise. Usually, when you take a commerce towards the near-term momentum, which on this case was up, there’s probability you’ll have to exit early…

A violation of a setup low or excessive doesn’t all the time imply it fails…

The ultimate instance I wish to present you is a latest EURUSD pin bar purchase sign and the way worth merely violating it’s low, didn’t imply the commerce concept failed.

This setup fashioned on the key assist of a buying and selling vary, close to 1.0520; a key chart stage that had held on quite a few latest events. Now, keep in mind, key ranges are normally extra like zones of assist or resistance, not all the time static ranges. So, it goes to motive that our cease losses ought to be past them slightly bit, not proper on the stage. Had you entered this pin on my commerce entry trick, you need to have had your cease properly beneath the pin low (50 to 100 pips). Doing so would have allowed you to keep away from a untimely cease out when worth was simply ‘flirting’ with the pin low, proper earlier than it surged on in your favor to be a big successful commerce. From when this pin bar fashioned, to when worth hit the highest of the buying and selling vary close to 1.0830 space, a month glided by. Would you could have been in a position to maintain that place in a reside account with all of the chopping and transferring towards your cease loss? In case you did, you’ll have banked a big revenue just by doing nothing…

Recap

Listed below are the primary take away factors of this lesson:

- Good trades usually take time to play out, usually that point is longer than you need (normally it’s) or anticipate.

- Let your trades breathe by giving them a wider cease loss than it’s your decision (scale back place dimension accordingly).

- A market would possibly chop sideways, flounder and even retrace 1 pip out of your cease loss earlier than turning round in your favor. However, as a result of there’s a random distribution of wins and losses, it makes zero sense (more often than not) to shut your trades out earlier than they hit your cease loss.

- Value transferring past the low or excessive of a pin bar or stage momentarily isn’t all the time an indication the setup has failed.

Conclusion

I hope you possibly can see that you would be able to considerably assist your buying and selling efficiency by merely DOING LESS. I imply, just by fiddling together with your trades much less usually and by not closing them out earlier than they hit your cease loss, you possibly can tremendously enhance the quantity and quantity of your wins.

Now, I’m not saying you gained’t have losses as a result of you’ll! However, STOP taking them voluntarily and for no motive! So many merchants take so many losses that they merely don’t must take. Perhaps it means you need to dial down your threat per commerce so that you aren’t so emotionally rattled when worth rotates towards your cease loss, possibly it means you have to be taught extra about cease loss placement and how one can commerce with worth motion. However, no matter it takes, you will need to cease shedding cash merely since you received nervous on account of uneven worth motion or worth transferring towards you.

Appropriate cease loss placement, studying what’s on the charts appropriately and controlling your feelings are all core parts to defending your buying and selling capital and maximising your wins. These are a few of the classes I educate and go extra into extra in-depth in my buying and selling programs and members’ space. If you’re critical about understanding these things and how one can cease sabotaging your personal buying and selling, it’s time to take the subsequent step…

PLEASE LEAVE A COMMENT BELOW – I WOULD LIKE TO HEAR YOUR FEEDBACK 🙂

QUESTIONS ? – CONTACT ME HERE