Bitcoin is demonstrating resilience after a risky week marked by an undecisive market. Holding sturdy above the important $104,000 degree, the main cryptocurrency seems well-positioned for continued development. Regardless of fluctuations, Bitcoin’s means to take care of this assist has boosted confidence amongst buyers, lots of whom are anticipating additional upward momentum within the close to time period.

Key information from CryptoQuant highlights an intriguing development: giant buyers, sometimes called “good cash,” have been driving BTC value good points because the U.S. election. Their elevated exercise suggests a strategic accumulation part, signaling expectations of a major transfer within the coming weeks. This aligns with BTC’s historic habits, the place institutional curiosity typically precedes main value surges.

As Bitcoin consolidates above $104K, market individuals are watching intently for indicators of the subsequent breakout. With giant buyers main the cost, the cryptocurrency’s potential for development stays sturdy, even amid broader market uncertainty. Whether or not BTC can capitalize on this momentum and push towards new highs will rely on its means to maintain present assist ranges and overcome key resistance factors.

Bitcoin Dynamics Sign Regular Progress

Bitcoin has skilled outstanding development over the previous yr, solidifying its place because the main cryptocurrency. Its spectacular efficiency has caught the eye of enormous buyers, signaling sturdy market confidence. Present market dynamics counsel BTC is poised for additional development, providing substantial alternatives for buyers. The stage seems set for a significant transfer that might ship vital good points.

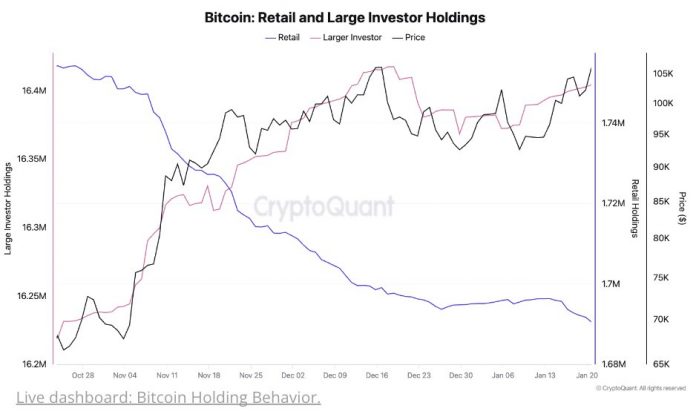

Current information from CryptoQuant underscores this development, revealing that enormous buyers have been a driving power behind Bitcoin’s value good points because the U.S. election. Throughout this era, BTC holdings amongst main gamers have elevated from 16.2 million BTC to 16.4 million BTC, demonstrating a transparent sample of accumulation. This exercise highlights the strategic positioning of institutional and high-net-worth buyers who anticipate continued upward momentum in Bitcoin’s value.

In distinction, small buyers have decreased their holdings from 1.75 million BTC to 1.69 million BTC, indicating a degree of hesitancy or profit-taking amongst retail individuals. This dynamic confirms that retail buyers have but to completely re-enter the market, suggesting the potential for even better upward stress on Bitcoin’s value as soon as they do.

As giant buyers proceed to build up and retail curiosity begins to develop, the outlook for BTC stays extremely bullish. Institutional confidence and untapped retail demand might gas a large rally, propelling BTC to new highs within the coming months. For now, Bitcoin’s sturdy fundamentals and rising investor curiosity level to a brilliant future for the cryptocurrency.

BTC Value Evaluation: Holding Regular Above $100K

Bitcoin (BTC) is at present buying and selling at $104,700, navigating via a interval of huge volatility and market uncertainty. The worth has been fluctuating inside an outlined vary, bouncing between its all-time excessive (ATH) and the important $100,000 assist degree. This lack of clear path has left each bulls and bears on edge, with merchants intently monitoring key ranges for potential indicators of the subsequent huge transfer.

For Bitcoin to verify a bullish breakout and maintain its upward trajectory, the value should decisively push above the $107,000 mark. Breaking this resistance would probably pave the best way for a rally into value discovery, the place Bitcoin might obtain new file highs. Such a transfer would reinforce confidence available in the market and entice recent shopping for curiosity from each institutional and retail buyers.

On the draw back, shedding the $100,000 assist degree would sign weak point and will end in a deeper correction. A sustained break beneath this psychological degree would probably result in elevated promoting stress, probably testing decrease demand zones and delaying Bitcoin’s subsequent try at a breakout.

As BTC consolidates, the approaching days shall be pivotal in figuring out its short-term trajectory. Merchants and buyers are protecting an in depth eye on these important ranges, as the end result will form Bitcoin’s efficiency within the close to future.

Featured picture from Dall-E, chart from TradingView