Massive-cap altcoins similar to Ethereum (ETH), Solana (SOL), and XRP are steadily dropping their enchantment to crypto traders. These property had been as soon as thought of important holdings for smaller traders. Nevertheless, they’ve now fallen beneath the worth ranges seen in the beginning of the 12 months.

On-chain information signifies that traders are more and more dealing with losses. The query is whether or not they nonetheless have an opportunity to recuperate what has been misplaced.

Sponsored

Loss Stress Might Push New Buyers Away

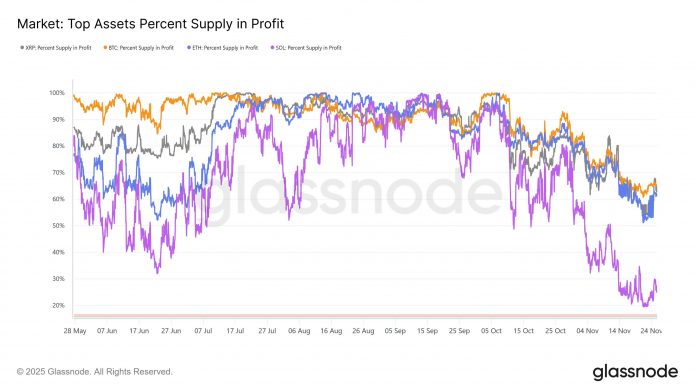

Glassnode’s P.c Provide in Revenue information for ETH, XRP, and SOL exhibits a continued decline since October.

P.c Provide in Revenue measures the variety of cash whose final motion occurred at a lower cost than the present worth. A decline on this indicator means fewer cash are sitting in revenue.

Conversely, the variety of cash held at a loss will increase as large-cap altcoin costs proceed to fall.

“Right here’s the % of provide in loss, for prime property:

BTC: 34.91%

XRP: 36.70%

ETH: 38.37%

SOL: 74.84%” — Glassnode experiences.

Sponsored

As well as, Realized Loss affords a extra concrete view. It denotes the full USD worth of cash moved at a time when their earlier worth was larger than the present market worth.

The metric displays a 7-day common Realized Loss, highlighting the situation of latest merchants who purchased throughout latest worth declines.

As of November 25, ETH, SOL, and XRP all recorded the best 7-day common realized Loss for the reason that market drop in April.

“Realized losses amongst new traders in main altcoins are rising, as costs proceed to battle to recuperate, signalling rising stress throughout the speculative finish of the market.” — Glassnode feedback.

Sponsored

Loss stress might proceed to immediate new market entrants to exit, thereby preserving capital, which may exacerbate downward worth momentum.

As an alternative, many traders are beginning to concentrate to altcoins with extra enticing tales, similar to Privateness Cash and Neobank Cash.

Brief-Time period Outlook: The Most Necessary Situation for Restoration

Santiment affords a extra optimistic framing utilizing on-chain indicators. Based mostly on the MVRV (Market Worth to Realized Worth) ratio, short-term and mid-term holders of ADA, LINK, ETH, and XRP are experiencing notable losses.

Sponsored

Relatively than emphasizing losses, Santiment states that these property could also be undervalued. This suggests potential restoration again towards common valuation ranges.

What situations are essential for large-cap altcoins to rebound and reclaim their management position out there? Altcoin Vector — Swissblock’s institutional-grade report states that the reply is determined by Bitcoin’s worth actions.

“The ultimate This autumn stretch may supply a turnaround if $BTC stabilizes as in April, setting the stage for enlargement.” — Altcoin Vector forecasts.

Nevertheless, even Bitcoin has confronted sturdy promoting stress this month. A Bitcoin restoration might function the quickest catalyst to interrupt the pessimistic market sentiment that has endured all through the month.