Whereas many are nonetheless targeted on how excessive the bitcoin value may go throughout this present bull market (though given present value motion, possibly not!), it’s equally essential to arrange for what comes subsequent. Right here we’ll have a look at the info and arithmetic that may assist us estimate the place Bitcoin’s subsequent bear market low may happen — not as a prediction, however as a framework based mostly on prior cycles, on-chain valuation metrics, and even the basic valuations of BTC.

Cycle Grasp: Modeling Historic Bitcoin Value Bottoms

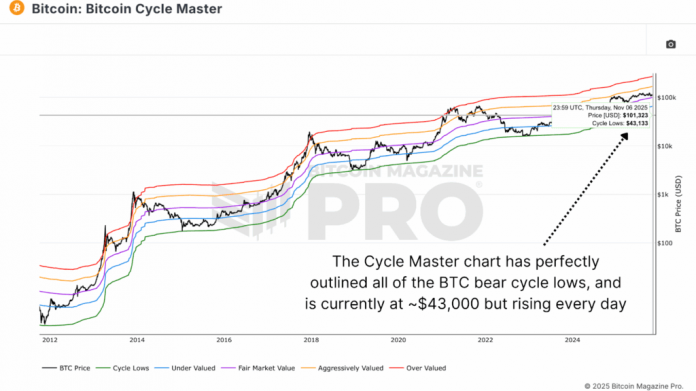

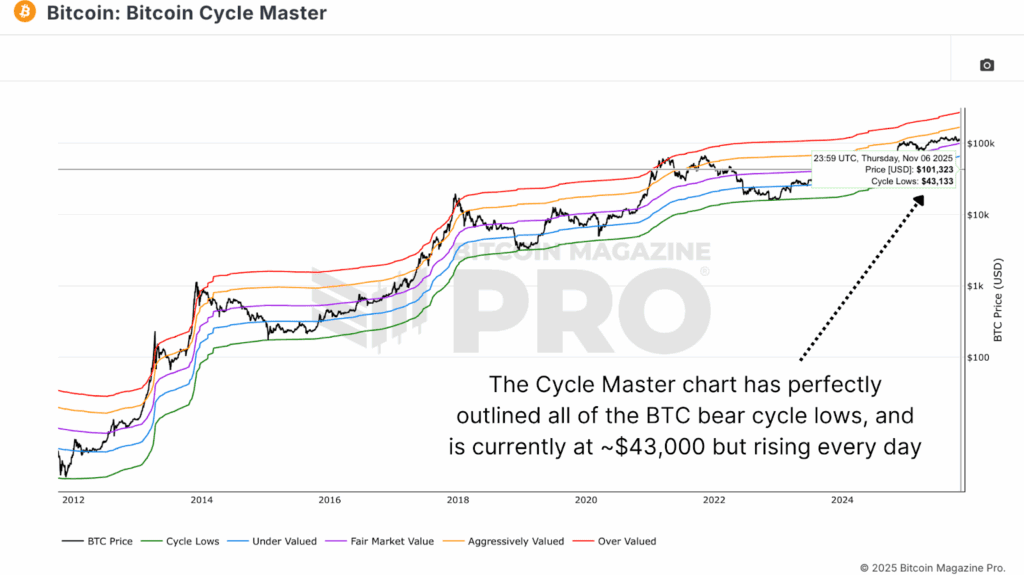

Some of the persistently correct fashions for figuring out Bitcoin’s cyclical bottoms is what we consult with because the Bitcoin Cycle Grasp chart, which collates a variety of on-chain metrics to create bands round value with sure valuation ranges.

Traditionally, this inexperienced “Cycle Lows” line has pinpointed Bitcoin’s macro bottoms with close to perfection. From $160 in 2015 to $3,200 in 2018, and once more at $15,500 in late 2022. As of at this time, this band sits round $43,000 and rising every day, which supplies a helpful baseline to estimate how far Bitcoin may decline within the subsequent full cycle.

Diminishing Drawdowns: Why Every Bitcoin Value Bear Market Hurts Much less

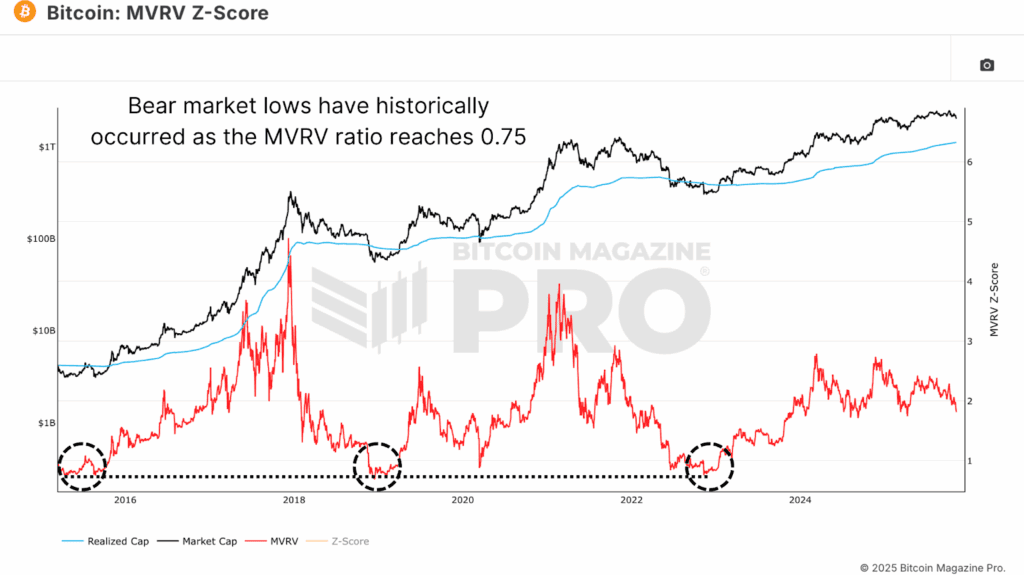

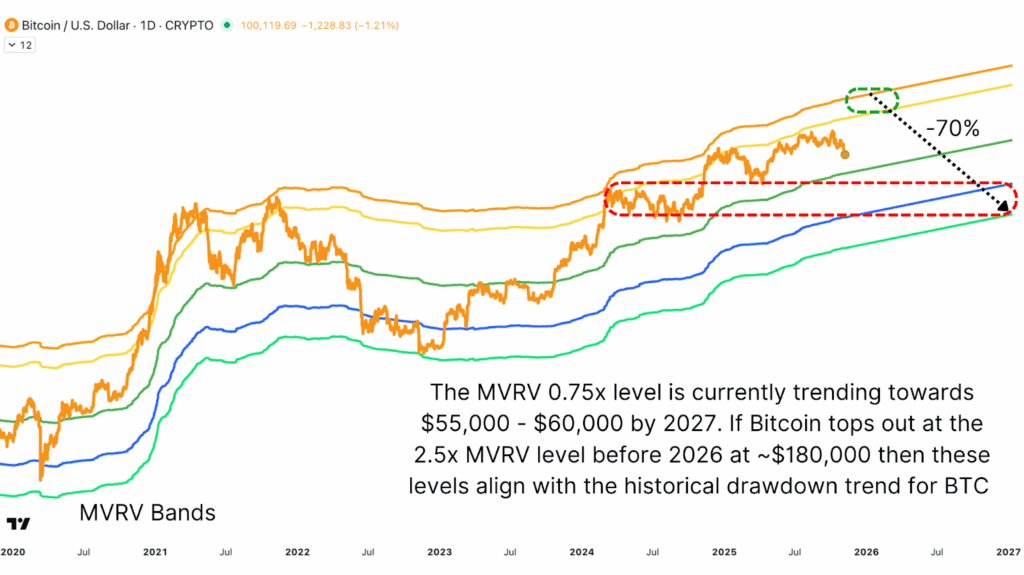

Alongside this, we are able to have a look at the uncooked MVRV Ratio, which measures Bitcoin’s market value versus its realized value (the typical price foundation of all cash). Traditionally, throughout deep bear markets, Bitcoin tends to fall to 0.75x of its realized value, that means the market value trades about 25% beneath the community’s combination price foundation.

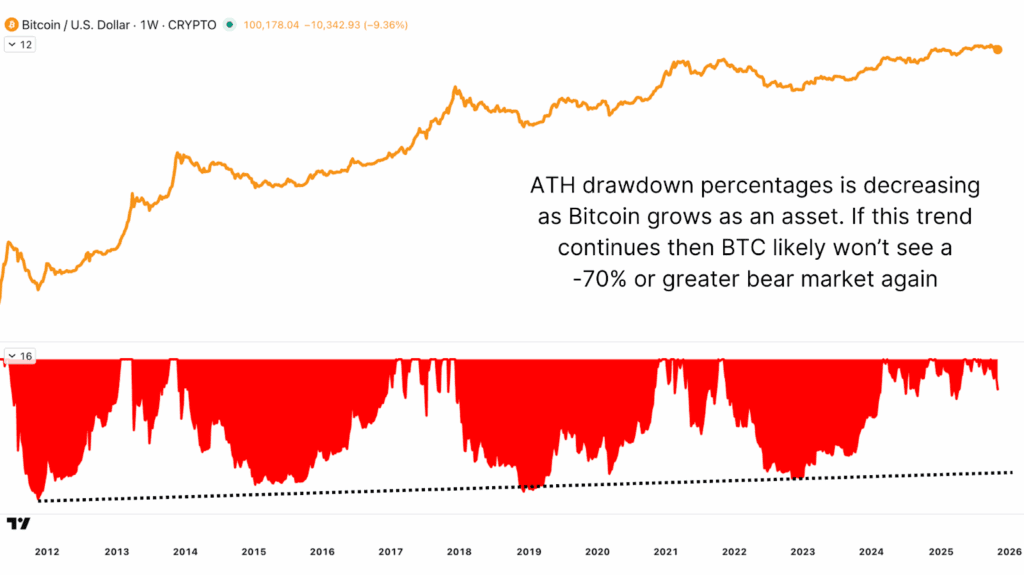

This repeatability provides us a robust anchor for estimating potential draw back when mixed with the pattern of diminishing drawdowns. Whereas Bitcoin’s earliest cycles noticed declines as deep as 88%, that determine has been steadily compressing, to 80% in 2018 and 75% in 2022. Projecting that very same pattern ahead, a continuation of diminishing volatility would indicate that the following bear market may deliver a ~70% retracement from cycle highs.

Forecasting the Subsequent Bitcoin Value Prime and Backside

Earlier than we estimate the following low, we want an inexpensive assumption for the place this bull market may peak. Primarily based on historic MVRV multiples and slope-trended realized value progress, Bitcoin has lately tended to prime at roughly 2.5x its realized value. If that relationship holds and the realized value continues trending upward, it suggests a possible prime someplace close to $180,000 per BTC in late 2025.

If that’s the case, and Bitcoin had been to observe its historic one-year bear market lag into 2027, a 70% retracement from that degree would deliver the following main cycle low to roughly $55,000–$60,000, based mostly on the present realized value trajectory at the moment. These costs additionally align properly with Bitcoin’s uneven consolidation vary from final 12 months to offer some technical confluence.

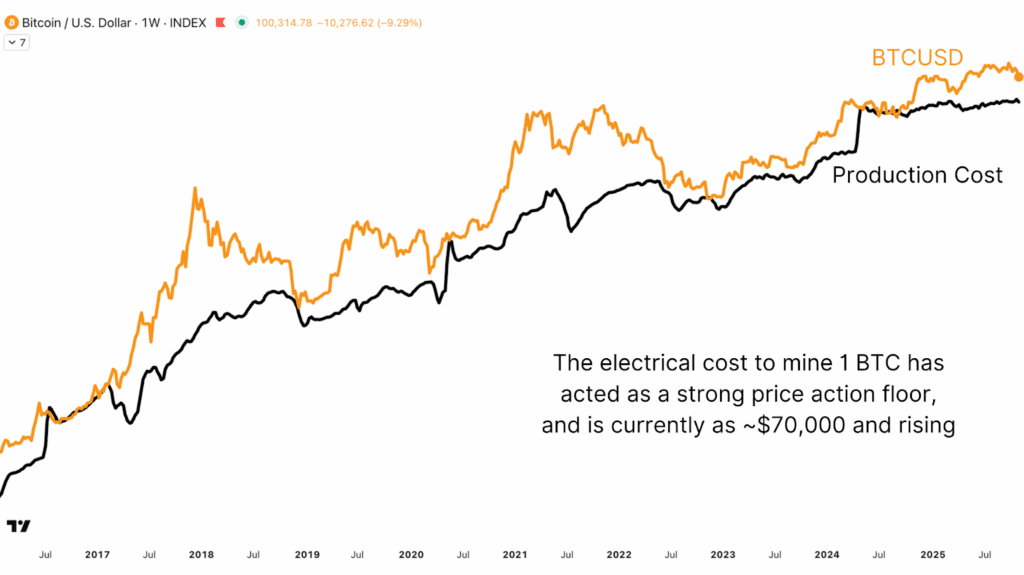

Bitcoin Value and the Rising Value of Manufacturing

Some of the dependable long-term valuation metrics for Bitcoin is its manufacturing price, the estimated electrical expense to mine one BTC. This metric has traditionally aligned carefully with Bitcoin’s deepest bear market lows. After each halving, the manufacturing price doubles, forming a rising structural flooring underneath the value over time.

When Bitcoin trades beneath its manufacturing price, it indicators miner stress and usually coincides with generational accumulation alternatives. As of the April 2024 halving, the brand new price foundation rose sharply, and every time Bitcoin has dipped close to or barely beneath it since, it has marked native bottoms and subsequent sharp reversals. This worth presently sits at ~$70,000 however fluctuates every day.

Conclusion: The Subsequent Bitcoin Value Cycle Will Seemingly Be Shallower

Each Bitcoin cycle has been accompanied by a wave of euphoria claiming, “This time is completely different.” However the knowledge continues to indicate in any other case. Whereas institutional adoption and broader monetary integration have certainly modified Bitcoin’s construction, they haven’t erased its cyclicality.

The information suggests the following bear market will doubtless be shallower, reflecting a extra mature and liquidity-driven atmosphere. A retracement towards the $55,000–$70,000 zone wouldn’t sign collapse, however it could mark the continuation of Bitcoin’s historic rhythm of growth and reset.

For a extra in-depth look into this matter, watch our most up-to-date YouTube video right here: Utilizing Math & Knowledge To Predict The Bitcoin Bear Market Low

For deeper knowledge, charts, {and professional} insights into bitcoin value traits, go to BitcoinMagazinePro.com.

Subscribe to Bitcoin Journal Professional on YouTube for extra knowledgeable market insights and evaluation!

Disclaimer: This text is for informational functions solely and shouldn’t be thought-about monetary recommendation. All the time do your personal analysis earlier than making any funding choices.