With Bitcoin breaking into new all-time highs, the inevitable query emerges for each investor: how excessive can this bull market truly go? On this evaluation, we’ll take a data-driven and mathematical strategy to attempt to estimate potential value targets for each Bitcoin and (Micro)Technique all through the present cycle.

Reevaluating The Pi

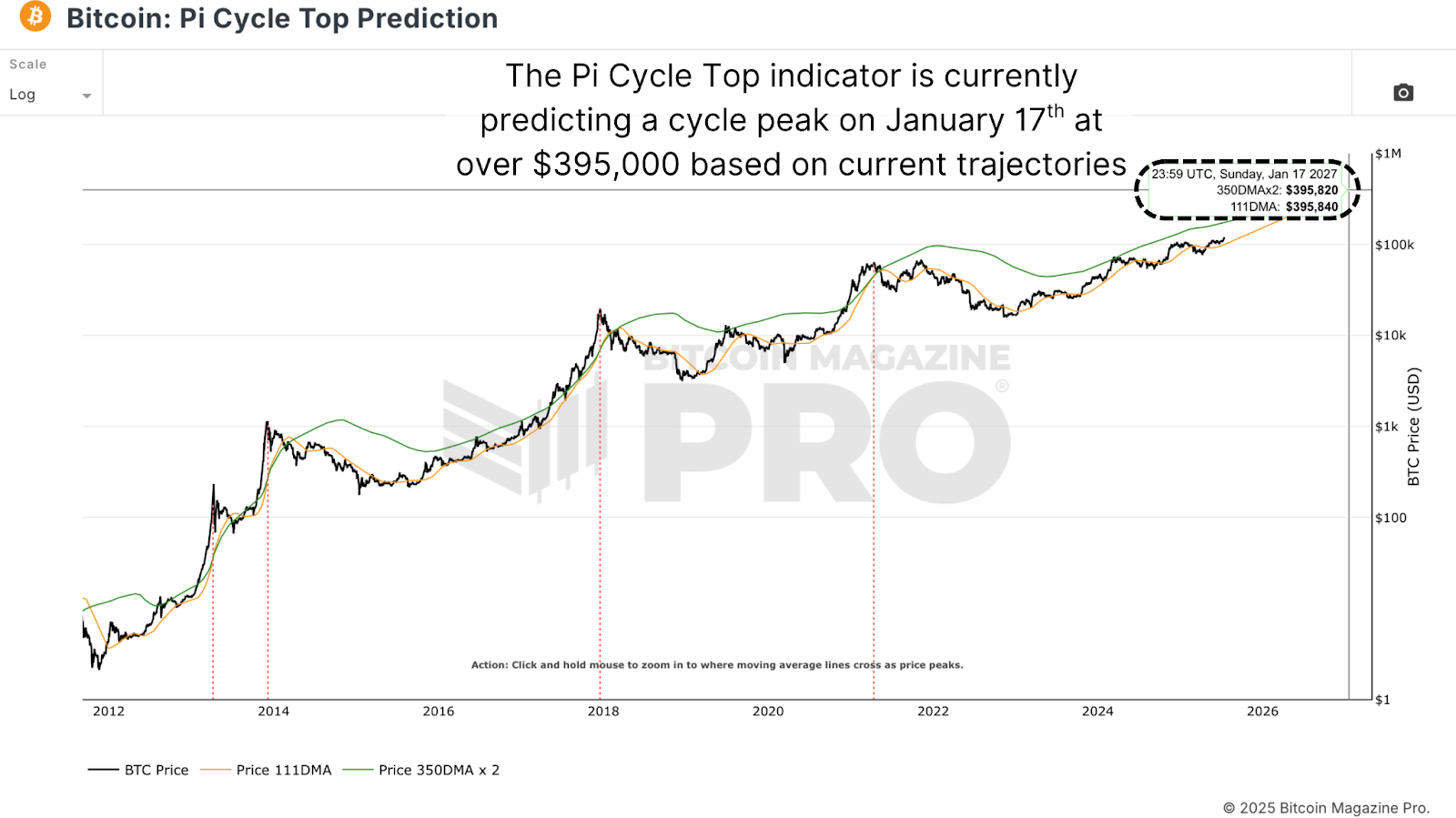

The Pi Cycle Prime Prediction chart depends on two key shifting averages: the 350-day shifting common multiplied by two (inexperienced line) and the 111-day shifting common (orange line). Traditionally, when the 111-day MA crosses above the 350-day MA x 2, a cycle peak has occurred inside just some days. Regardless of its previous accuracy, together with flawless calls throughout prior cycles, it’s essential to stay cautious.

At present trajectories, the indicator forecasts a cycle peak round January 17, 2027. Nonetheless, for any crossover to happen, BTC would wish to maintain costs properly above the 350DMA*2 for months, possible at costs considerably greater than $200,000. That stage of sustained value appreciation appears unlikely this cycle, though I’d like to be confirmed improper! Whereas the instrument stays a priceless danger administration indicator, we shouldn’t rely solely on it for timing macro tops simply due to its historic accuracy.

MVRV Ratio

A extra grounded methodology entails the Market Worth to Realized Worth (MVRV) ratio. By analyzing the connection between market value and the realized value (the typical price foundation of all BTC in circulation), we are able to set real looking expectations. If we extrapolate a conservative cycle peak MVRV rating of two.8 utilizing prior diminishing returns, peaks we’ve already set on this cycle within the MVRV, and the present realized value of $50,000, we arrive at a present projected Bitcoin high of round $140,000.

Nonetheless, because the realized value continues to extend as capital flows into Bitcoin, a $70,000 realized value later within the cycle would recommend a possible peak nearer to $200,000. This methodology displays a extra dynamic strategy to understanding Bitcoin’s market habits primarily based on on-chain information and investor psychology.

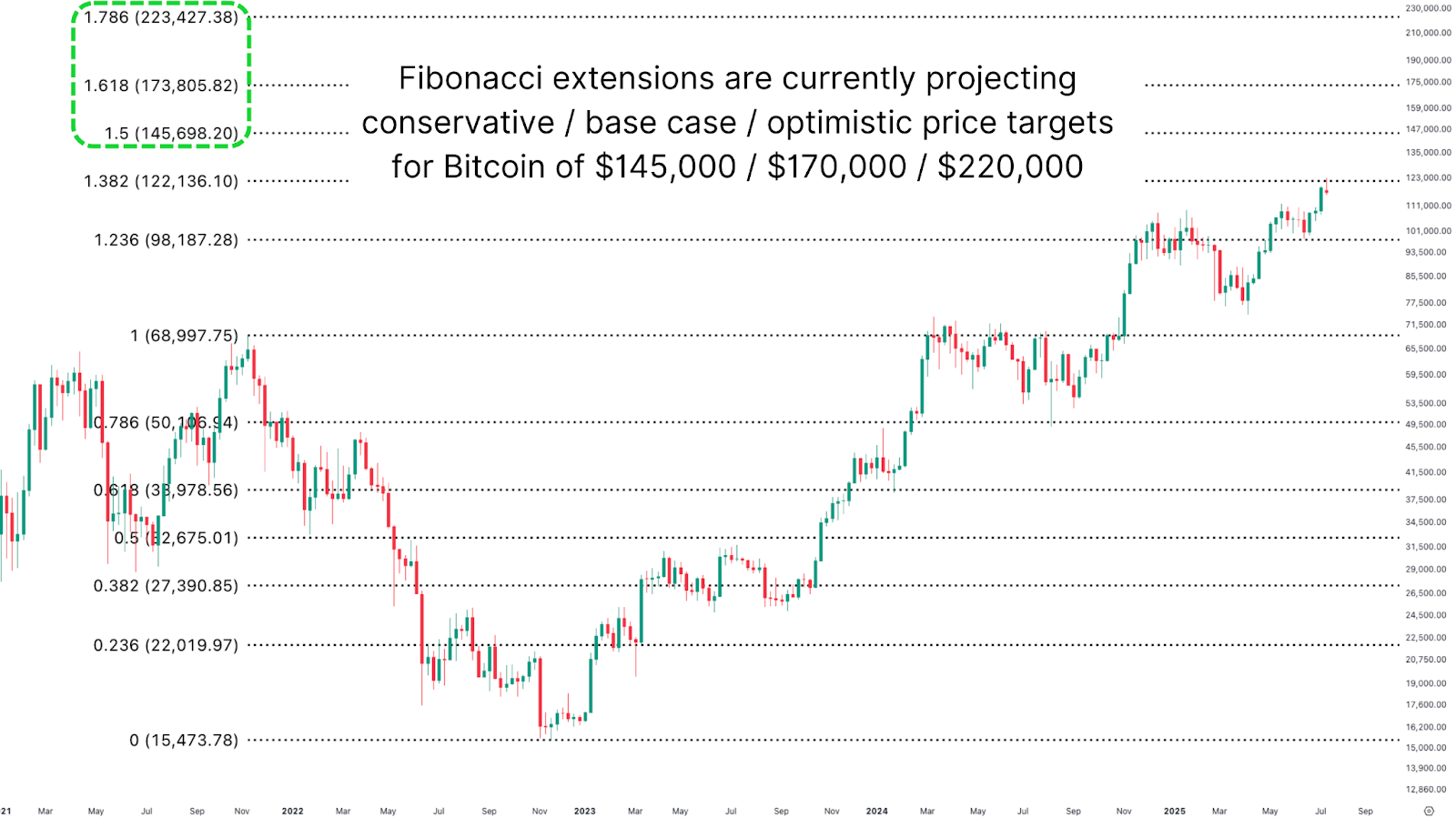

Fibonacci Extensions

For extra technically inclined merchants, Fibonacci extensions can supply insights when getting into value discovery. Utilizing TradingView’s Fib extension instrument on earlier cycle lows and highs, we’ve recognized vital ranges which have acted as resistance and help traditionally with an extremely excessive diploma of accuracy. Together with that, the current excessive corresponded extremely intently to the 1.382 Fib stage at ~$122,000.

Trying forward, the 1.618 extension suggests ~$170,000 as a possible cycle high, with a extra aggressive upside goal of ~$220,000. Apparently, this aligns intently with the $140k to $200k projections derived from MVRV evaluation, offering stable cross-model validation.

Technique’s Peaks

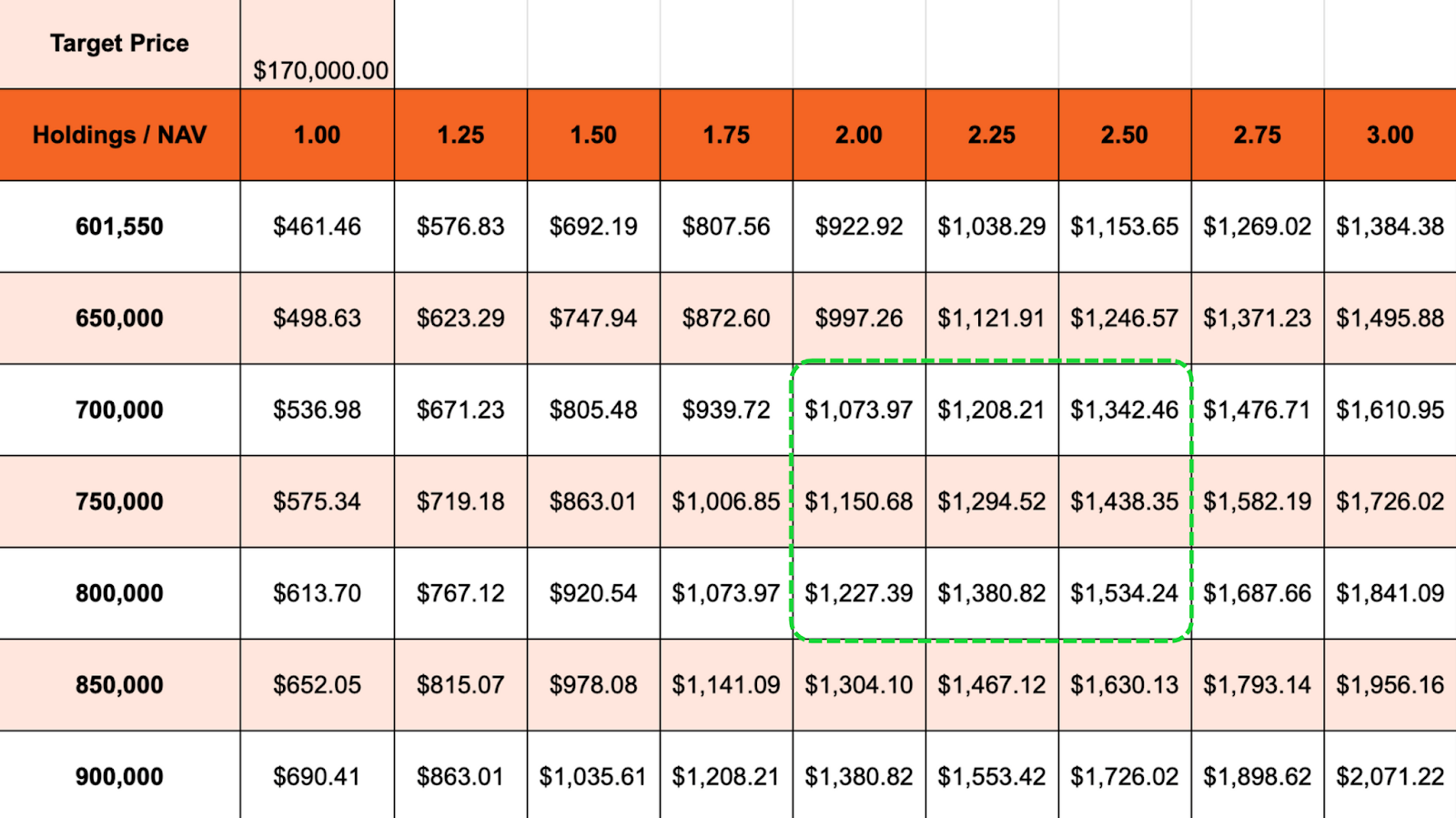

(Micro)Technique’s share value is closely influenced by its rising BTC reserves. The corporate at present holds over 600,000 BTC and is anticipated to extend this to between 700k and 800k because the cycle continues. Making use of the identical Fibonacci framework to MSTR reveals a possible resistance round $543, additionally the present all-time excessive, and upcoming targets of ~$800 and ~$1,300.

To validate this, we analyzed MSTR’s premium to its Bitcoin Web Asset Worth (NAV), which has fluctuated between 2x and practically 3x a number of instances this cycle. Assuming a future Bitcoin value of $170K and continued accumulation, a 2–2.5x premium means that MSTR reaching $1,300 is a reputable higher sure.

Conclusion

Bitcoin’s value potential this cycle ranges from $140,000 on the conservative finish, to $170,000 within the base case, and as much as $220,000 in a bullish state of affairs. For Technique, this interprets into a possible higher sure of round $1,300, providing uneven upside for traders betting on oblique Bitcoin publicity.

Finally, whereas modeling future value motion is informative, information ought to information your selections, not dictate them. Don’t cling to spherical numbers or fashions alone. Be ready to behave when danger alerts emerge, even when your favourite mannequin hasn’t hit its magic quantity.

💡 Liked this deep dive into bitcoin value dynamics? Subscribe to Bitcoin Journal Professional on YouTube for extra skilled market insights and evaluation!

For extra deep-dive analysis, technical indicators, real-time market alerts, and entry to skilled evaluation, go to BitcoinMagazinePro.com.

Disclaimer: This text is for informational functions solely and shouldn’t be thought-about monetary recommendation. All the time do your individual analysis earlier than making any funding selections.