Palantir has emerged as a disruptive power within the AI realm, ushering in a wave of enthusiastic buyers to the protection tech house.

Palantir Applied sciences was the top-performing inventory within the S&P 500 and Nasdaq-100 through the first half of 2025. With shares hovering by 80% by the primary six months of the 12 months — and by 427% over the past 12 months — Palantir has helped drive a variety of consideration to the intersection of synthetic intelligence (AI) and protection contracting.

Palantir is way from the one firm looking for to disrupt protection tech. Slightly-known competitor to the corporate is BigBear.ai (BBAI -3.35%), whose shares are up by a powerful 357% over the past 12 months.

May BigBear.ai emerge as the following Palantir? Learn on to seek out out.

BigBear.ai is an thrilling firm on this planet of protection tech, however…

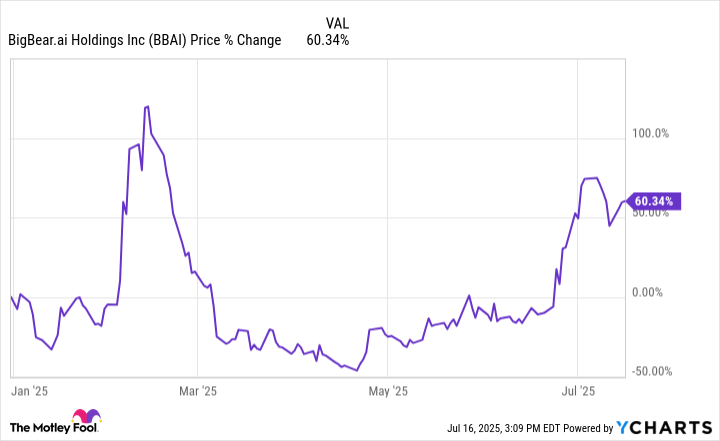

BigBear.ai’s share value volatility up to now this 12 months mimics the actions of a rollercoaster. Initially, shares rose significantly shortly following President Donald Trump’s inauguration and the next announcement of Venture Stargate — an infrastructure initiative that goals to take a position $500 billion into AI tasks by 2029.

Nonetheless, these early positive factors retreated following the Pentagon’s plans to scale back its funds by 8% yearly.

Whereas diminished spending from the Division of Protection (DOD) was initially seen as a significant blow to contractors resembling Palantir and BigBear.ai, the traits illustrated above recommend that shares rebounded sharply — implying that the sell-offs again in February could have been overblown. Why is that?

In my eyes, a significant contributor to the restoration in protection shares got here after Protection Secretary Pete Hegseth introduced his intentions to double down on a method dubbed the Software program Acquisition Pathway (SWP).

In actuality, the DOD’s funds cuts are centered on areas which can be deemed non-essential or inefficient. For instance, the Pentagon freed up billions in capital by lowering spend with consulting corporations resembling Booz Allen Hamilton, Accenture, and Deloitte. As well as, a contract revolving round an HR software program system managed by Oracle was additionally reduce.

Below the SWP, it seems that the DOD is definitely seeking to liberate capital with the intention to double down on extra tech-focused initiatives and establish distributors that may really deal with the Pentagon’s refined workflows.

With a lot alternative up for grabs, it is possible that optimistic buyers noticed this as a tailwind for BigBear.ai. This logic is not too far off base, both.

BigBear.ai’s CEO is Kevin McAleenan, a former authorities official with shut ties to the Trump administration. McAleenan’s strategic relationships inside the authorities mixed with the DOD’s give attention to working with main software program companies suppliers possible has some buyers shopping for into the concept BigBear.ai will not be flying below the radar for much longer.

Picture supply: Getty Photos.

…how does the corporate actually stack up beside Palantir?

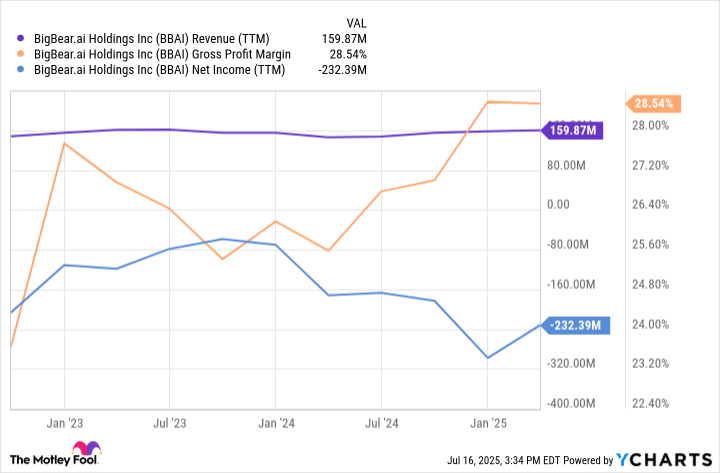

The graph beneath breaks down income, gross margin, and internet revenue for BigBear.ai over the past 12 months. With simply $160 million in gross sales, the corporate tends to generate inconsistent gross margins — which prime out at lower than 30%. Furthermore, with a reasonably small gross sales base and unimpressive margin profile, it isn’t stunning to see BigBear.ai’s losses proceed to mount.

BBAI Income (TTM) information by YCharts

By comparability, Palantir generated $487 million in authorities income through the first quarter of 2025. In different phrases, Palantir’s authorities operation generates practically triple the quantity of income in a single quarter that BigBear.ai does in a whole 12 months. On prime of that, Palantir’s gross margins hover round 80%, whereas the corporate’s internet revenue over the past 12 months was over $570 million.

Is BigBear.ai inventory a purchase proper now?

Proper now, BigBear.ai trades at a price-to-sales (P/S) ratio of round 11. Whereas this will likely look “low-cost” in comparison with Palantir’s P/S a number of of 120, there’s a purpose for the valuation disparity between the 2 AI protection contractors.

Palantir boasts massive, fast-growing private and non-private sector companies that command robust revenue margins. Against this, BigBear.ai goes to have a tough time scaling as long as it retains burning by heaps of money.

Not solely would I go on BigBear.ai inventory, however I additionally don’t see the corporate turning into the following Palantir. Palantir is in a league of its personal within the protection tech house, and I don’t see BigBear.ai as a formidable challenger.

Adam Spatacco has positions in Palantir Applied sciences. The Motley Idiot has positions in and recommends Abbott Laboratories, Accenture Plc, Oracle, and Palantir Applied sciences. The Motley Idiot has a disclosure coverage.