Palantir (PLTR 2.59%) has been one of many best-performing shares up to now this 12 months, with its worth greater than doubling. Discovering shares that may obtain that may be a dream for each investor, and contemplating the circumstances of Palantir’s run-up, practically any inventory might be a candidate for such efficiency.

So, what shares may duplicate this unimaginable run transferring ahead? Let’s have a look.

Palantir’s run-up is not business-related

Though Palantir posted robust earnings ends in Q1, 39% income progress usually does not justify the inventory doubling. Moreover, that is year-over-year income progress, and contemplating the inventory has risen round 800% because the begin of 2024, there’s one thing a bit odd right here.

The mismatch between progress and inventory efficiency may be attributed to the inventory’s valuation, which has exploded over the previous 12 months.

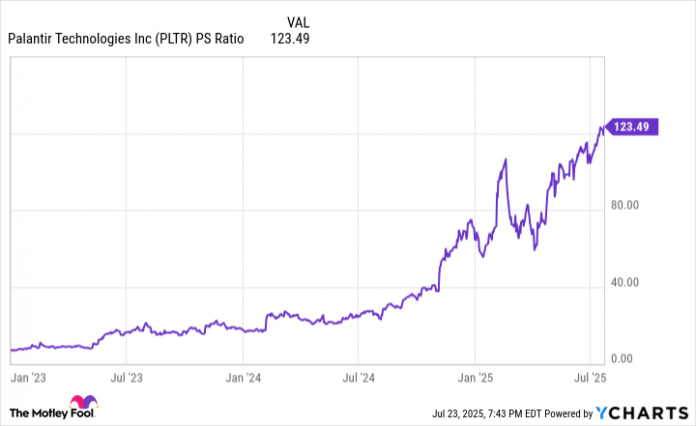

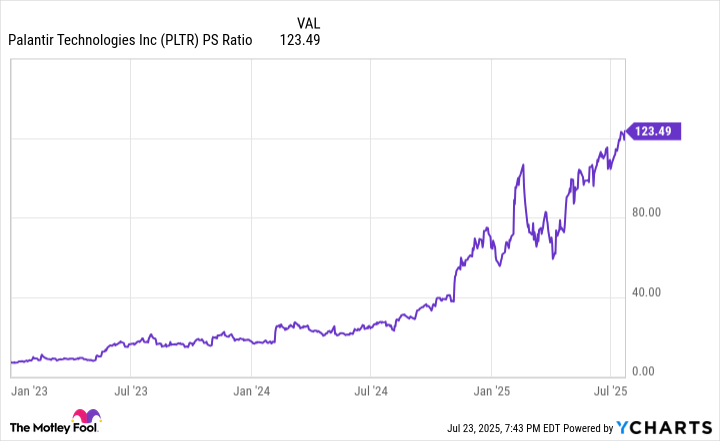

PLTR PS Ratio knowledge by YCharts

Palantir has risen from a inventory that traded within the typical software program valuation vary of 10 to twenty occasions gross sales to greater than 120 occasions gross sales. A superb rule of thumb is {that a} software program firm ought to be rising its income at a charge larger than its price-to-sales (P/S) ratio. Ideally, it is rising at two to 3 occasions this charge. Nevertheless, Palantir’s progress is a 3rd of its valuation, indicating an extremely costly inventory.

This means that almost all of Palantir’s motion has come from market exuberance quite than enterprise efficiency. Contemplating Palantir’s inventory entered the 12 months buying and selling at an already costly 65 occasions gross sales, the rise is sort of straight tied to its valuation rising to an much more costly degree. If its inventory have been really tied to the enterprise, then it would not be valued as excessive.

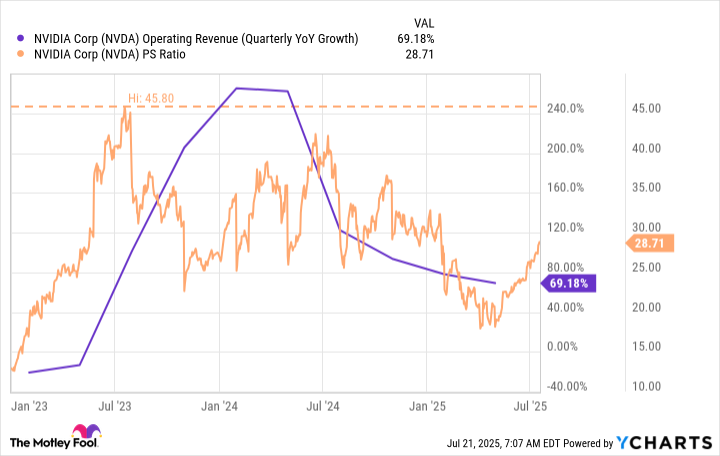

For reference, when Nvidia (NASDAQ: NVDA) was tripling its income 12 months over 12 months, it by no means traded for greater than 46 occasions gross sales. Moreover, it is nonetheless rising a lot sooner than Palantir is true now and is much cheaper.

NVDA Working Income (Quarterly YoY Development) knowledge by YCharts

The truth is that Palantir’s inventory has change into far too costly for its progress charge, and an unrealistic valuation has pushed its spectacular efficiency. Any inventory has the potential to be bid up considerably by its shareholders and yield unimaginable returns, as seen with Palantir. So, if you happen to’re on the lookout for a inventory that will double, then actually any inventory out there is a candidate if the circumstances are the identical as Palantir’s.

Nevertheless, listed below are a pair shares which have the potential to realistically double, with out requiring unreasonable valuations to realize it.

Alphabet

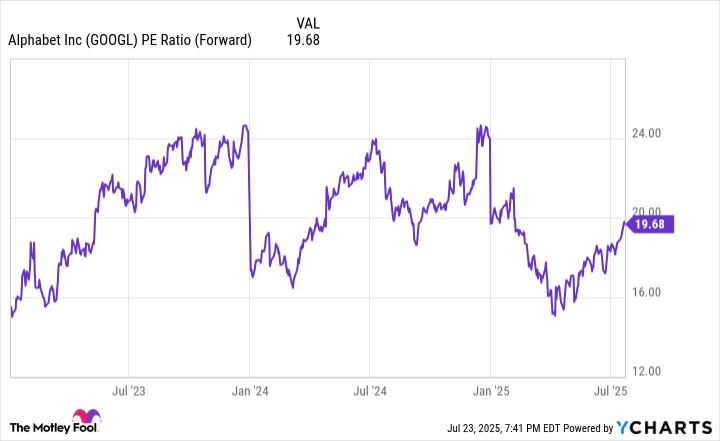

Alphabet (GOOG 0.45%) (GOOGL 0.54%) is the father or mother firm of Google, and does not obtain the identical premium that a lot of its large tech friends do. That is unlucky, as its progress charges are sometimes corresponding to these of a few of its friends. The large concern is that Google Search might be overtaken by generative AI, so the market costs it at a reduction to its friends.

At present, Alphabet trades at 20 occasions ahead earnings.

GOOGL PE Ratio (Ahead) knowledge by YCharts

Most of its large tech friends commerce within the low- to high-30s ahead P/E vary, so if Alphabet can return to receiving the identical premium as its friends, then it has the potential to double.

Whereas I do not suppose a real double is life like, I imagine a 50% achieve is well achievable if the market acknowledges that Google Search is right here to remain.

IonQ

IonQ (IONQ -1.66%) is a frontrunner in quantum computing. Though this expertise hasn’t proved its price, it is quickly approaching that time. 2030 is predicted to be a key 12 months for quantum computing deployment, and if IonQ can show that its expertise is a high choice, the inventory might be poised for a major rise.

By 2035, this market is predicted to be price $87 billion, offering IonQ with a considerable income base to seize. Contemplating that IonQ is at present a $11 billion firm, it might be poised for a major inventory rise if it declares a breakthrough in its pursuit of creating quantum computing commercially related.

The truth is that any inventory can double below the circumstances that Palantir’s did. However, if you happen to’re on the lookout for two shares with life like prospects to double, Alphabet and IonQ might not be too far off.

Keithen Drury has positions in Alphabet and Nvidia. The Motley Idiot has positions in and recommends Alphabet, Nvidia, and Palantir Applied sciences. The Motley Idiot has a disclosure coverage.