If you happen to’re on the lookout for high-yield dividend shares, I’ve obtained some excellent news. A few mortgage REITs provide eye-popping yields, and there is a likelihood they’re going to be capable to keep their payouts.

Shares of AGNC Funding (AGNC 2.37%) and Annaly Capital (NLY 2.53%) provide a median yield of 13.2% at latest costs. Which means an funding of simply $7,580 is sufficient to set you up with $1,000 in annual dividend revenue.

Earlier than whipping out a brokerage software to purchase these shares, it is best to know that they’re actual property funding trusts (REITs) that do not personal any actual property. As a substitute, they put money into mortgages and associated monetary devices, which has every kind of implications for buyers searching for dependable dividend funds.

AGNC Funding

AGNC Funding is a mortgage REIT (mREIT). This implies it makes a residing by borrowing at comparatively low short-term charges and investing in long-term mortgage-backed securities (MBS). The corporate makes month-to-month dividend funds, and at latest costs, the inventory affords an enormous 14.2% yield.

AGNC now affords an enormous dividend yield as a result of buyers are anxious about declining web curiosity spreads. The mREIT’s common price of funds surged 373% increased to 2.89% through the two-year interval that ended on Dec. 31, 2024. Traders are involved {that a} new commerce warfare might spark one other spherical of inflation that will drive the Federal Reserve to boost rates of interest another time.

One factor AGNC buyers do not have to fret about is mortgage defaults. As its identify implies, the mortgages in its MBS portfolio are backed by authorities businesses that step in when debtors cannot sustain with funds.

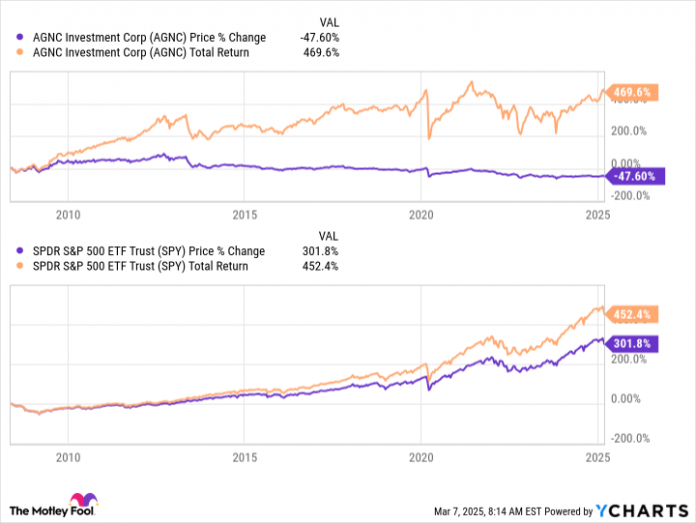

From its inventory market debut in 2008 via March 6, 2025, AGNC’s inventory worth has declined by about 47.6%. By returning heaps of income to shareholders as dividends, although, it has produced a whole return of 470% since that debut. That is a bit higher than buyers would have carried out with an S&P 500 index fund over the identical interval.

Annaly Capital

Annaly Capital is one other mREIT with a declining inventory worth and rising dividend yield. Like AGNC, Annaly inventory is below strain as a consequence of fears that the brand new commerce warfare will begin one other spherical of inflation and drive the Fed to hike rates of interest. These days, it has been providing a 12.2% yield.

About 87% of Annaly’s $80.9 billion portfolio is invested in agency-backed securities. With the federal government able to step in for many of its portfolio, concern of mortgage defaults is not a difficulty maintaining Annaly’s shareholders up at night time.

Whereas AGNC focuses nearly completely on agency-backed MBS, Annaly has diversified its income stream. Its residential credit score operation invests in non-agency mortgages and packages them into new securities. In 2024, it priced residential mortgage securitizations value $11 billion.

Along with a rising residential credit score operation, Annaly has been investing in mortgage servicing rights. It is a nice hedge in opposition to declining MBS bills. In a nutshell, whoever owns servicing rights to a mortgage receives charges each time the debtors make month-to-month funds.

Within the fourth quarter of 2024, financing prices decreased. With the typical price of interest-bearing liabilities declining to three.79%, web revenue on a usually accepted accounting ideas (GAAP) foundation reached $0.78 per share within the fourth quarter. That is sufficient to help a dividend of $0.72 per quarter. If charges maintain regular, sustaining its dividend payout at current ranges in all probability will not be a difficulty.

Know the dangers

There’s an opportunity these two mREITs will keep their dividends over the long term, however buyers who want a dependable supply of passive revenue will need to maintain trying. A look at their payouts over the previous decade reveals us why so few income-seekers discover them acceptable.

AGNC Dividend knowledge by YCharts.

With none bodily properties to borrow in opposition to, mREITs use their MBS portfolios to safe comparatively low-interest loans. Sadly, the costs of long-term belongings with mounted curiosity funds are delicate to rate of interest adjustments. When speedy charge adjustments decrease the worth of an mREIT’s collateral, they are often pressured to promote belongings at fireplace sale costs to spice up liquidity and fulfill lenders. With a excessive sensitivity to rate of interest adjustments they cannot management, most income-seeking buyers are higher off avoiding these shares.

Cory Renauer has no place in any of the shares talked about. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a disclosure coverage.